-

Some customers have complained of limits being slashed by one-third to two-thirds, eroding their ability to borrow in an emergency during a pandemic or potentially hurting their credit scores.

August 28 -

COVID-19 has caused a shift in how workers are using the DailyPay earned wage access (EWA) service by withdrawing more money to help out others and pay down debt.

August 28 -

All parts of the payments industry can preserve cash, but mandates may be necessary, says Moorwand's Luc Geuriane.

August 28 Moorwand

Moorwand -

Some customers have complained of limits being slashed by one-third to two-thirds, eroding their ability to borrow in an emergency during a pandemic or potentially hurting their credit scores.

August 28 -

The need to quickly streamline business payments isn’t possible through manual processing, says Medius’ Daniel Saraste.

August 28 Medius

Medius -

New analysis from S&P found that only two of the of the top 20 credit unions that participated in the Paycheck Protection Program loans had assets of less than $1 billion.

August 27 -

There’s never been a better time, nor better technology available, to make cardholders safe from card-not-present fraud, says Keyno's Robert Steinman.

August 27 Keyno

Keyno -

One thing that many parents are finding unusual this year is the amount of money being spent on school supplies during the coronavirus crisis — it’s actually going up.

August 27 -

Both the Federal Housing Finance Agency and Federal Housing Administration are extending relief for homeowners and renters due to the pandemic crisis.

August 27 -

A historic charter award defines a new beginning for digital banking, Varo Money becomes the first consumer fintech in US history to gain full regulatory approval to become a national bank

-

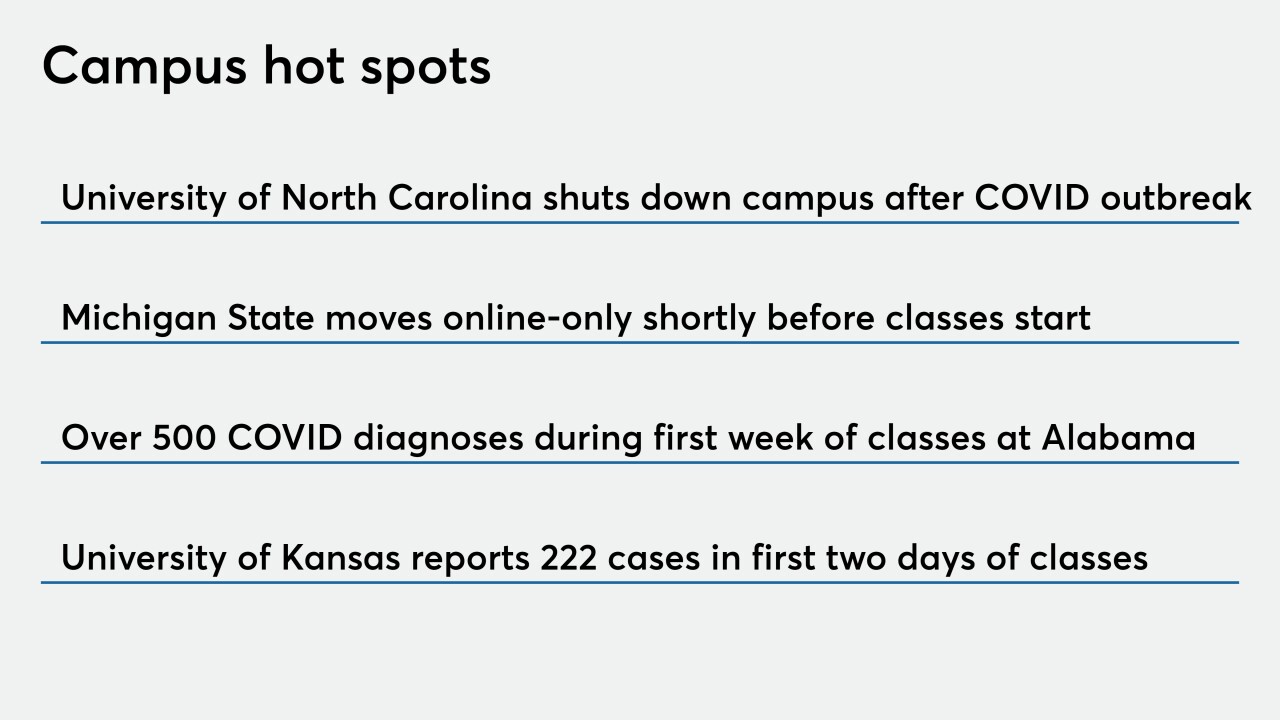

Institutions serving colleges and universities traditionally see membership surge in the fall, but are now planning for a decline as classes move online.

August 27 -

Several months after the pandemic took hold, Diebold Nixdorf and NCR have adopted an ATM recovery strategy that stresses contactless access as well as innovations that are similar to other industries that traditionally rely on kiosks.

August 27 -

The Minneapolis company’s partnership with the Black Business Investment Fund and other community development financial institutions is an example of how banks can fulfill multimillion-dollar pledges aimed at closing the racial wealth gap.

August 26 -

The agencies completed steps to ease a community bank capital measure temporarily and to delay a new credit-loss accounting standard.

August 26 -

If the mega payments deals of 2019 left the acquiring landscape somewhat scorched, the COVID-19 pandemic planted new seeds to allow ISOs to grow by quickly converting merchants to electronic payments.

August 26 -

The OCC’s efforts to bring the technology into the financial mainstream could help people in underserved communities execute payments more securely.

August 26 FinClusive

FinClusive -

"It's on-demand capital for us," Optus Bank's CEO says of the payment company's deposit. The funds are part of PayPal's broader effort to confront race and income inequality.

August 26 -

"It's on-demand capital for us," Optus Bank's CEO says of the payment company's deposit. The funds are part of PayPal's broader effort to confront race and income inequality.

August 26 -

Various efforts to limit cash were in motion well before the global health crisis, but merchant and consumer digital money habits being built during the pandemic will carry on for many years, thus leaving cash sidelined in many purchasing scenarios.

August 26 -

The mortgage giants were criticized earlier this month for a plan to charge an "adverse market fee" to protect against losses resulting from the pandemic.

August 25