-

The financial industry has praised the measured approach taken in a pending regulation on permitted communications with consumers. But two recent complaints by the bureau against debt collectors reflect a potentially aggressive enforcement stance.

September 11 -

The industry saw small gains in many loan categories during the second quarter, but credit cards declined. A new study from WalletHub shows the biggest quarterly drop in credit card balances in over 30 years.

September 9 -

Fintech lenders that reported a surge in missed payments at the start of the pandemic have seen credit quality rebound substantially since. But credit performance could still deteriorate if high unemployment persists and Congress fails to enact more relief measures.

September 8 -

Texas Trust Credit Union boosted loan volumes with a marketing tool inspired by “Game of Thrones,” but gamification strategies can be risky in light of data privacy concerns.

September 4 -

The state's financial regulator sent a subpoena to an auto-title lender seeking information about its partnership with a Utah bank, marking the first public disclosure of an investigation into efforts to evade a 2019 law capping interest rates on many consumer loans.

September 3 -

The agreement between Colorado authorities, marketplace lenders and banks offers a way to structure partnerships without triggering the wrath of state regulators.

September 3 Hunton Andrews Kurth LLP

Hunton Andrews Kurth LLP -

The card networks, along with PayPal and Citi, are responding to competition from the likes of Affirm, Afterpay and other "buy now, pay later" lenders. Should traditional credit card lenders be worried?

September 2 -

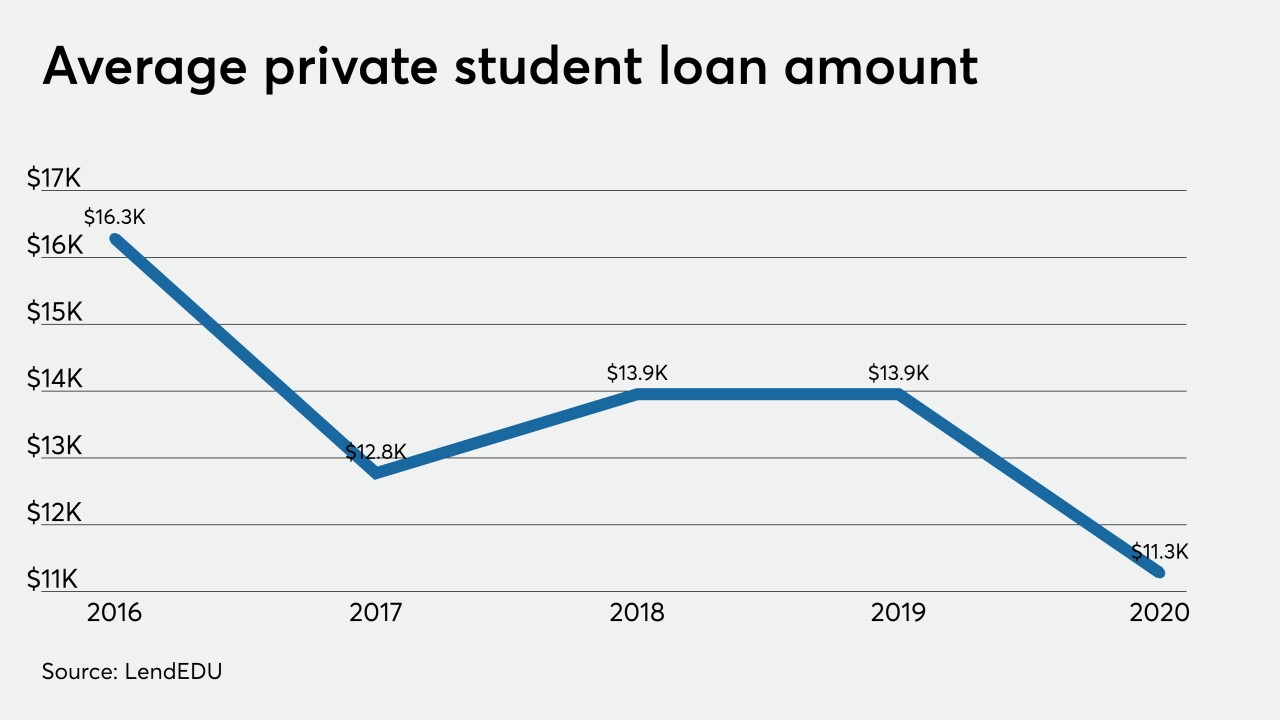

Lenders are struggling to deploy deposits into interest-earning assets, and changes to post-secondary education may further limit these options.

September 1 -

Capital One Financial is reining in credit lines to reduce its exposure while the nation’s largest card issuer, JPMorgan Chase, is rolling out a new card designed for travelers and diners.

September 1 -

The California plan to create a new, tougher state regulatory agency is at the finish line after lawmakers agreed to key exemptions for banks while maintaining strong enforcement measures for payday lenders and other firms.

August 31