-

On Dec. 31, 2018. Dollars in thousands.

May 20 -

The Illinois bank is buying a bank formed in the 1970s to serve Cuban-Americans.

May 17 -

The AGs say the agency's plan to rescind ability-to-repay requirements for payday loans would undermine states' ability to enforce their own laws.

May 17 -

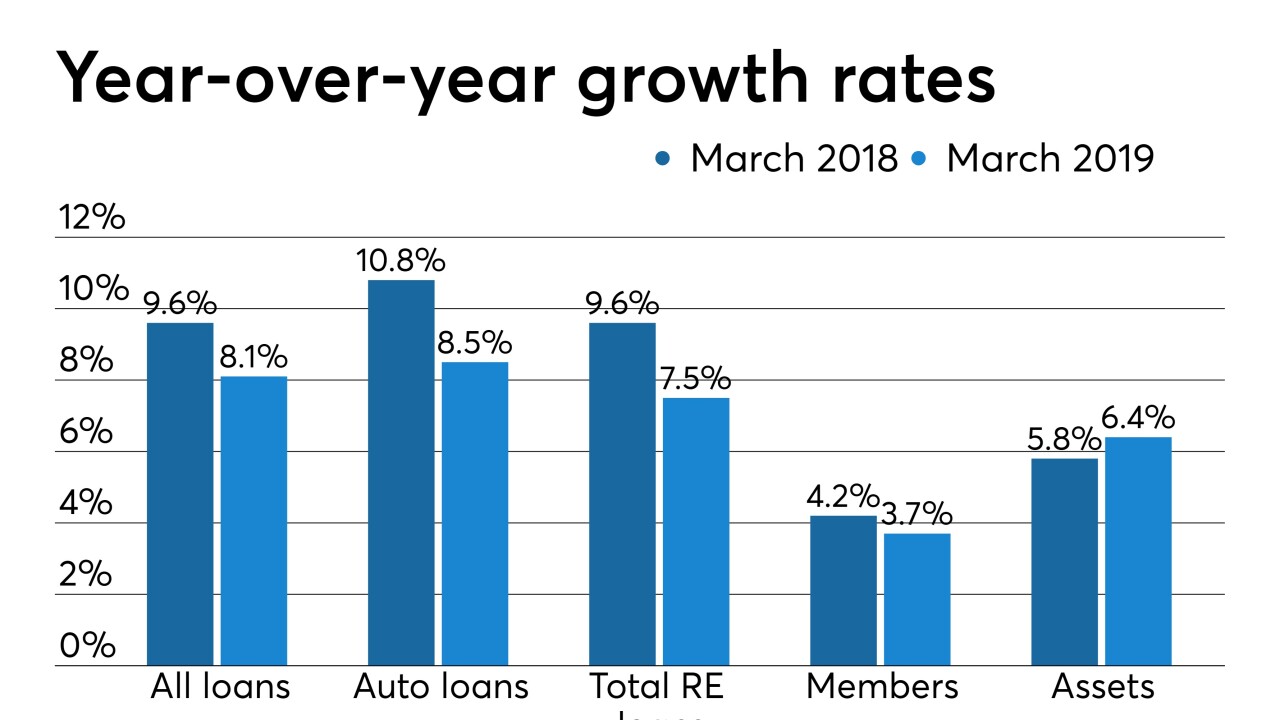

A new study from CUNA Mutual Group shows CUs ended March with tepid growth in membership and auto and real estate loans compared with a year earlier.

May 17 -

Farmers were already taking on more debt to cover losses from falling crop prices. New tariffs and other retaliatory moves could hurt ag borrowers further and lead to loan losses and tighter underwriting.

May 16 -

The official told lawmakers Thursday that the research underlying the bureau's 2017 payday rule proposal did not support strict underwriting requirements of small-dollar loans.

May 16 -

Democrats and Republicans on the House Financial Services Committee called for steps to minimize the harm to community banks and credit unions bracing for the new accounting standard.

May 16 -

Azlo will offer customers the ability to apply for a Kabbage loan through a new program called Mission Street Capital.

May 16 -

Recent letters from NAFCU and CUNA called on the Consumer Financial Protection Bureau to provide a carve out in its payday lending rule for loans made by credit unions.

May 16 -

The first day of CU Direct's annual Drive conference included insights from dealers, executives at online car-buying platforms and more.

May 16 -

At a Senate Banking hearing focusing primarily on predatory lending practices, NCUA Chairman Rodney Hood offered insight into the agency's priorities under his leadership.

May 15 -

Ask 453 bankers their forecasts on loan demand and the economy, or their feelings about the BB&T-SunTrust merger, pot banking as well as other hot issues, and a clear picture emerges. Promontory Interfinancial Network recently did just that, and here our five takeaways from the results.

May 15 -

The New York bank says it acted appropriately in withholding the collateral on a loan to a developer that First Foundation Bank later refinanced. First Foundation’s CEO begs to differ.

May 14 -

The Nashville, Tenn., company hired Tim Schools from Highlands Bancshares to succeed founding CEO Claire Tucker.

May 14 -

The forces reshaping small-business lending are also leading to “a moment of reckoning” for small banks, says former SBA head Karen Mills.

May 14 -

The ranking Democrat on the Senate Banking Committee says he wants answers from the Financial Stability Oversight Council on efforts to address corporate debt risks.

May 13 -

The deals lets a North Carolina group skip the de novo process. West Town, which sold the bank, will use the funds to support a fast-growing business line.

May 10 -

Housing advocates and Democratic lawmakers want to create more protections for tenants of rent-controlled apartments, but they are facing stiff opposition from property owners and the banks that lend to them.

May 10 -

The city, among the Midwest's most vibrant C&I markets, is luring community banks, as well as giants like PNC and JPMorgan Chase.

May 9 -

Pinnacle Bank chief Terry Turner never lacks specifics. He wants to expand inside a triangular zone that connects three Southern and mid-Atlantic cities, aims to enter five particular markets, and speaks bluntly about his plans for hiring alums of BB&T and SunTrust.

May 8