-

Banks have resisted the need to switch their core systems, but how long can a financial institution continue to operate on a foundation of dust?

May 16 Financial Services Club

Financial Services Club -

The Delaware-based credit union will also implement other Symitar products for data analytics and forecasting.

May 10 -

The credit union said the conversion is part of its "members first" approach.

May 4 -

All six institutions have assets of $1 billion or more.

April 27 -

The $72 million-asset credit union plans to add an affinity debit card program, relationship-based patronage and other benefits in order to boost membership growth.

April 25 -

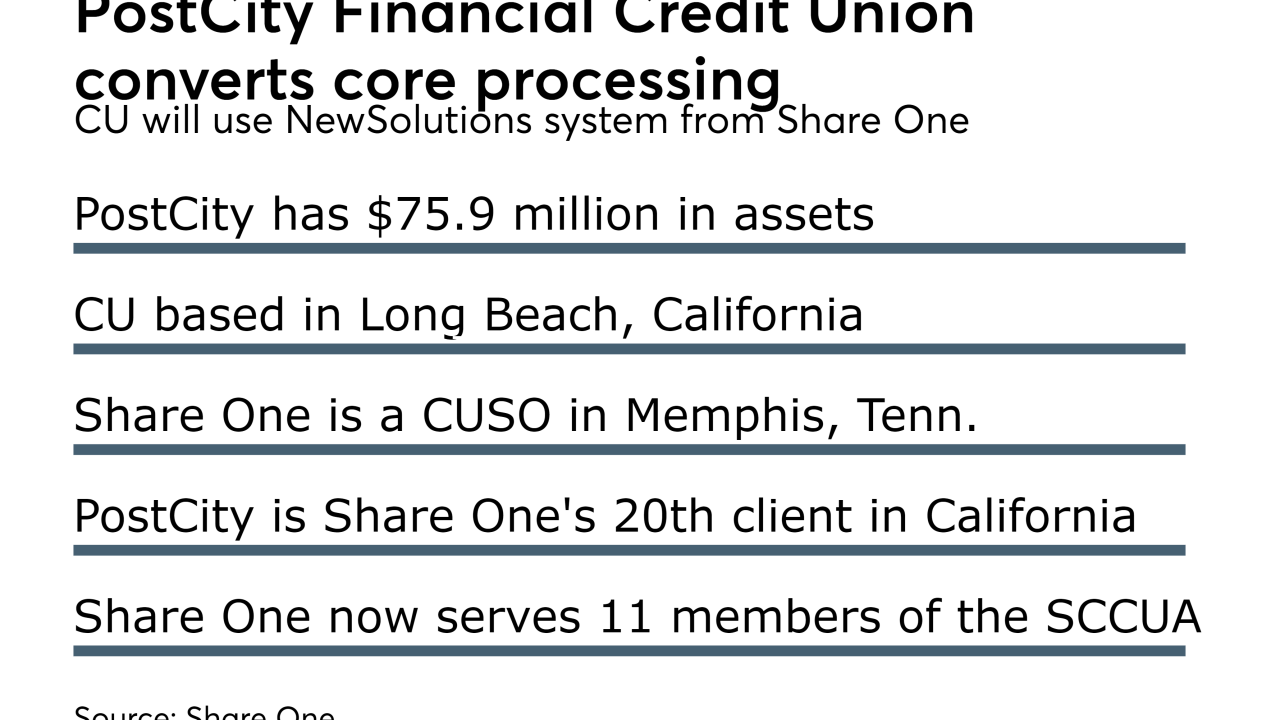

Credit union will switch May 1, becoming the 20th Share One client in California.

April 18 -

In our recent Community Bank Tech Projects series, we looked at the way a handful of banks chose to invest their precious resources over the last year. Here is a roundup of those projects.

March 31 -

Bank3 started as a $12 million-asset institution with a single branch, no online banking and a core system that was obsolete. Now it's much more.

March 24 -

OAS Staff FCU is one of a slew of CUs to sign new deals or renewals with EPL.

March 23 -

VA Desert Pacific FCU and East Idaho CU select outsourced delivery model of Episys core processing platform.

March 22 -

The credit union completed the conversion at the end of February.

March 21 -

Brazosport Teachers selected the core processing platform as a way to increase efficiencies and improve members' experience with the credit union.

February 27 -

Fearful banks hesitate on core conversions they need. But what's more risky? Keeping legacy technology? Or finally replacing it?

February 21 -

The Dorchester, Mass.-based CU liked COCC’s robust functionality.

February 15 -

The Massachusetts-based CU liked COCC’s cooperative business model.

January 27 -

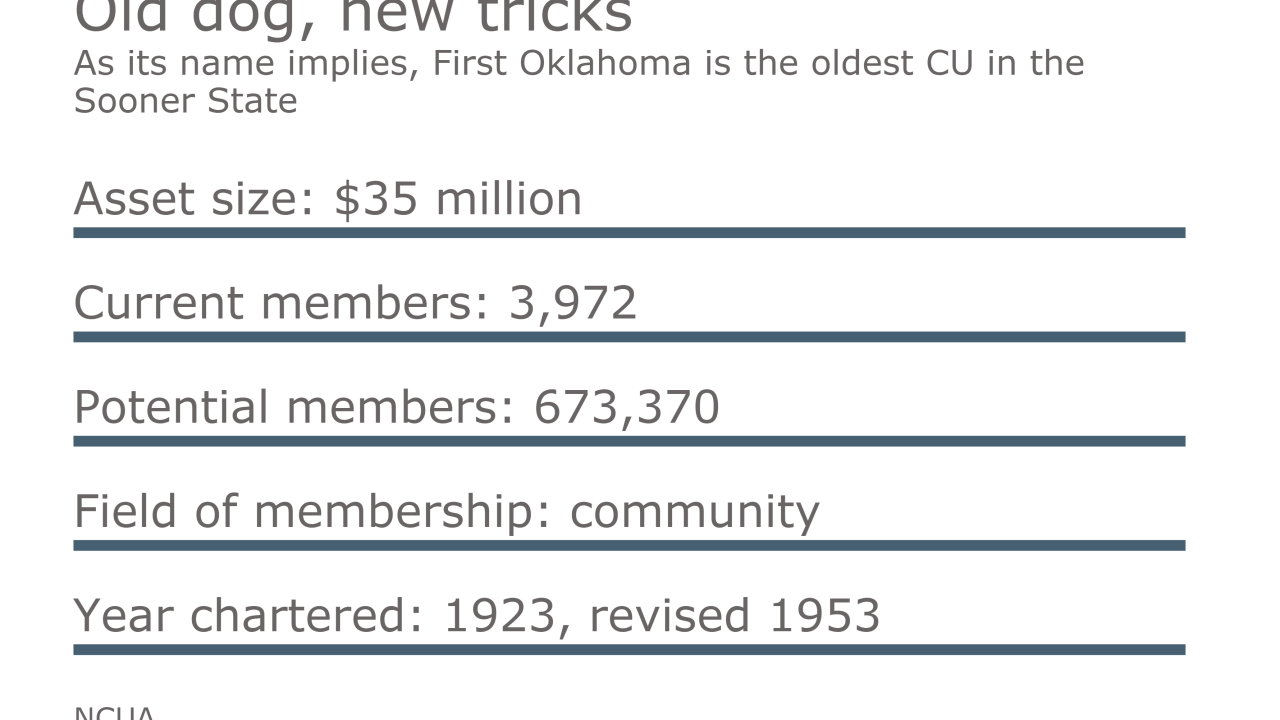

As its name implies, First Oklahoma is the oldest CU in the Sooner State.

January 17 -

Zions Bancorp. and its vendor, Tata Consultancy Services, shared more details Tuesday about the bank's ongoing core system conversion- a rare project, especially for financial institutions this size.

November 5