-

Failure to recognize the importance of artificial intelligence, mobile banking and other evolving technology would be a serious misstep.

April 30 EPL

EPL -

Alternative providers like courting new banks. De novos like the modern features many alternative providers offer upfront.

April 18 -

The FIS-Worldpay and Fiserv-First Data combos do provide notable scale, but the even-larger companies still won't produce the same pace of growth that younger nimble fintechs enjoy, says Eric Grover, a principal at Intrepid Ventures.

April 2

-

The companies could bring something new, such as merchant acquiring to community banks, but their merger could also cause anxiety about giant vendors.

March 18 -

The bank says it has restored access, but it hasn’t explained how a fire-suppression system at one facility could cause a nationwide outage across all of its channels, or how its system as a whole could have been left so vulnerable to the incident.

February 8 -

The merged bank would set up an innovation and technology center in Charlotte as part of its bid to compete better against the largest institutions and fintech startups.

February 7 -

Customers reported being unable to access online banking, mobile banking or their debit cards.

February 7 -

The core-banking vendor won the investment and ringing endorsements from the trade group and several banks because its open system and cloud delivery could eventually challenge entrenched tech players.

January 25 -

The large core banking software vendors are already criticized as large and slow-moving. Consolidations like these are only likely to make them more so.

January 16 American Banker

American Banker -

The large core banking software vendors are already criticized as large and slow-moving. Consolidations like these are only likely to make them more so.

January 16 American Banker

American Banker -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

The $126 million-asset credit union selected the new core platform in order to increase automation and cut down on "busy work" for employees.

December 27 -

The three institutions will use a platform from Fiserv to help improve efficiency.

December 20 -

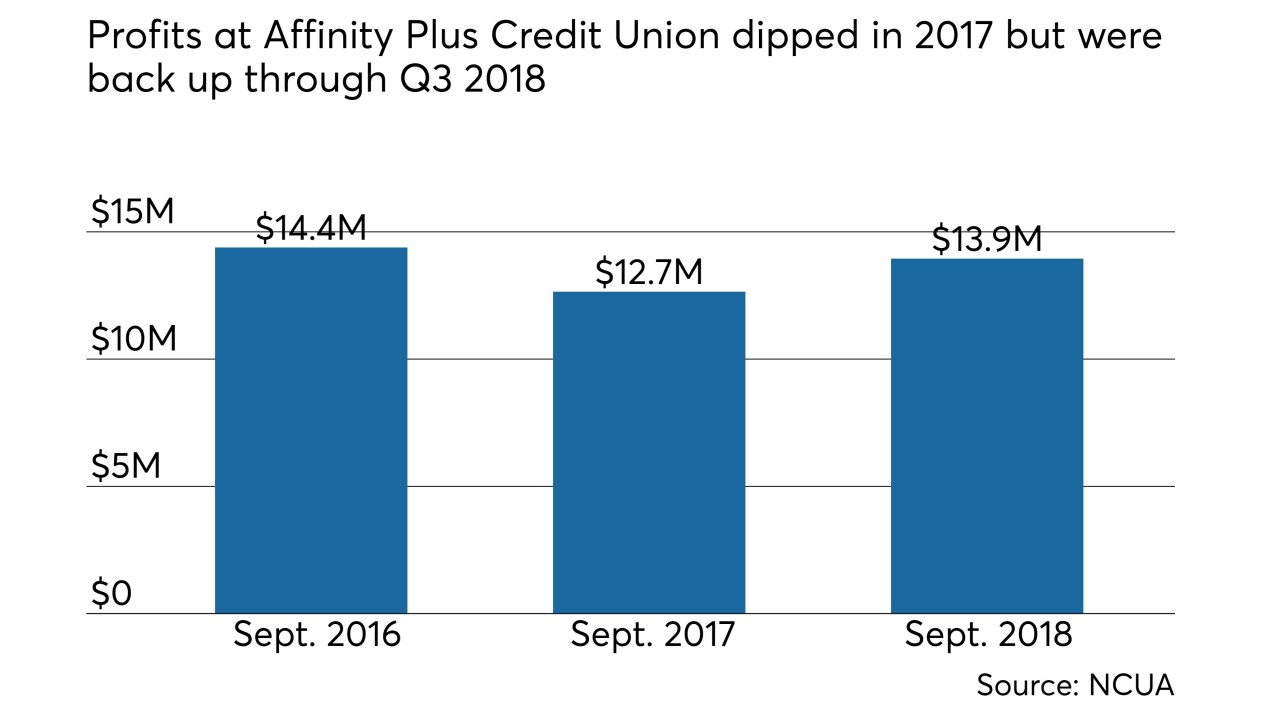

Along with a core conversion, the Twin Cities-area credit union deployed new loan origination systems and online and mobile banking platforms.

December 18 -

The Ponca City-based institution becomes the first credit union in Oklahoma to join CU*Answers.

December 13 -

The banking software company has agreed to acquire Avoka, a software-as-a-service company that helps banks with customer acquisition.

December 12 -

The Memphis-based CUSO, known for its NewSolutions system, signed six credit unions, all with assets under $140 million.

November 13 -

The credit union hsa been a Sharetec client for five years but was stuck in a contract that left it unable to convert until now.

November 7 -

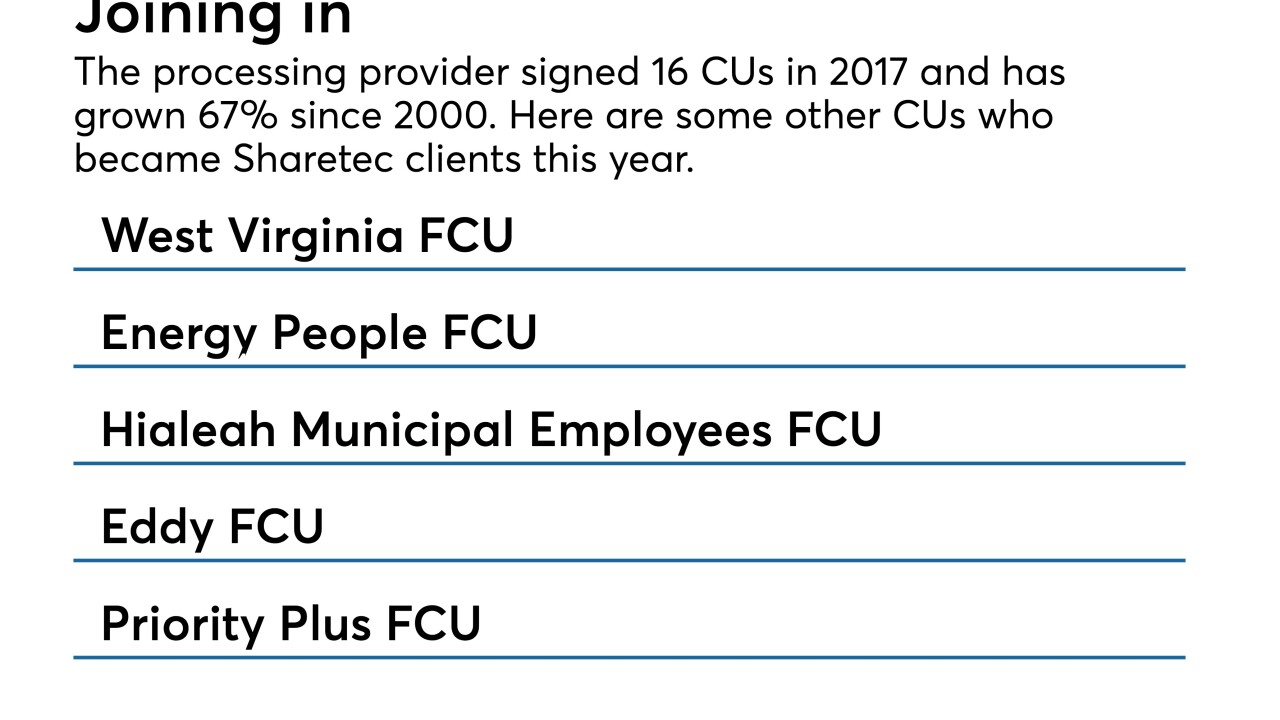

Unlimited third-party integrations and the system's design were some of the draw for the credit unions who signed up for the platform.

November 5