-

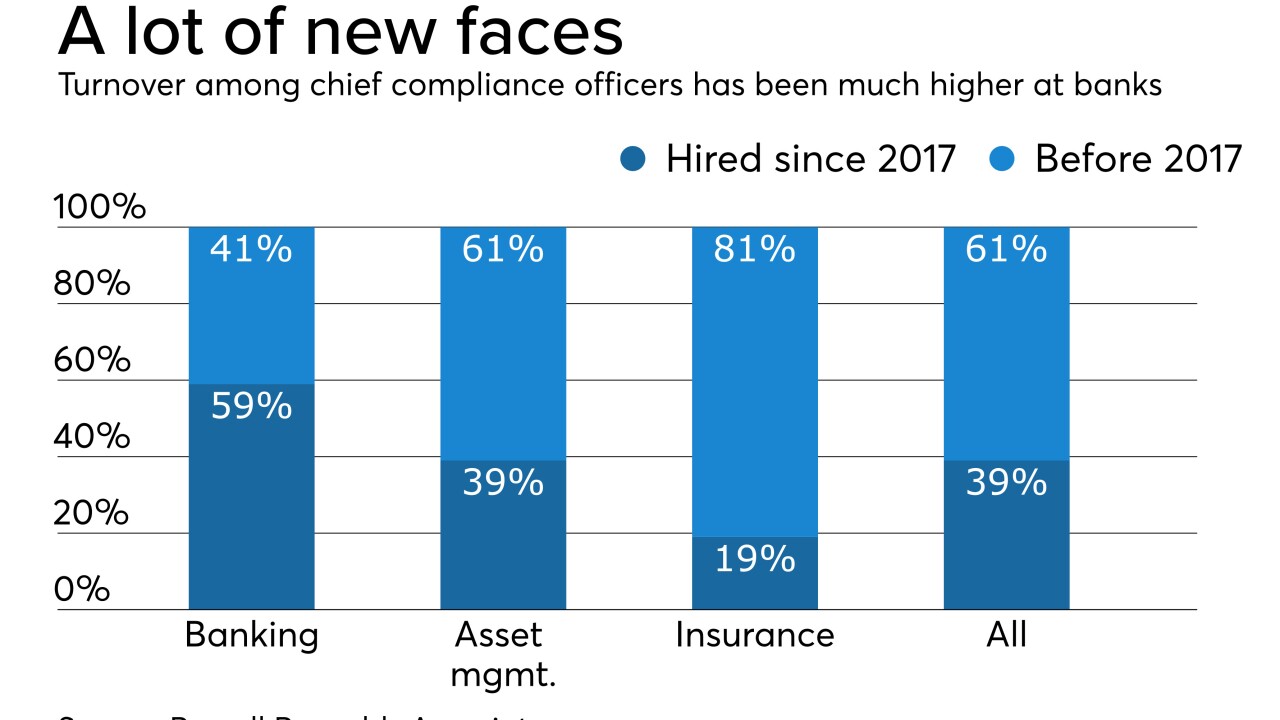

Banks had the highest turnover of chief compliance officers among the 100 largest financial services firms in the world, according to a recent study. Recruiters say that’s a function of changing job demands, high pressure and poaching by fintechs — plus old-fashioned demographics.

January 3 -

In its proposal to obtain one of the full digital banking licenses Singapore will award later this year, online gaming company Razer has laid out the gaps between what traditional banks offer and young adults need.

January 2 -

A California regulator on Monday denied a lending license to the point-of-sale financier Sezzle in a detailed written decision that could have broader consequences for upstart consumer lenders.

December 31 -

From massive growth and consolidation to the fallout after the corporate credit union crisis, uncertainty at the National Credit Union Administration and more, here's a look at the decade in review.

December 31 -

The decision by the state’s Department of Business Oversight on an application for a lending license by Sezzle could guide fintechs and others seeking to make loans to consumers at the time of purchase.

December 30 -

Credit unions bought banks at a record pace in 2019, but just a decade ago it had never been done before. Gary Easterling helped change that.

December 30 -

When the European Union began developing the Single Euro Payments Area more than a decade ago, it didn't include a vision for real-time payments and the potential for a third European payments scheme.

December 30 -

The Competition and Markets Authority said Friday it’s opening an in-depth investigation of Amazon’s investment of about $500 million, saying it risked a “substantial lessening” of competition “in the supply of online food platforms in the U.K. and in the supply of online convenience groceries.”

December 27 -

From new growth strategies to courts, Congress and the industry's own #MeToo moment, here's a look back at some of the year's biggest moments.

December 27 -

As 2020 dawns, a new decade will soon bring new levels of friction for contactless customers as a result of Strong Customer Authentication (SCA), a key part of the European Union’s drive to reduce card fraud across Europe.

December 27 -

The board- and management-level handing of CRE concentration was the chief concern of FDIC examiners, making up more than 56% of all the supervisory recommendations regulators made in the two-year period.

December 23 -

The Federal Trade Commission has filed a lawsuit against FleetCor Technologies and its CEO Ronald Clarke, alleging they used deceptive practices that defrauded its business customers of hundreds of millions of dollars in fees and false claims about fuel savings.

December 23 -

A new report from the National Credit Union Administration's Office of the Inspector General outlines what to expect in the year ahead following some 2019 scandals.

December 23 -

Open banking transactions are not initiated by a consumer but are coming from another financial services company. This could make some fraud detection models in place today obsolete.

December 20 Appdome

Appdome -

The state has proposed a law to cap the interest rate on certain consumer loans, but nonbanks aim to skirt it by seeking a rent-a-charter.

December 20 California Department of Business Oversight

California Department of Business Oversight -

Many large lenders pointed regulatory restrictions on their balance sheets and reduced risk appetite to explain why they stood on the sidelines during the September spike in overnight funding rates, according to a Federal Reserve survey of senior credit officers.

December 19 -

The National Credit Union's ACET tool will have a big impact on the industry, but passing the exam with flying colors could be a challenge for smaller shops.

December 18Cygilant -

The two Democrats sent a letter “raising grave concerns about whether the bureau is fulfilling its statutory obligations.”

December 18 -

Despite assurances by Director Kathy Kraninger that the agency is cracking down on discrimination, it hasn't filed an enforcement action or sent a Department of Justice referral on a fair-lending violation in two years.

December 17 -

Despite assurances by Director Kathy Kraninger that the agency is cracking down on discrimination, it hasn't sent a Department of Justice referral on a fair-lending violation in two years.

December 16