Community banking

Community banking

-

Executives at the 90 institutions that made the ninth annual ranking are boosting benefits to attract new employees, amid intense competition for talent. They're also rethinking how they approach recruiting and increasing their diversity efforts.

November 8 -

With its agreement to buy KS StateBank’s residential mortgage operation, Kansas-based Armed Forces is going all in on home lending.

November 5 -

The Office of the Comptroller of the Currency has raised “certain regulatory concerns” about Blue Ridge Bankshares, delaying its combination with FVCBankcorp well into next year.

November 5 -

The $323 million acquisition would give the Indiana bank a presence in affluent Oakland County and in Ann Arbor and Grand Rapids.

November 4 -

OceanFirst Financial in New Jersey has agreed to pay $186 million to buy Partners Bancorp, which owns two banks that operate in the Washington suburbs and surrounding areas.

November 4 -

The small Pennsylvania regional signed up four cryptocurrency services companies as customers this week. CEO Sam Sidhu says the bank's new platform is helping it win business in this highly specialized market.

November 3 -

Amid a spate of deals in 2021, community banks are actively recruiting from merging rivals that are focused on closing and integrating acquisitions.

November 3 -

The Cooperative Bank in Massachusetts is working with the tech startup Carefull to monitor accounts for signs that older clients are being swindled by scammers — including people close to them.

November 2 -

The Indiana-based online banking pioneer is purchasing First Century, a similarly tech-savvy company, for $80 million. The deal would diversify its revenue and improve its prepaid card offerings for small businesses.

November 2 -

The $47.6 million deal would help MidWestOne, which has been opening offices in other parts of the U.S., to expand closer to home in Iowa.

November 2 -

Fifty-three percent of community bank executives who participated in a recent survey said they’d spurn a takeover offer by a credit union, even if it was the highest bid. The findings underscore the rivalry between the two sectors at a time of rising consolidation.

October 29 -

The community lender, which emphasizes an environmental, social and governance mission, plans to beat the Paris Climate Agreement's timeline by five years.

October 28 -

Lending momentum is building and tourists have come back, but the coronavirus is a lingering concern for a state that relies heavily on vacationers.

October 27 -

Community banks don’t need to match the biggest banks’ digital offerings or advertising budgets. Where they can compete, and win, is by delivering more personalized service.

October 27 -

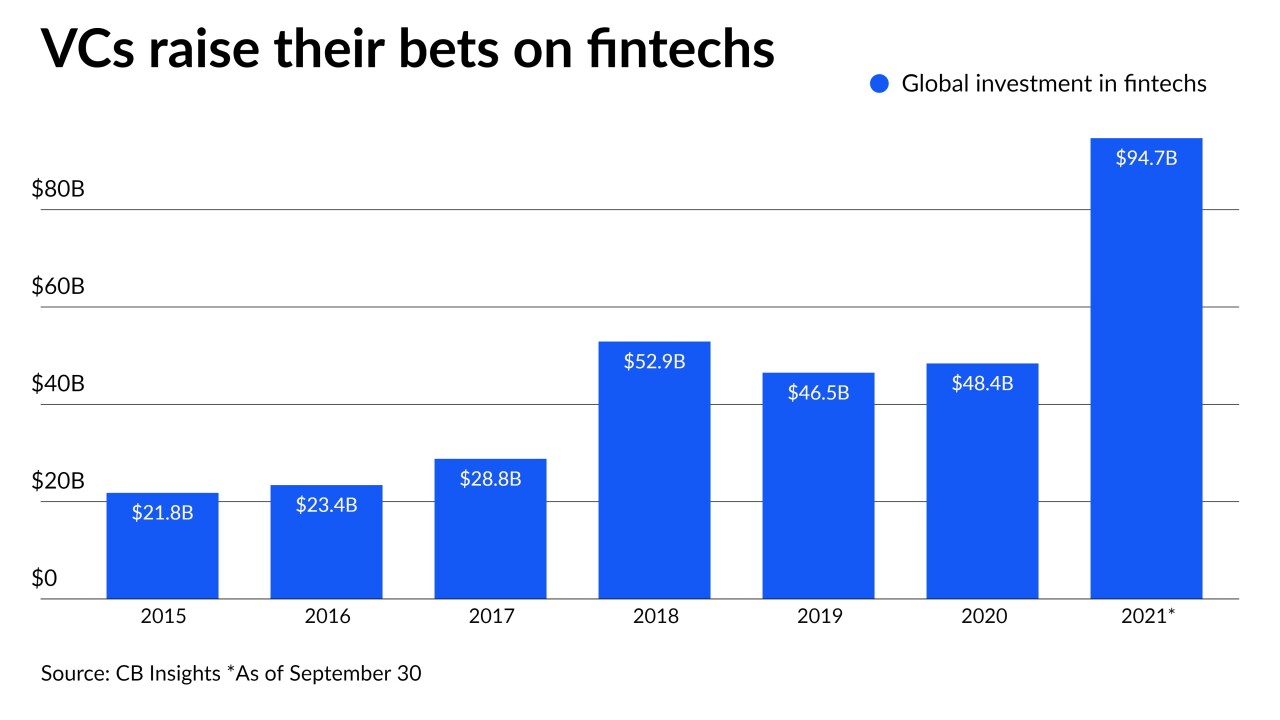

These venture capital firms are investing in young companies that could help small financial institutions meet their growing technology needs.

October 26 -

Businesses trying to meet a surge in demand for consumer goods are knocking on community banks' doors to finance expansions.

October 25 -

Building on four years of rapid growth in Dallas, Business First expects the acquisition to help it grow into a regional bank.

October 21 -

The Indiana company told investors that it’s ready to complete its combination with First Midwest Bancorp but that it’s unclear whether a recently filed mortgage discrimination lawsuit will get in the way of Fed approval.

October 19 -

New enlistees typically lack credit histories, so the $1.2 billion-asset lender is using other transaction data to underwrite loans. It's a common practice among large banks and fintechs but rare for a community bank.

October 18 -

Year to date through June 30, 2021. Dollars in thousands.

October 18