-

Since Wells Fargo’s phony-accounts scandal broke in 2016, the bank has appeared contrite in public. In private, it’s a different story.

April 7 -

Deutsche Bank employees in the U.S. received the lion's share of bonuses as the lender sought to retain top performers following cuts to the investment bank there.

March 22 -

The unit is under investigation by federal agencies for misrepresenting pricing; investment bankers are looking at a possible 15-20% drop in bonus money.

January 9 -

Mayor Eric Garcetti signed an ordinance Monday that establishes new requirements for banks that want to do business with the city. The rules are thought to be the first of their kind nationally.

July 10 -

An inquiry into the sales practices of more than 40 banks launched in the wake of the Wells scandal found several systemic issues and hundreds of problems at individual institutions. The OCC completed the review in December but is not making the results public.

June 5 -

Payouts on Wall Street averaged $184,000, following only 2006’s record high; ethics office eying $500 million of real estate loans made to Trump son-in-law.

March 27 -

The departing New York Fed president said Monday that the banking industry should improve its culture, better aligning pay with long-term stability.

March 26 -

The banks announced bonuses, wage hikes and charitable contributions resulting from the lower corporate tax rate enacted by Congress.

January 2 -

The $50 billion threshold replaced by a formula, but bill must be reconciled with Senate version; Fed, FDIC say the eight big banks still have work to do.

December 20 -

The Trump administration is “sounding a friendlier tone” toward bankers following the Obama chill; credit bureau takes steps to limit the financial damage.

November 13 -

Want employees to feel empowered to make decisions to help customers? Rewarding that behavior is one way to reinforce the message. Here’s how one South Dakota community bank goes about it — in a splashy, Super Bowl-sized way.

September 7 -

A regulatory plan to create new restrictions on banks’ executive compensation practices appears dead — but changes since the financial crisis may have made the proposal largely obsolete anyway.

July 21 -

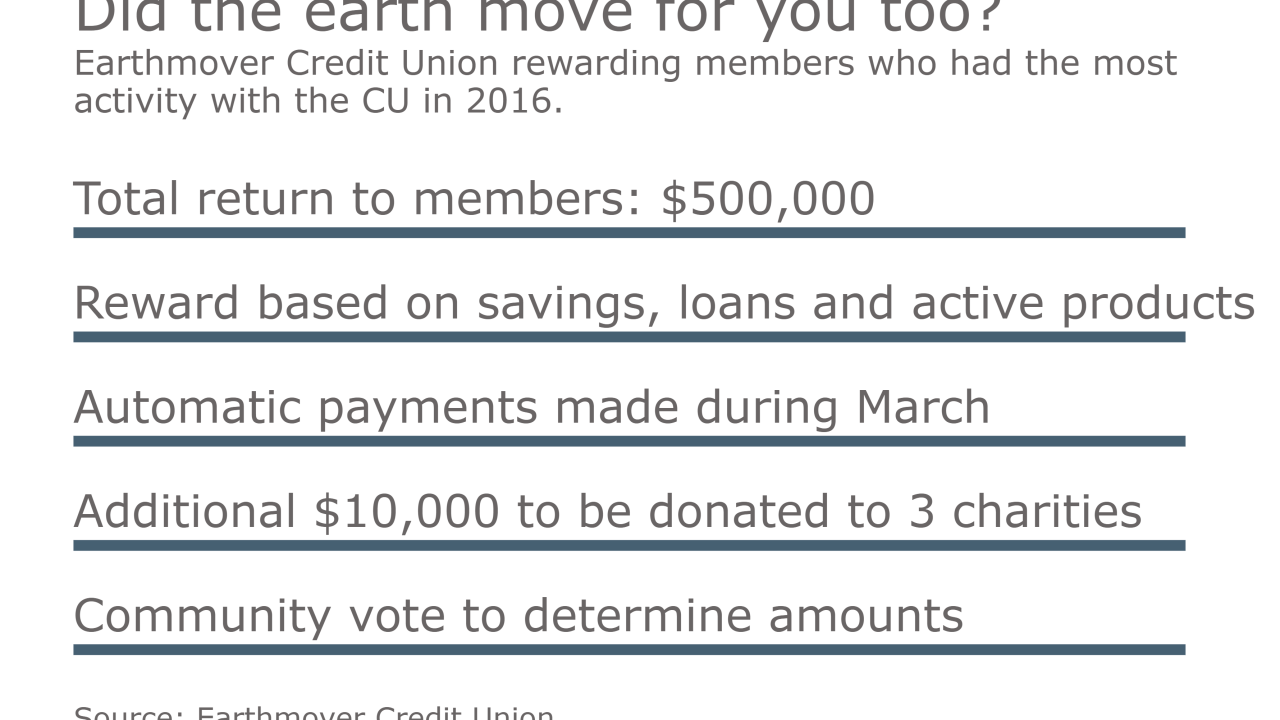

Distribution based on deposit, loan relationships with the credit union in the first half of 2017.

July 20 -

In March 1998, American Banker reported plans by Norwest Corp. to establish sales quotas and step up cross-selling. Three months later, the Minneapolis bank announced a merger with Wells Fargo.

May 18

-

Texas Capital ties bankers’ bonuses to loan performance instead of volume. The strategy has aided recruitment and helped the bank achieve exceptional loan growth while keeping credit quality respectable.

April 3 -

So-called performance-share units are pushing aside stock options as the preferred long-term incentive pay for bank executives. Many investors and regulators fear that options can encourage reckless conduct and have other shortcomings, though options still have supporters.

March 21 -

CU is rewarding members for activity in savings, loans and active products.

March 20 -

Banks like TD and U.S. Bancorp are suddenly taking public shots from current and former employees critical of their sales practices, a sign that the industry has not put behind it the questions raised months ago by the phony-accounts scandal at Wells.

March 17 -

The embattled bank said that the decision to withhold 2016 bonuses for CEO Tim Sloan and seven other executives was not based on any findings of improper behavior.

March 1 -

Minnesota CU has returned more than $2.6 million since rewards program started in 2012.

February 27