-

Wells Fargos freshly installed CEO made clear Friday that he wants to chart a new course following the revelation that thousands of employees opened phony accounts. But Tim Sloan made few promises about what the megabank will eventually look like.

October 14 -

The budget proposal was released less than two weeks before the agency's first public budget hearing since 2008 and drew immediate criticisms from the CU trade associations.

October 14 -

A nationwide payday lending rule would add to credit unions' regulatory burden and could increase costs -- a move which would ultimately lead to increase costs for consumers, NASCUS told CFPB.

October 14 -

Consumers voted with their feet in September, as the embattled bank said Friday that new checking accounts were down by 25% from year earlier.

October 14 -

Consumers voted with their feet in September, as the embattled bank said Friday that new checking accounts were down by 25% from a year earlier.

October 14 -

WASHINGTON Democratic presidential nominee Hillary Clinton would engage in a review of financial regulations and simplify or eliminate those that are found to be unnecessary if she is elected president, a top adviser said Thursday.

October 14 -

WASHINGTON The government should encourage the development of the fintech sector, but should not grant a safe harbor for such firms, Sen. Mark Warner, D-Va., said Thursday.

October 14 -

Warren's voice is powerful in criticizing big banks, but she could play a more active role in providing relief to community banks to help boost job creation.

October 14 Florida Bankers Association

Florida Bankers Association -

A $28.5 million fine wont have much impact on the worlds largest credit union, but observers say that being disciplined by the Consumer Financial Protection Bureau could be a bellwether for further enforcement actions from the embattled agency.

October 13 -

Without investigations by the Los Angeles Times and city prosecutors, the Wells Fargo account scandal would never have come to light. Where were federal regulators?

October 13

-

A federal appeals court ruling against the Consumer Financial Protection Bureau has raised questions about whether banks and other firms cited by the agency can protest previous enforcement actions. But doing so may create new risks for firms.

October 12 -

The No. 3 U.S. bank by assets has made a change at the top after a snowballing scandal involving the creation of fraudulent accounts.

October 12 -

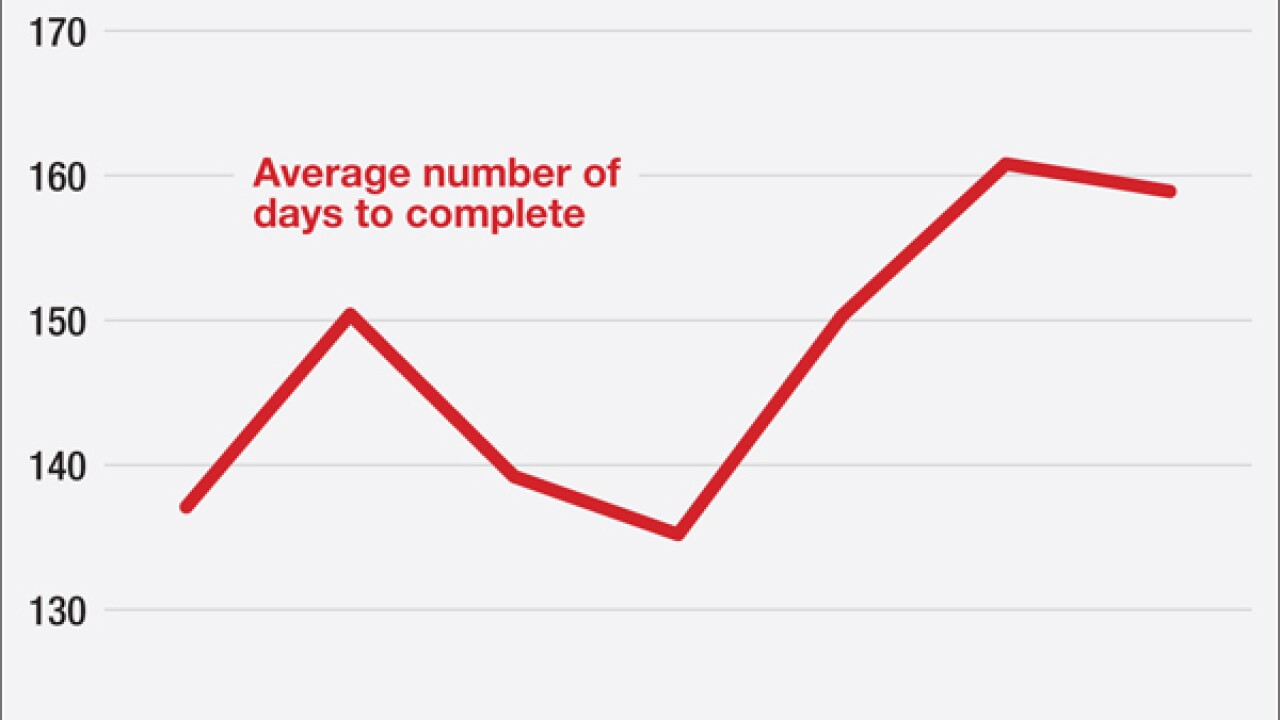

Heightened regulatory scrutiny, stricter credit-quality reviews by buyers themselves, cautiousness over systems conversions and other factors have added about three weeks to deal closings in recent years. There are inherent risks in that trend and ways to minimize them.

October 12 -

A top Wells Fargo executive and a former employee painted very different pictures of the culture and oversight at the San Francisco bank during a hearing by a California Assembly committee on Tuesday that probed the opening of 2 million phony accounts.

October 12 -

WASHINGTON Eighteen Republican State Attorneys General sent a letter to the Consumer Financial Protection Bureau last week pushing back against the agency's proposal to rein in high-cost small-dollar loans.

October 12 -

The ramifications for a U.S. Court of Appeals decision against the CFPBs constitutionality go far beyond just the agencys independence, and may have consequences for other federal agencies with similar structures. The ruling may also hamper the CFPBs powers going forward, including its ability to retroactively apply new rules.

October 11 -

WASHINGTON Navy Federal Credit Union, the largest credit union in the country, agreed Tuesday to pay $28.5 million to settle regulatory allegations it engaged in illegal debt collection practices.

October 11 -

Fintech circles are abuzz about the possibilities for streamlining compliance work following IBM's deal to buy Promontory. Artificial intelligence software could help separate false positives from true violations, for example, or read and parse through lengthy regulations.

October 11 -

The single-director structure of the Consumer Financial Protection Bureau represents an unconstitutional concentration of executive power, a federal appeals court said Tuesday. But the court stopped short of disbanding the agency, instead giving the president more power to remove its leader.

October 11 -

ATM operators have been down this road before, dealing with Mastercard's rules on EMV transactions occurring with the international Maestro debit cards as far back as 2013. But awareness and experience doesn't automatically translate to preparation.

October 10