-

The head of data and digital at Ally Bank came up with protective measures governing the use of generative AI and organized "AI Days" for employees to learn about Ally's progress.

June 25 -

By adopting more inclusive lending practices and actively seeking to support minority-owned businesses, banks can help bridge the financing gap that often stifles the growth of these businesses.

June 25

-

Later this week, the Federal Reserve will release the results of its annual check-up on larger banks' balance sheets. Experts say there are always surprises, but that pending capital rules may have a bigger impact than the stress-test results on banks' dividend and buyback decisions.

June 24 -

There were 27 bank acquisitions worth $5.45 billion announced in the second quarter as of mid-June. That was more than the $5.2 billion combined value of deals announced over the previous five quarters.

June 24 -

The former head of Square Banking at Square is one of American Banker's 2024 Most Influential Women in Fintech.

June 24 -

These 20 bankers and fintech executives are helping banks go digital in new ways.

June 24 -

The managing director and head of treasury solutions at Texas Capital Bank is one of American Banker's 2024 Innovators of the Year.

June 24 -

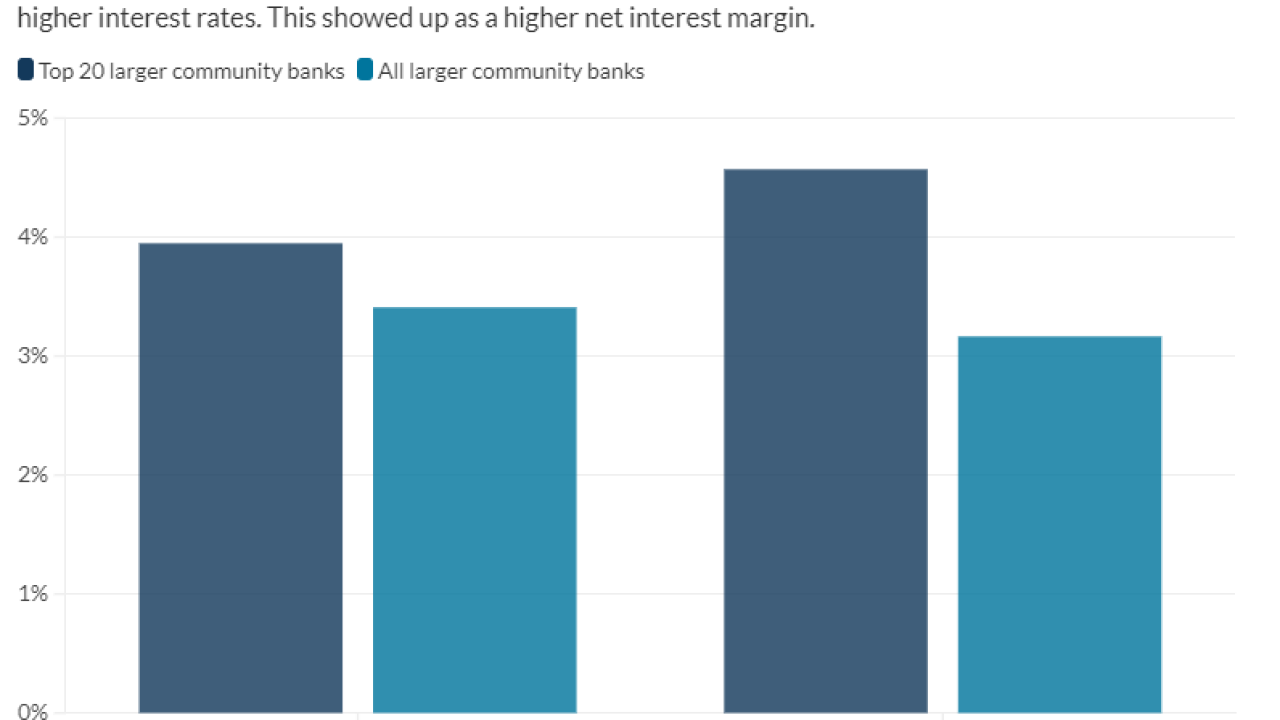

This year Texas banks dominated American Banker's annual list of the top-performing larger community banks. See which institution came in at No. 1 for this asset class.

June 23 -

The best-performing larger Main Street Banks, those in the $2 billion to $10 billion asset class, were asset sensitive, a position that worked to their advantage as rates continued to climb in 2023.

June 23 -

The head of digital product management, platforms and innovation at BMO Bank is one of American Banker's 2024 Innovators of the Year.

June 21 -

The founder and CEO of Owners Bank, a division of Liberty Bank, is one of American Banker's 2024 Innovators of the Year.

June 21 -

Why banks believe fraud prevention and customer experience are both top priorities

June 21 -

The Minneapolis-based Thrivent Financial for Lutherans received approval from the Federal Deposit Insurance Corp. on Friday for its industrial loan company application and planned merger between the institution and subsidiary Thrivent Federal Credit Union.

June 21 -

Vancouver, Washington's Riverview Bancorp announces Nicole Sherman as its next president and CEO; Happauge, New York-based Dime Community Bancshares is expanding its deposits strategy to Manhattan; UBS hires Guggenheim banker Ananya Das; and more in this week's banking news roundup.

June 21 -

U.K. banks are testing machines that can accept deposits from multiple machines.

June 21 -

The Honolulu bank is raising $165 million through depositary shares, a move that two observers said would help boost its below-average leverage ratio.

June 20 -

A federal judge granted a preliminary injunction sought by industry groups that sued to block a Colorado law. The law, which would cap interest rates on consumer loans, targets partnerships between fintechs and out-of-state banks.

June 20 -

PeoplesBank and Cornerstone Bank entered into an agreement to combine their holding companies in a deal slated to close early in 2025. The banks would continue to operate separately.

June 20 -

"We're in an era of instant gratification, where we're not compared to other financial institutions, but rather to companies like Amazon, Apple, Google and Facebook," says Chief Technology Officer Sandeep Uthra.

June 20 -

In a win for credit card issuers, a lawsuit challenging the Consumer Financial Protection Bureau's $8 credit card late fee rule will remain in a Texas court and not be transferred to Washington, D.C.

June 20