-

The Georgia company warned that outstanding loans could fall and deferrals will likely rise as its home state and Florida grapple with the pandemic.

July 21 -

The Federal Reserve, U.S. Mint and financial industry representatives are strongly considering a public call for Americans to deposit their spare change, among other fixes, to get coins circulating again. Meanwhile, banks of all sizes are getting creative at the local level.

July 21 -

The coronavirus pandemic has exposed weaknesses even at well-established fintechs. They could become more resilient by partnering with traditional financial institutions.

July 21 CCG Catalyst

CCG Catalyst -

The “new normal” of COVID-19-influenced retail is actively being exploited by fraudsters, as LexisNexis Risk Solutions finds fraud costs for U.S. retailers rising in 2020 by 7.3% over last year’s data.

July 21 -

The coronavirus pandemic has cast a shadow over the use of cash, which is often perceived as dirty because it frequently changes hands and is almost never washed.

July 21 -

By boosting digital payments and mobile experience, issuers can turn routine transactions into meaningful interactions, says Entersekt's Simon Rodway.

July 21 Entersekt

Entersekt -

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

July 20 -

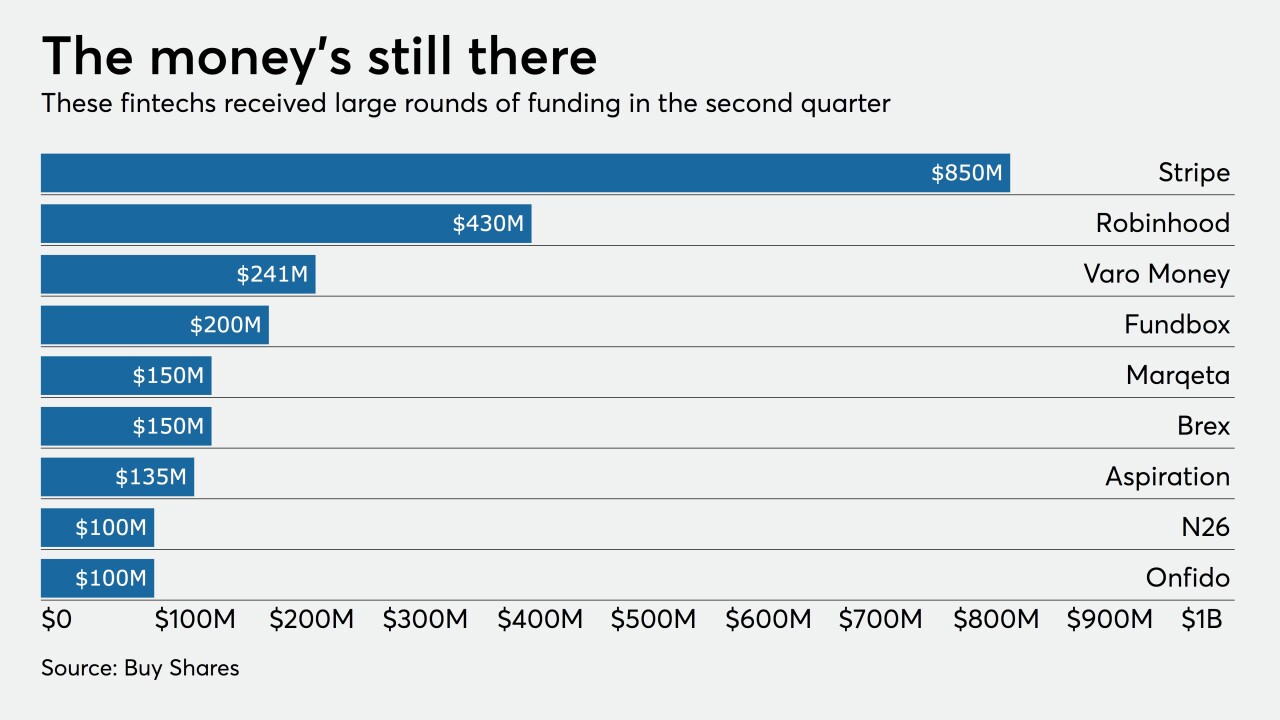

Business models and adaptability will determine the success — or failure — of financial technology companies as they deal with fallout from the coronavirus outbreak.

July 20 -

The report from the commission created to monitor the government's response to the pandemic comes as Congress begins negotiations over another round of stimulus.

July 20 -

Mortgages taken out to fund business operations can now be modified in bankruptcy. That’s a relief to borrowers — particularly with business failures expected to increase as the pandemic drags on — but a possible headache for banks and investors that hold the loans.

July 20 -

Ant Group is planning one of Asia’s largest IPOs while the world’s afflicted by a global pandemic, political turmoil and historic economic stress. Despite the chaos — or perhaps because of it — the timing could be right for Ant to challenge the global order in e-commerce and digital payments.

July 20 -

The latest nominee to the National Credit Union Administration board is set to appear before a Senate committee while a new forecast indicates the economy could take longer to turn around than expected.

July 20 -

Old scoring and algorithms don't consider a rapidly changing economy and risks, according to consultants Maria Arminio and Bo Berg.

July 20 Avenue B Consulting

Avenue B Consulting -

The streak of strong gains for new members was flagging by the end of 2019 and has only worsened since then.

July 20 -

The Birmingham, Ala., company more than doubled its loan-loss provision from three months earlier and its chief financial officer said that more than half of its loans to oil and gas companies could eventually become criticized.

July 17 -

Government stimulus efforts, including the Paycheck Protection Program, have fueled a deposit surge. The challenge for banks is figuring out how to put that new money to use.

July 17 -

Some 60% of Ally’s auto originations in the second quarter were used-vehicle loans, the highest percentage in the company's history.

July 17 -

Rolling out digital strategies now that enable creativity and innovation will establish a reliable foundation to prepare retailers to best meet their customer needs during whatever phase comes next, says Mobiquity's Sree Singaraju.

July 17 Mobiquity

Mobiquity -

The central bank is expanding its lending facilities meant to help businesses weather the coronavirus pandemic to organizations like educational institutions, hospitals and social service groups.

July 17 -

The coronavirus pandemic has cast a shadow over the use of cash, which is often perceived as dirty because it frequently changes hands and is almost never washed.

July 17