Credit cards

Credit cards

-

Wells Fargo is opting to keep its private-label credit card unit after reaching out to potential buyers last year, according to a person with knowledge of the matter.

February 9 -

On Sep. 30, 2020. Dollars in thousands.

February 8 -

Citigroup will refund an additional $4.2 million to some credit card customers who were overcharged years ago.

February 8 -

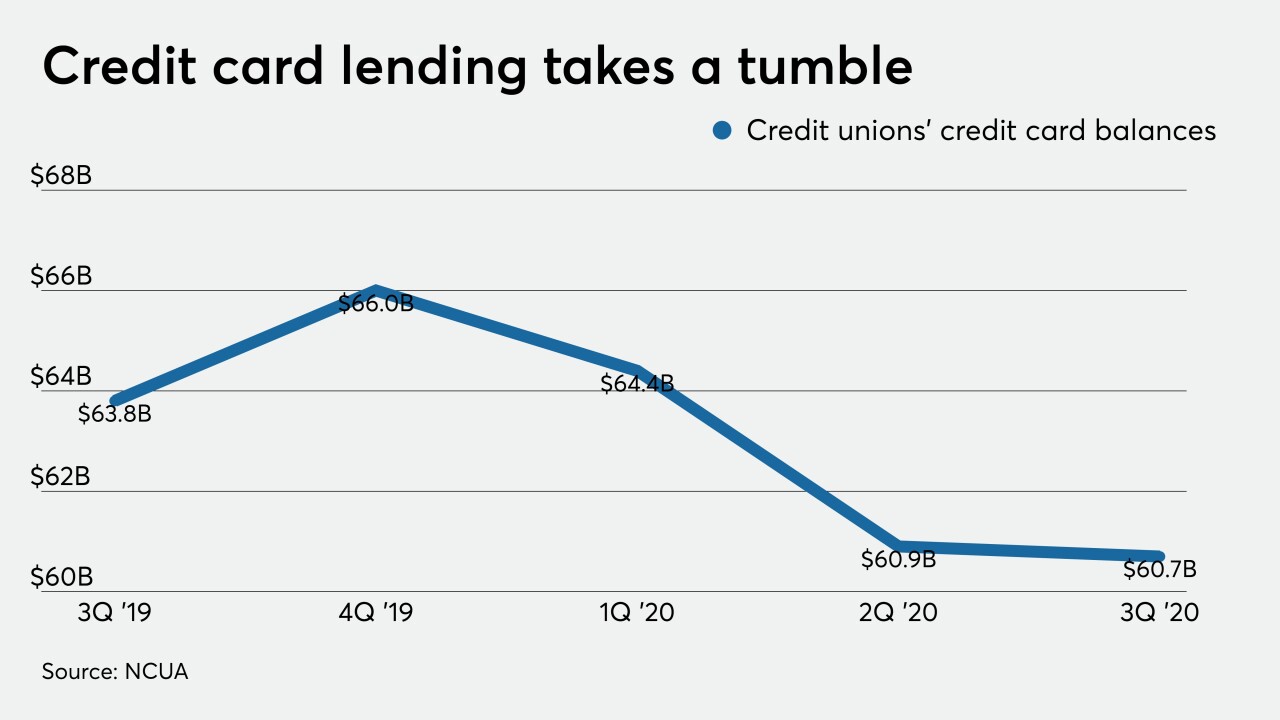

Credit unions are hoping for a return to normal credit card spending patterns sometime during the second half, but the pandemic has created a domino effect of complicating factors.

February 4 -

On Sep. 30, 2020. Dollars in thousands.

February 1 -

Like other card issuers, the Stamford, Conn., company expects current trends — soft loan demand but strong credit quality — to reverse later this year as the economy emerges from the pandemic-induced recession.

January 29 -

City National Bank is working with the fintech startup Extend to further boost contactless payments at the point of sale for business employees through the launch of a virtual Visa commercial credit card.

January 29 -

Allowing employees to work from home until the holiday will give Amex the chance to monitor the speed with which vaccines are distributed, CEO Stephen Squeri said in a memo to workers.

January 29 -

Walmart’s warehouse unit Sam’s Club is introducing digital features and new rewards tiers to modernize its Synchrony-issued Mastercard.

January 28 -

Capital One Financial is the latest credit card issuer to release loss reserves because its loans have performed better than expected during the pandemic.

January 27