Compensation

Compensation

- IBM proposes AI rules to ease bias concerns

IBM called for rules aimed at eliminating bias in artificial intelligence to ease concerns that the technology relies on data that bakes in past discriminatory practices and could harm women, minorities, the disabled, older Americans and others.

January 21 -

For small regionals like Atlantic Union and F.N.B., the biggest opportunity to snag customers will come when the rebranding of BB&T and SunTrust branches begins next year.

January 21 -

Doug Nielson at U.S. Bank and Jane Barratt at MX explain how men can be more supportive of their female colleagues.

January 20 -

Werner Loots, the bank’s first head of transformation, is helping the bank redesign how work is done, then streamlining and digitizing as much as possible.

-

The agency issued a fair housing proposal last month that would perpetuate segregation and make it harder to detect discrimination.

January 17 -

The investment bank is raising its return on equity target following a record earnings year; Democrat lawmakers say JPMorgan's response on racial discrimination questions was inadequate.

January 17 -

In the year since it voluntarily disclosed its own data, Citigroup has shown an improvement in its median pay for female and minority employees, the firm said Wednesday.

January 15 -

A shrinking industry and inadequate succession planning – particularly at smaller credit unions – is likely to increase competition for top talent and make executive recruitment even more challenging in the year ahead.

January 15 -

President Trump's impeachment trial could get underway in the Senate this week, making it even harder for the movement's legislative priorities to gain traction.

January 13 -

New legislation in Congress seeks to do away with a data-collection mandate that addressed discrimination in business lending. The repeal measure has the support of two bank industry groups based in Washington.

January 10 -

Marcus and the Apple credit card accounted for 3% of the bank’s profit in the first three quarters of 2019, despite a multibillion-dollar investment in consumer operations; the senator’s plan would make it easier to expunge debt.

January 8 -

The Department of Housing and Urban Development has proposed an overhaul of an Obama-era rule meant to guide local jurisdictions in how they comply with the Fair Housing Act.

January 7 -

Some banks and fintechs have already introduced pet-friendly policies in the office. Here are five reasons why it works.

January 7 -

Andy Kempf has taken the helm from David Leusink, who retired after 30 years in the credit union movement.

January 7 -

David Frazier will take the helm of the Dallas-area institution in February.

January 7 -

Laurie Baker, a 25-year veteran of the credit union, will take the helm next month after longtime CEO Mike Vadala retires

January 6 -

The institutional clients group will add the jobs in New York, London, Shanghai and several other cities across the globe.

January 6 -

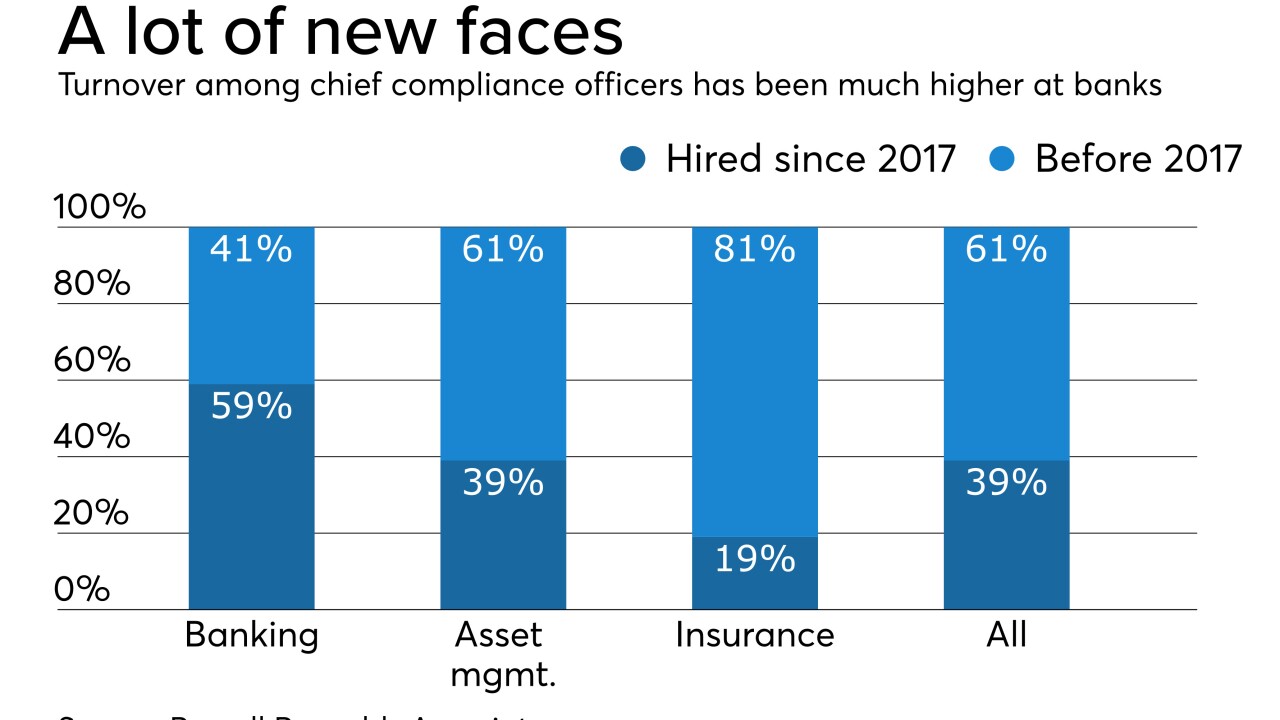

Banks had the highest turnover of chief compliance officers among the 100 largest financial services firms in the world, according to a recent study. Recruiters say that’s a function of changing job demands, high pressure and poaching by fintechs — plus old-fashioned demographics.

January 3 -

Michael Troutman will serve as chief revenue officer at Bay Banks of Virginia, where he will advise management and the board on growth opportunities.

January 3 -

Courtney Fifield, a longtime staffer at Athol Credit Union, was recently appointed president and CEO.

December 31