-

The U.S. economy can escape another decadelong slog back to health if strong public measures or a vaccine curb virus surges, Federal Reserve Bank of San Francisco President Mary Daly said.

July 1 -

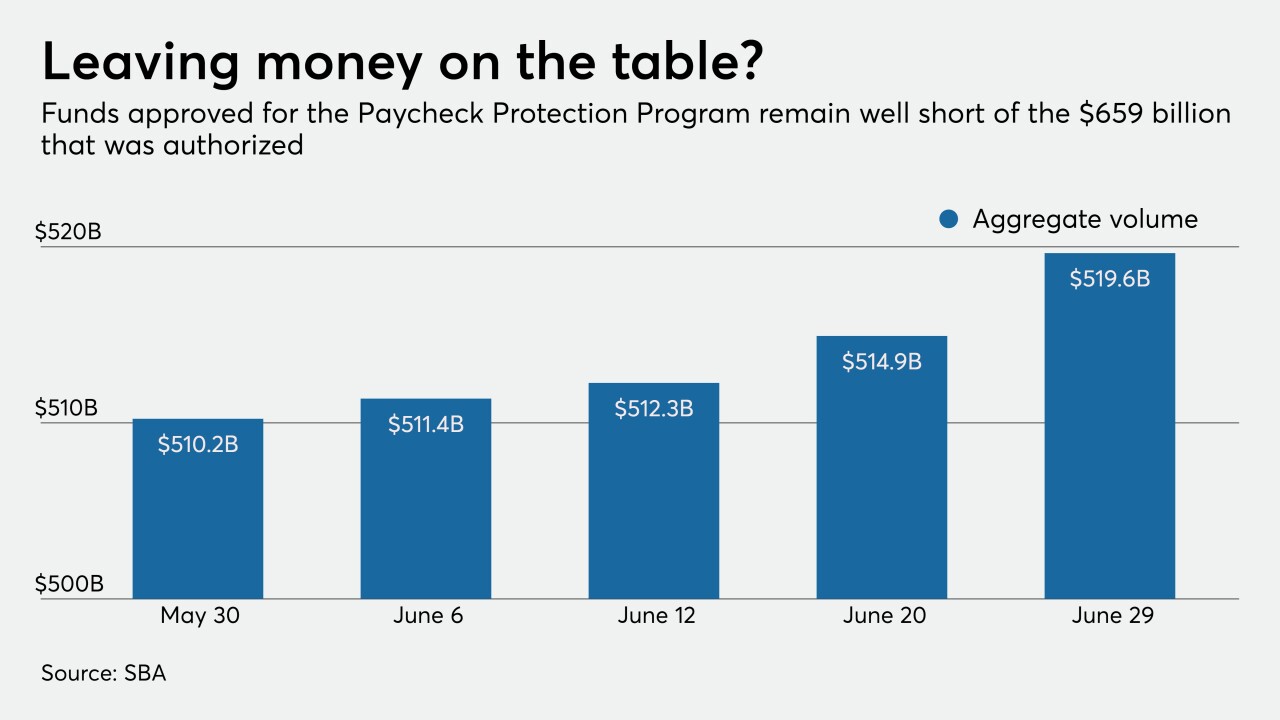

The Paycheck Protection Program propped up many banks' balance sheets in the first half of the year, but what will drive loan demand in the second half?

July 1 -

An obscure-sounding statistic gives a fresh look at how dramatic the move to digital finance has been the past few months — and how permanent the move will be.

July 1 -

The bank is rethinking its plans for bringing back workers in Texas, Florida and other states where new coronavirus cases are surging.

July 1 -

Jelena McWilliams explains the agency's decision to enlist the help of tech innovators to modernize a reporting process that the coronavirus epidemic has exposed as outdated.

July 1 Federal Deposit Insurance Corp.

Federal Deposit Insurance Corp. -

Investar Holding called off its deal to buy Cheaha Financial in Alabama.

July 1 -

CB Financial Services, Mercantile Bank and Nicolet Bankshares said they would shutter a total of 12 branches.

July 1 -

Fintech is providing real, viable and more affordable options for money remitters, to continue to be the lifeblood for communities all around the world, says Ding's Rupert Shaw.

July 1 Ding

Ding -

Federal Reserve Chairman Jerome Powell said about 300 lenders have signed on to the program and that the central bank is committed to making adjustments that could attract more borrowers.

June 30 -

Chris Dodd and Barney Frank said the legislation — nearing its 10th anniversary — put banks in position to be a stabilizing force during the coronavirus crisis.

June 30 -

Six of the eight regional banks that announced their stress capital buffers on Tuesday said they will need just a 2.5% cushion to weather an economic downturn. All eight said they’ll keep their dividends steady.

June 30 -

Lenders are selling their Paycheck Protection Program loans or hiring outside companies to navigate the process in an effort to reduce risk and avoid overloading their employees.

June 30 -

Banks are using emotion AI, which picks up subtle signals over text, audio and video, to help their customer service agents do their jobs better.

June 30 -

The coronavirus outbreak forced BBVA USA to rethink a plan to add 15 branches in Texas, but it decided to move ahead anyway, albeit with a few tweaks.

June 30 -

COVID-19 has been a major accelerator in the shift to digital for most of us; how we take classes, do our jobs, connect with friends, and definitely how we shop, says PPRO's James Booth.

June 30 PPRO

PPRO -

Tia Ilori, Senior Director of global fraud and breach investigations at Visa, joins us to talk with Michael Moeser, PaymentsSource's senior analyst, about the new attacks and fraud trends that have emerged since the start of the pandemic.

June 30 -

The so-called tech sprint involving 20 companies from across the country is intended to help improve the efficiency of banks' quarterly data submissions to the regulators.

June 30 -

Bank consolidation has been stagnant since the pandemic hit, and the outlook for the rest of the year is bleak.

June 29 -

With multiple business sectors reeling from the pandemic, banks are facing tighter net interest margins, provisioning more for losses and seeing their balance sheets expand, the agency said in a report.

June 29 -

Payments technology company WEX has received a $400 million investment to offset negative effects from coronavirus, and will back out of a $1.7 billion pair of deals announced six months ago.

June 29