-

While small and regional banks are pushing for a rollback of the Dodd-Frank Act, big banks are largely supportive of the 2010 financial reform law, Bank of America CEO Brian Moynihan said Thursday.

February 15 -

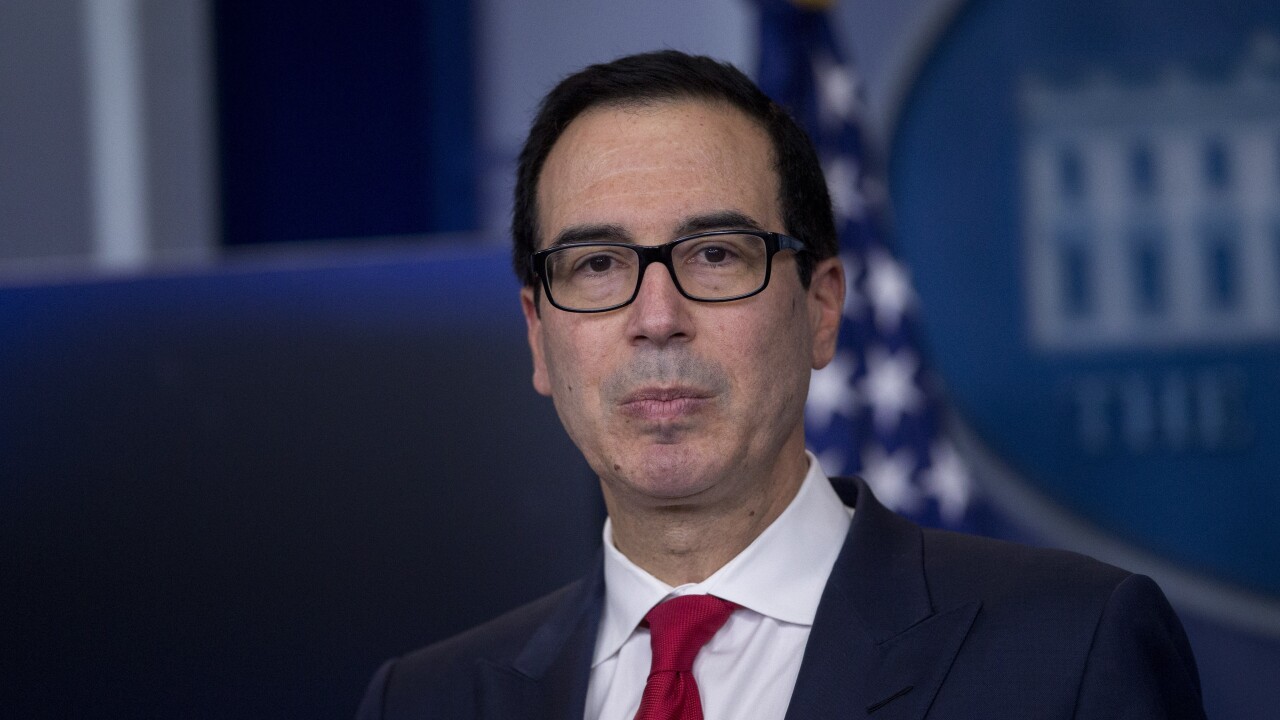

The government must continue to provide support for the mortgage market in any new housing finance system, Treasury Secretary Steven Mnuchin said Tuesday.

January 30 -

Three Trump administration nominees faced thorough questioning from the Senate Banking Committee, although Democrats reserved much of their fire for the president’s nominee to the Federal Reserve Board.

January 23 -

The new standards are aimed at reducing the variability between regulatory treatments of risk-weighted assets.

December 7 -

President Trump’s pick to head the Federal Reserve will face the Senate Banking Committee this week. Here’s what to watch for.

November 27 -

While some community bankers and Washington advocates doubt the likelihood of achieving meaningful regulatory relief in the 115th Congress, the many measures advancing on Capitol Hill leave plenty of room for optimism.

November 13 ValueBank Texas

ValueBank Texas -

The Senate's repeal of the Consumer Financial Protection Bureau rule is arguably the industry's biggest policy victory since passage of Dodd-Frank. But is it the sign of a trend?

October 26 -

The Senate's repeal of the Consumer Financial Protection Bureau rule is arguably the industry's biggest policy victory since passage of Dodd-Frank. But is it the sign of a trend?

October 25 -

Readers weigh in on online lending growth, how President Trump’s healthcare policies affect lenders, regulation’s effects on community banks and more.

October 19 -

Federal regulators are moving forward with plans to finalize one of the last significant Obama-era rules governing long-term bank liquidity despite widespread expectations by banks that the proposal was all but dead.

October 19 -

Andreas Dombret, head of regulation at Germany’s central bank, fears entering “the next stage of … an eternal cycle” of crises as countries begin dialing back regulations.

October 13 -

Banks could help narrow the financing gap for U.N. development goals to be met, but changes in Basel and loan guarantee standards are necessary.

October 12 Milken Institute’s Center for Financial Markets

Milken Institute’s Center for Financial Markets -

Cynthia Blankenship, an executive at Bank of the West in Grapevine, Texas, has been a regular in Washington for years fighting for regulatory changes. She is encouraging other bankers to do likewise.

October 4 -

Federal Reserve Gov. Jerome Powell said capital levels have been well calibrated but that some changes to the capital rules may be in order to make compliance easier.

October 3 -

EU-based banks are citing a U.S. Treasury Department report as reason to slow-walk international regulatory standards.

September 18 -

The Trump administration is prepping recommendations to address shortcomings in the capital markets in a report to be released next month, a top Treasury Department official said Monday.

September 18 -

A perfect risk-based capital ratio obviously is preferable to an admittedly imperfect leverage ratio. The problem is there is no perfect risk-based measure.

September 6

-

Having a leverage ratio as a backstop to risk-based capital requirements is sound, but the way it is currently calibrated is having a dramatic effect on financial markets.

August 11 Bank Policy Institute

Bank Policy Institute -

The advanced approach has limited value, eliminating it has no downside risks and regulators have better tools at their disposal.

June 29

-

The Bank for International Settlements, the Basel-based central bankers' bank, isn't ready to call an end to financial globalization.

June 20