-

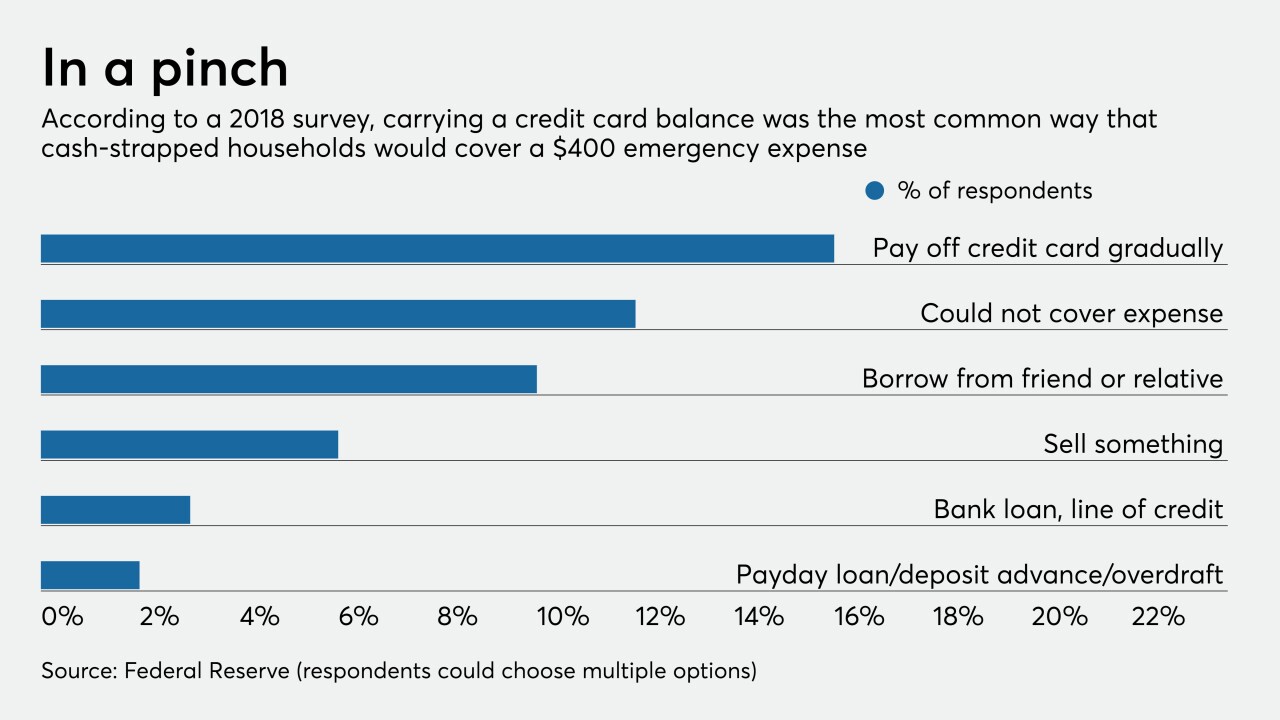

Regulators point to traditional financial institutions as well-positioned to meet short-term credit needs during the coronavirus pandemic, but there are still a host of questions about whether the industry should try to compete with high-cost lenders.

April 2 -

Many bankers find crucial parts of the SBA effort to help businesses hurt by the coronavirus outbreak to be unclear and onerous. If those issues go unresolved, participation could suffer.

April 2 -

Mortgage lenders are preparing for the biggest wave of delinquencies in history. If the plan to buy time works, they may avert an even worse crisis: Mass foreclosures and mortgage market mayhem.

April 2 -

The worsening economy brought on by the coronavirus pandemic has big banks rethinking who they will lend to.

April 2 -

Digital banks outscored brick-and-mortar banks in a recent J.D. Power study of customer satisfaction. However, the survey pointed to shortcomings in call center services, which are in high demand during the COVID-19 pandemic.

April 2 -

The insurance and research company expects the U.S. to fall into a recession as unemployment spikes and the GDP declines.

April 2 -

Admitting it "may be professional suicide" to take the reins in the midst of a global health crisis, Brady Harris says his role atop Dwolla's management chain will be "a real test of my leadership abilities."

April 2 -

The agencies will give the industry another month to submit feedback on the so-called covered fund portion of the rule "in light of potential disruptions resulting from the coronavirus.”

April 2 -

If Capitol Hill plans another round of stimulus, Democrats could have more leverage to demand steps such as suspending overdraft fees – a measure which could have a big impact on credit union revenue.

April 2 -

Lenders can offer deferred payments and capitalize on digital banking to help small businesses and consumers get back on their feet.

April 2

-

The change — effective immediately — will reduce capital demands by about 2% overall, the Fed estimated, and will be open for a 45-day comment period.

April 2 -

A coronavirus-spurred slowdown in travel and restaurant spending has credit card issuers reworking their offerings.

April 2 -

Lloyds Banking Group Plc will offer interest-free overdrafts and credit card payment freezes to customers struggling during the coronavirus pandemic, pre-empting the Financial Conduct Authority’s latest measures to help households.

April 2 -

About 1,000 interns were notified of the change this week. They will still receive the pay and housing funds outlined in their original offer letters.

April 2 -

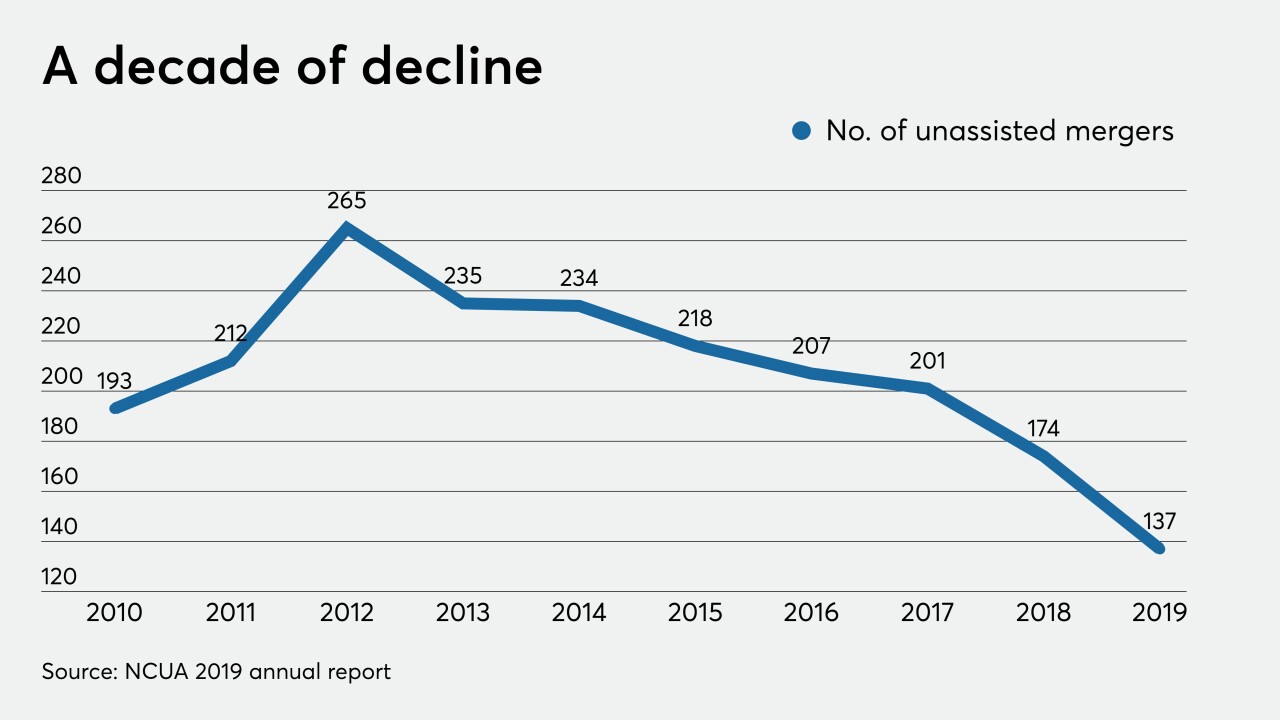

The number of deals per year was declining even before the pandemic, and it's unclear when things might pick up again.

April 2 -

The U.K.’s growing panic about the spread of coronavirus has created an open season for fraudsters, with government agencies and cybersecurity companies reporting unprecedented levels of criminal activity since the virus began sweeping across the globe in January.

April 2 -

If Capitol Hill plans another round of stimulus, Democrats could have more leverage to demand steps such as suspending overdraft fees or placing a temporary cap on consumer lending rates.

April 1 -

Amid the coronavirus emergency, the central bank may have to decide at what point the imperatives of an economic crisis outweigh the requirements of its most severe enforcement action in recent memory.

April 1 -

The agency said lenders should avoid reporting delinquent payments to credit bureaus for consumers who have sought payment relief due to the pandemic.

April 1 -

For the second time in a week, the National Credit Union Administration has delayed the deadline for public comment on a proposed regulation.

April 1