-

Core conversions are widely considered to be cumbersome, but experts offered an array of tips on how to ease the process.

June 14 -

Credit union will switch core processors in October, becoming the 21st Share One client in California.

May 31 -

In addition to renewing its agreement for core processing, the $258 million-asset credit union also re-upped with other Synergent products.

May 31 -

Credit unions in Alabama and Louisiana announce conversion to first-ever core system designed specifically for CDFIs.

May 25 -

The Virginia-based credit union will also implement a variety of Symitar platforms for business inteligence, analytics and more.

May 24 -

The Bellingham, Wash.-based credit union is the ninth $1 billion-plus CU to switch to Fiserv's DNA platform in the past six months.

May 22 -

Several firms are betting they will be able to help banks create platforms that allow customers to design their banking services.

May 19 -

Banks have resisted the need to switch their core systems, but how long can a financial institution continue to operate on a foundation of dust?

May 16 Financial Services Club

Financial Services Club -

Frank Sanchez, a former FIS executive, is launching a new cloud-based core banking system aimed at large community banks looking to ditch mainframes.

May 9 -

By banding together, banks can negotiate better terms with startups and other tech companies, FIS' chief operating officer says.

May 5 -

The credit union said the conversion is part of its "members first" approach.

May 4 -

All six institutions have assets of $1 billion or more.

April 27 -

All six credit unions will utilize Fiserv’s DNA core platform, extending contracts with the technology provider that go on for more than 20 years.

April 19 -

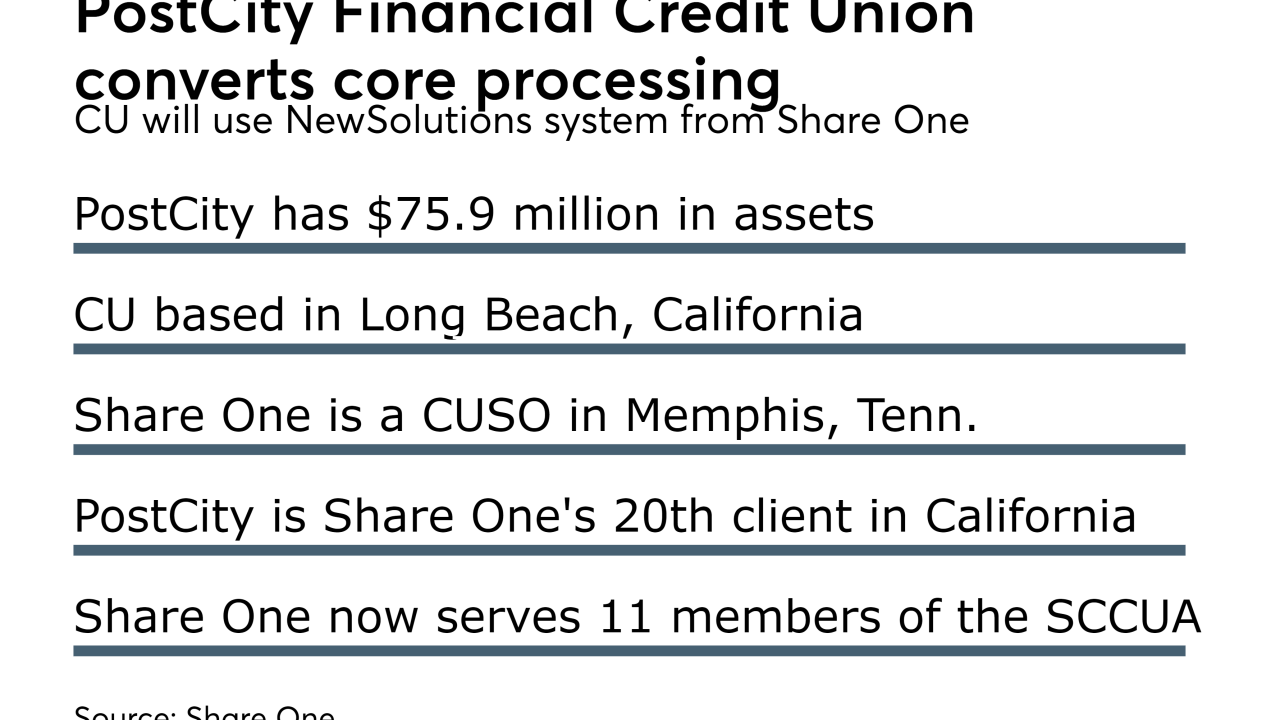

Credit union will switch May 1, becoming the 20th Share One client in California.

April 18 -

In our recent Community Bank Tech Projects series, we looked at the way a handful of banks chose to invest their precious resources over the last year. Here is a roundup of those projects.

March 31 -

Bank3 started as a $12 million-asset institution with a single branch, no online banking and a core system that was obsolete. Now it's much more.

March 24 -

With a hand from Geezeo, Jack Henry is rolling out a product that will guide consumers in managing their finances and is said to give banks better insights.

March 14 -

Banks that are customers of one or both vendors may look to leverage the situation to get better terms for certain products. But would small clients get enough attention from the global player the merger would create?

March 13 -

The private-equity firm Vista Equity Partners will acquire D+H in a deal valued at $3.57 billion.

March 13 -

A core processing startup gets $16 million and a U.K. challenger bank raises $27.6 million.

February 23