-

Credit unions need a clear strategy if they hope to break through to consumers already overwhelmed by the coronavirus.

May 26 PenFed Credit Union

PenFed Credit Union -

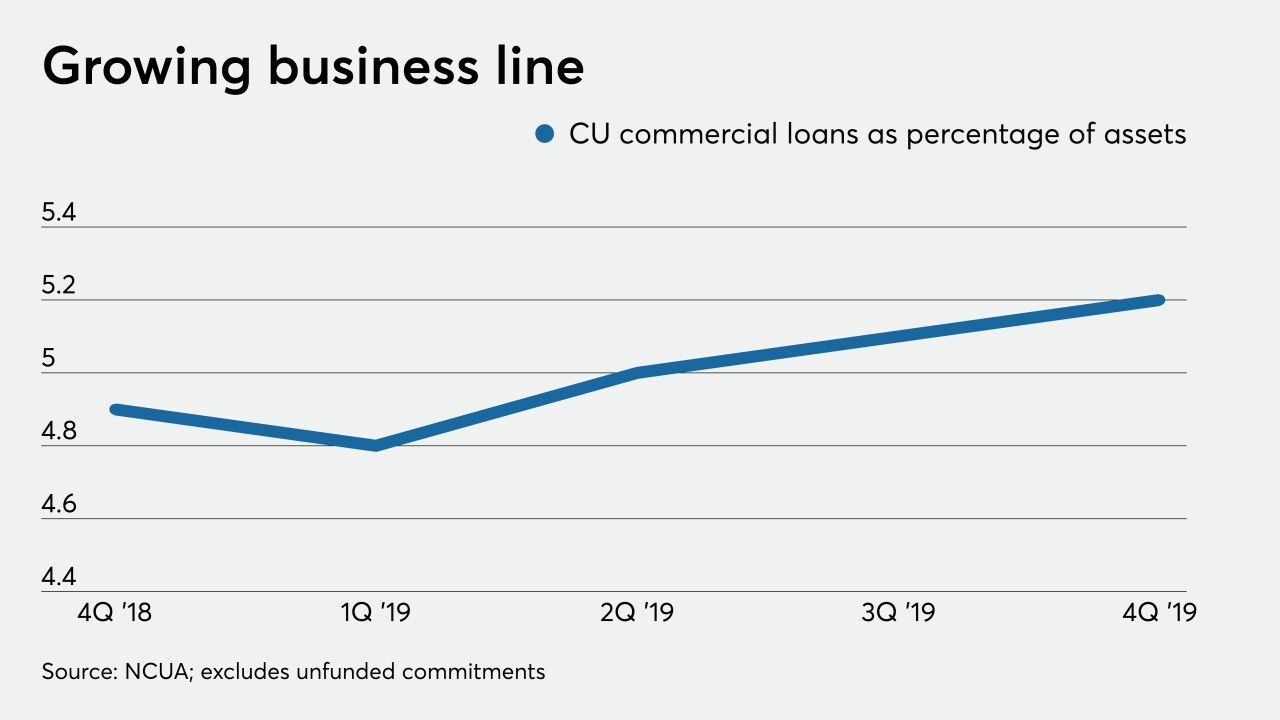

The industry is well positioned to gain market share, but institutions may not see the same levels of growth as after the last recession.

May 26 -

The new legislation directs the Treasury Department to protect electronic payments that Americans receive through the pandemic rescue package.

May 24 -

The templates are meant to make it easier to obtain agency approval for small-dollar loan products and to accommodate mortgage servicers that want to provide online loss mitigation options.

May 22 -

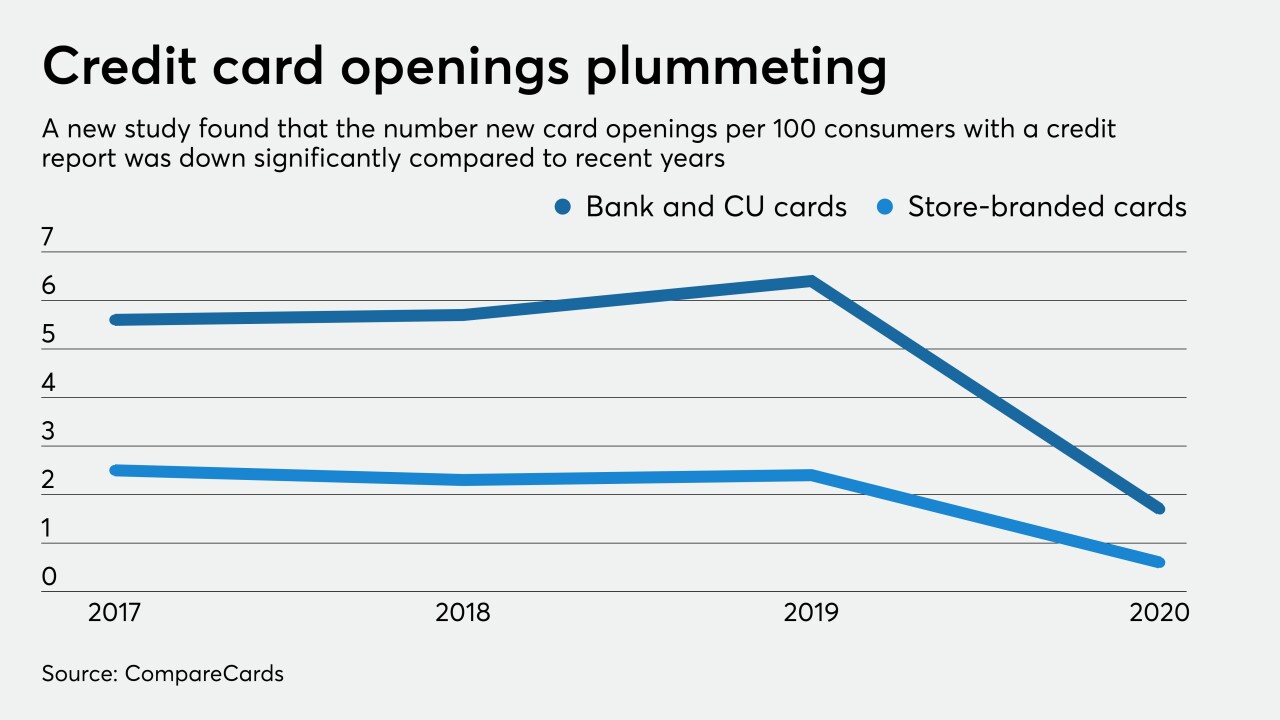

The drop is likely from both a decline in consumer demand and lenders becoming more cautious, according to CompareCards.

May 22 -

The HEROES Act aims to clarify whether economic stimulus checks from the government can be used for debt collection, but it's unclear if that language will survive the legislative process.

May 22 -

A Democratic measure to freeze foreclosures and auto repossessions through the coronavirus crisis while expanding eligibility for loan forbearance is getting strong pushback from banks and credit unions, which complain it would constrain credit.

May 21 -

The FHFA says the two government-sponsored enterprises need at least $240 billion of capital before they can go private; Transunion says more than 3% of consumer loans it tracks are in financial hardship.

May 21 -

Four federal agencies offered guidance Wednesday on how to offer products that compete against payday loans without incurring Washington's wrath. The announcement could spark the rebirth of deposit advances, which were regulated out of existence during the Obama administration.

May 20 -

One of the biggest subprime auto lenders agreed to pay $550 million to settle predatory lending charges; the bank regulator has largely completed his goal of overhauling the Community Reinvestment Act.

May 20 -

The lender will pay $65 million in restitution and forgive nearly $500 million in auto debt to settle charges that it steered subprime borrowers into risky loans.

May 19 -

Congress should pass legislation authorizing use of nontraditional data sources to make credit more available to consumers who’ve taken a hit from the coronavirus pandemic.

May 19Remitter USA and meldCX -

The Baltimore-area credit union crossed the latest threshold despite a dip in net income during the first quarter as many organizations struggle with the coronavirus fallout.

May 19 -

With rates so low — after steep emergency Federal Reserve cuts in response to the pandemic’s fallout — banks will struggle to generate bread-and-butter interest income and asset-sensitive lenders will face substantial net interest margin contraction this year and next, analysts say.

May 18 -

Democrats’ latest proposal to back debt collectors, enable loans for nonprofits and provide other relief could help steer negotiations with the Senate on more stimulus.

May 15 -

Democrats’ latest proposal to back debt collectors, enable loans for nonprofits and provide other relief could help steer negotiations with the Senate on more stimulus.

May 15 -

With the pandemic's economic toll leading to elevated billing error notices, the consumer bureau said card companies will not be cited if they fail to meet the typical time frame for resolving disputes.

May 13 -

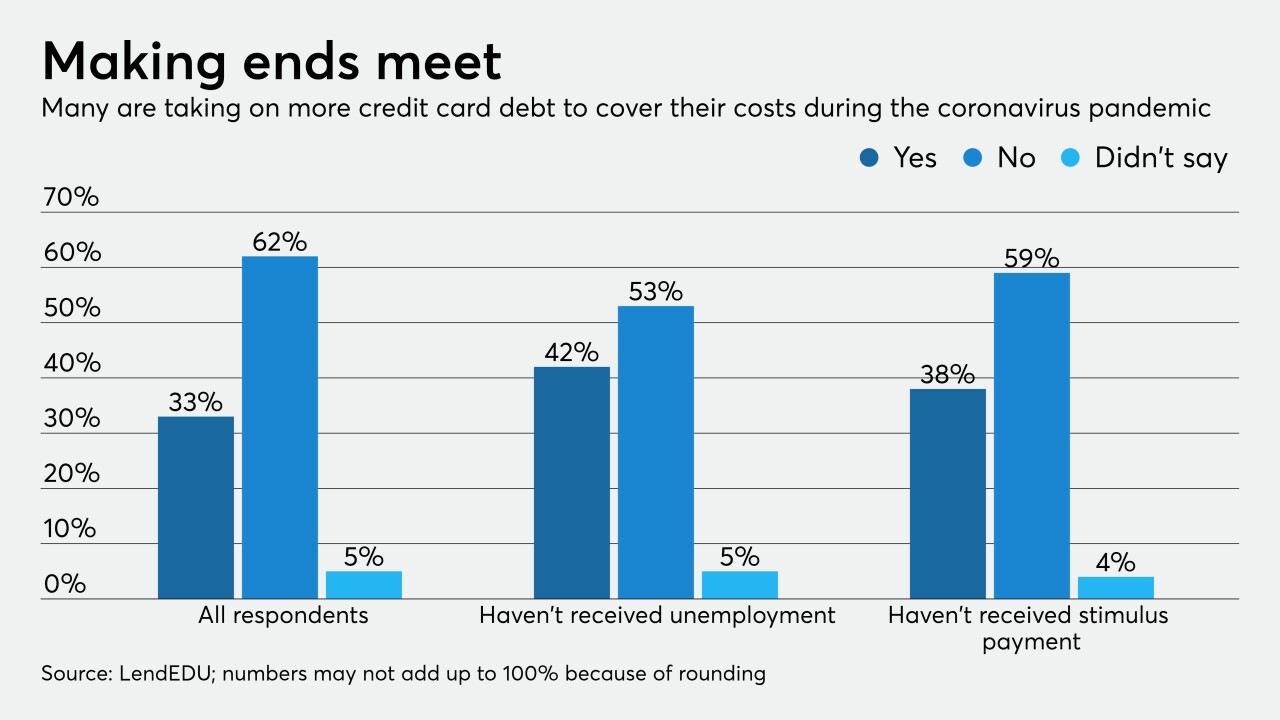

Despite some improvements, almost one-quarter of respondents to a LendEDU survey were still waiting on their relief checks and those consumers are more likely to take on additional credit card debt.

May 12 -

The Term Asset-Backed Securities Loan Facility is just one example of a fund that could be retooled.

May 12 Upstart

Upstart -

A surge in demand for home loans drove the increase, but the second quarter could see a slowdown in borrowing and more delinquencies as consumers contend with the economic fallout of the coronavirus pandemic.

May 5