-

Financial firms are going on offense in Washington, pressing a policy agenda that would have been unimaginable just a few months ago. Some proposals, like reforming the Consumer Financial Protection Bureau, have been floated before while others began to gain traction after Republicans swept the November elections. Here's a look at some of the industry's requests.

February 13 -

The rise in home values is good news for homeowners looking to tap the equity in their homes to pay down debt or make big purchases, but some consumer groups fear it could lead to a new wave of loan defaults.

February 9 -

Rather than push for looser rules on robo-calls, the industry should focus on policy related to the channels consumers prefer: email and text messages.

February 9 TrueAccord

TrueAccord -

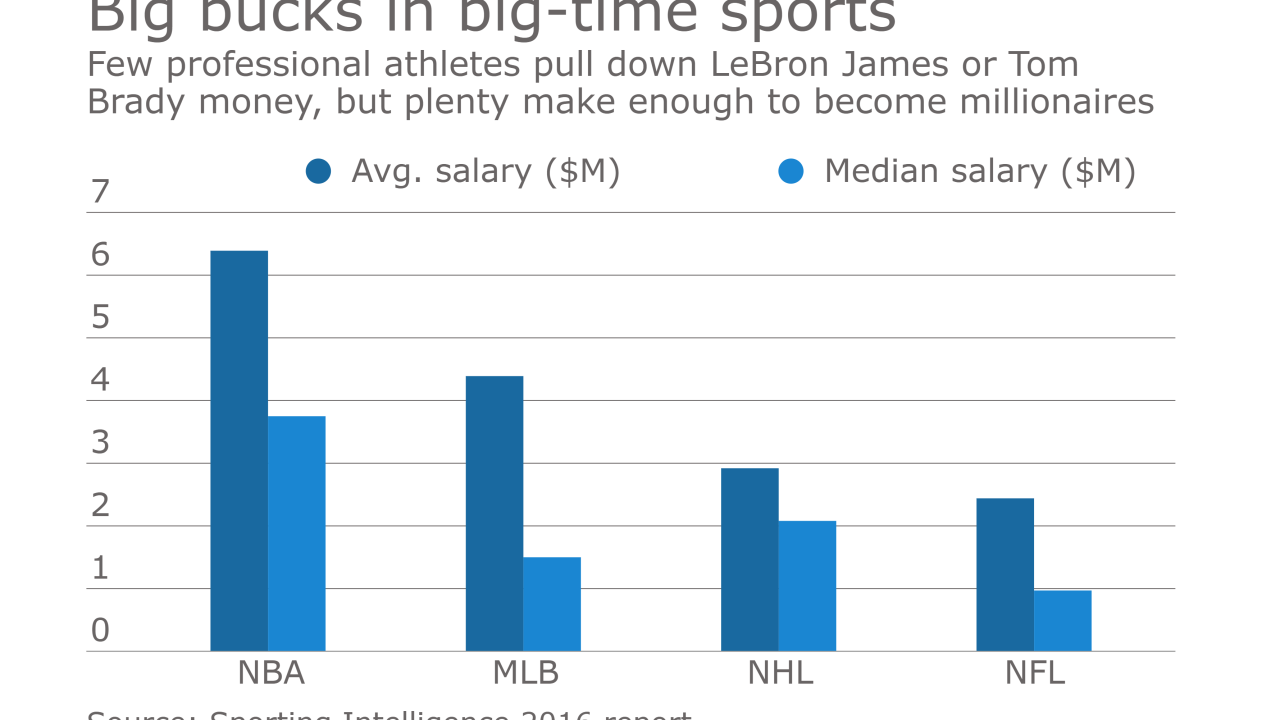

Sports stars face unique challenges obtaining credit, and bankers need to develop certain skills to successfully court those prospects.

February 8 -

Sports stars face unique challenges obtaining credit, and bankers need to develop certain skills to court those prospects successfully.

February 8 -

Most recently Thomas Pahl worked on debt collection and credit reporting issues as a partner at Arnall Golden Gregory in Washington.

February 8 -

The San Francisco-based online lender will soon begin selling refinanced student loans through Promontory’s member network.

February 8 -

Jessica Rich, who joined the agency in 1991, is stepping down in mid-February, the FTC announced Tuesday.

February 7 -

Home improvement lender EnerBank USA expects half of its loans will be originated on the app it built *in-house*, which promises near-instant approvals.

February 3 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

February 3