-

Giving more Community Reinvestment Act credit to such partnerships will help low-income communities, despite industry concerns.

February 25 Clearinghouse CDFI

Clearinghouse CDFI -

Legislation introduced Monday would go beyond changes the National Credit Union Administration put in place last year and increase parity with state-chartered institutions.

February 25 -

NCUA board member Mark McWatters defended the agency's position on credit union-bank purchases and called out the ongoing sniping on both sides of the argument.

February 25 -

After more than five decades as a volunteer board member and committee member, one industry veteran looks back at how the movement has changed and what has stayed the same.

February 21ORNL FCU -

The Treasury secretary's statements are a sign that government agencies are still in the early stages of understanding this fundamentally new technology.

February 21 University of Pittsburgh

University of Pittsburgh -

The Treasury Secretary's statements are a sign that government agencies are still in the early stages of understanding this fundamentally new technology.

February 21 University of Pittsburgh

University of Pittsburgh -

The U.K.’s departure from the European Union is still causing lots of headaches for financial technology companies, but there’s now enough clarity to work with. And that often means operating from a new address.

February 20 -

There's much bank executives can learn from the 737 Max and Deepwater Horizon catastrophes, which could have been averted if regulators had been notified sooner.

February 18 Ludwig Advisors

Ludwig Advisors -

Want to satisfy regulators and better compete with the big banks? Here's where to start.

February 14 Oak Tree Business Systems, Inc.

Oak Tree Business Systems, Inc. -

The three cease and desist orders and one written agreement had cited separate concerns at JPMorgan Chase, Discover, Deutsche Bank and RBS.

February 13 -

Congress should further expand a tiered regulatory system to help community banks better serve local neighborhoods.

February 13

-

Payday lenders have long used bank partnerships and similar means to circumvent state interest rate caps. Lawmakers should stop such practices now.

February 10 Colorado

Colorado -

Tidjane Thiam submits his resignation; the two agencies said they will soon start accepting mortgages tied to the new rate and drop Libor by yearend.

February 7 -

The agency agreed to most recommendations made by its inspector general but pushed back on some conclusions.

February 5 -

Fewer than 30 CUs in the state would be eligible to make use of the rule, intended to help rural institutions and others attract a more qualified pool of directors and committee members.

February 4 -

Since the Payment Card Industry Data Security Standard was introduced in 2004, many merchants found compliance to be too arduous or costly and just skipped it, risking fines. But increasingly, other regulations like GDPR are changing the PCI DSS compliance equation.

February 4 -

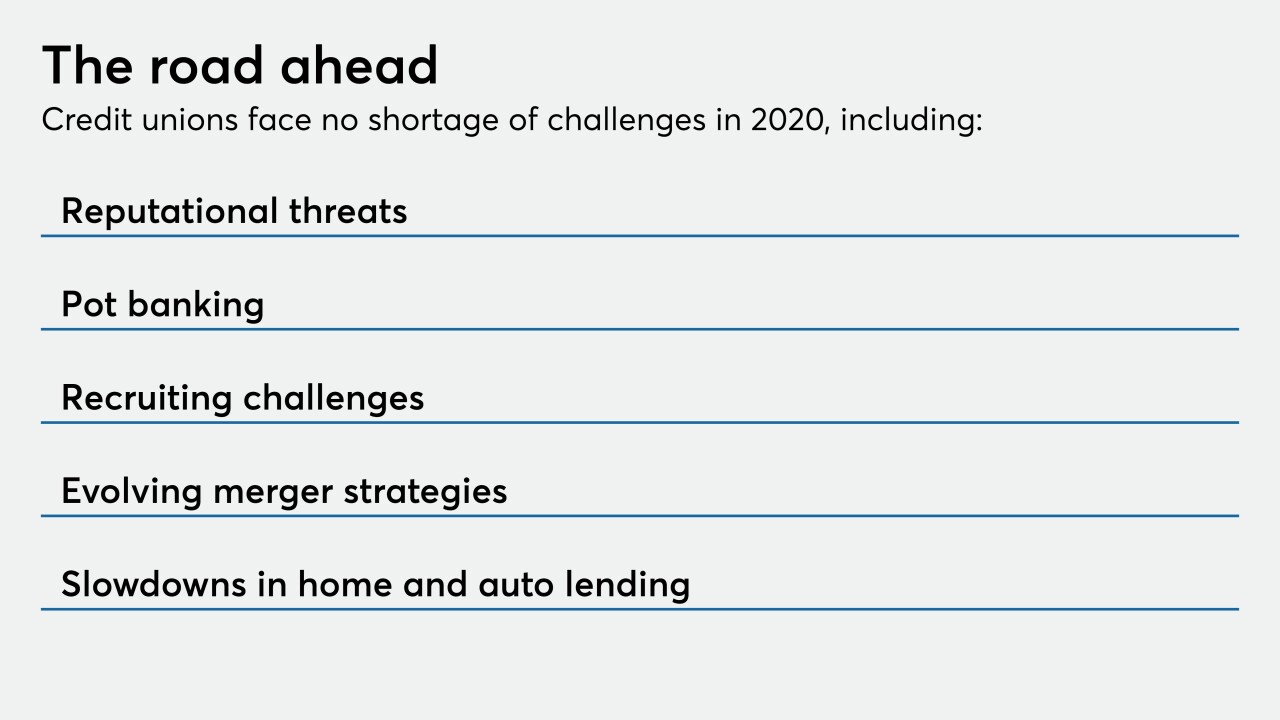

A look back at CU Journal's latest special report on the challenges the industry could face in the year ahead.

February 3 -

After maintaining a $250,000 exemption threshold for real estate appraisals for nearly 20 years, the National Credit Union Administration is set to raise that limit to $400,000.

January 31 -

Most stakeholders agree that the Community Reinvestment Act needs to be updated, but a congressional hearing featuring the regulator leading the overhaul effort showed just how contentious the process has become.

January 29 -

Critics of the OCC have long maintained that the agency was too close with the San Francisco bank. A watchdog's assessment of what transpired between 2009 and 2017 is expected to be completed late this spring.

January 28