-

A former economist says high-ranking officials engaged in “legally risky” behavior to downplay consumer harm; online payments and contactless transactions jumped in the first quarter, and some think the new habits will stick.

April 30 -

The ratings firm also took negative action with respect to Ally, Synchrony, Discover, Sallie Mae and Navient, citing the impact that the coronavirus crisis is having on their revenues and profits.

April 29 -

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

April 29 -

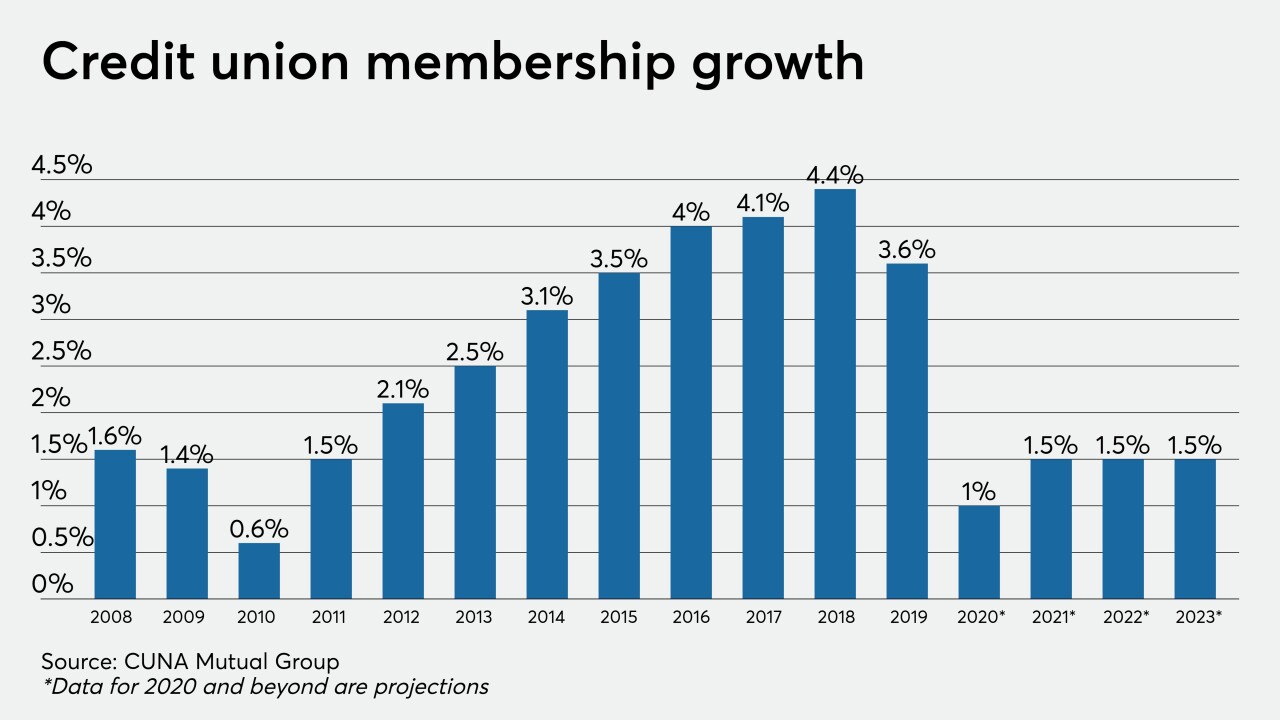

The company’s latest Credit Union Trends Report predicts that membership and lending will stall as job losses rise and consumer demand for loans dries up.

April 29 -

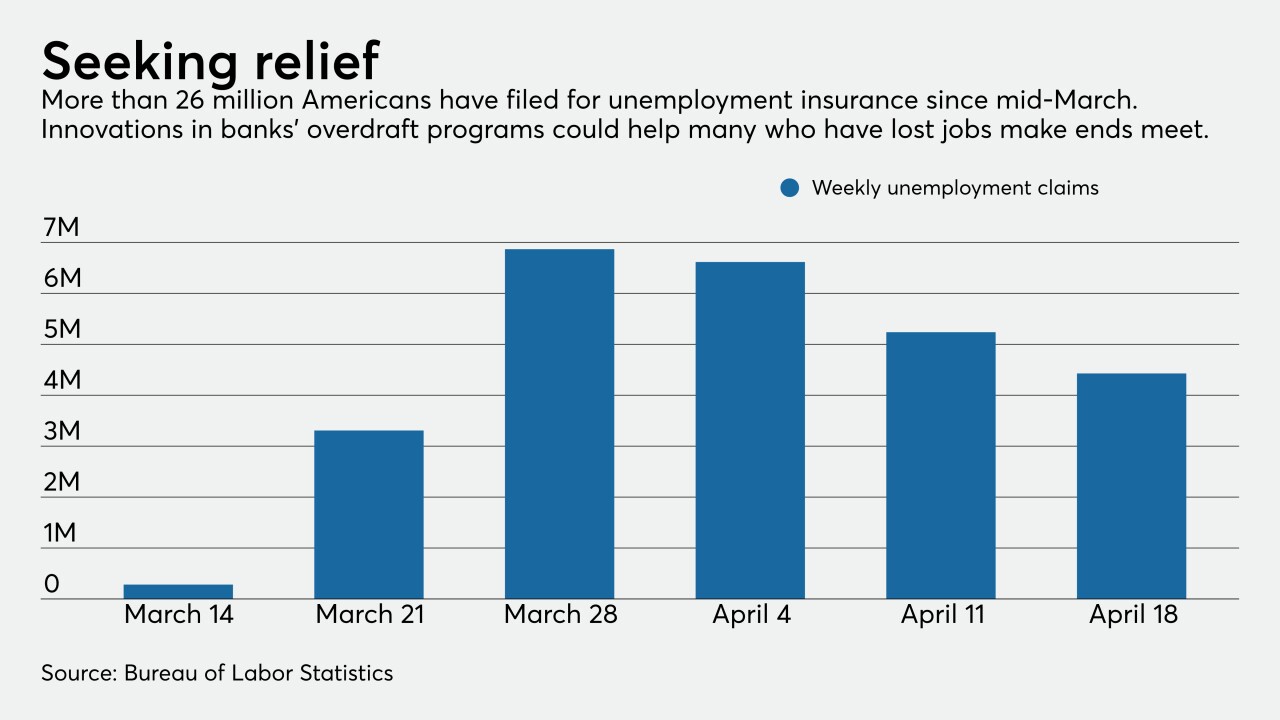

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

April 28 -

Just over 40% of respondents with private student loans said they had worked with their lenders to come up with a plan for reduced payments.

April 28 -

The two lenders are being more aggressive than other European banks in putting a price on the economic devastation caused by the coronavirus outbreak.

April 28 -

More details have emerged about the damage the coronavirus pandemic is inflicting on the hospitality industry. One servicer alone has received 2,000 workout requests in the past month.

April 24 -

The company reported a loss of $1.3 billion in the first quarter after setting aside more than $5.4 billion for potential loan losses.

April 24 -

Discover and Sallie Mae are the latest to report a surge in forbearance requests as households struggle with job loss and other hardships resulting from the coronavirus pandemic.

April 23