-

Singapore-based money transfer platform TransferTo is working with Stellar.org to facilitate low-cost blockchain-based cross-border remittances for underbanked and unbanked consumers in emerging markets.

September 19 -

South Korean cellular carrier LG Uplus, a unit of LG, says early next year it will launch a test of a blockchain-based overseas payment system.

September 17 -

At this year’s Swift Business Forum in New York, executives said banks can build "more intelligent routing" to speed up payments and reduce the cost of processing and delivery.

September 13 -

The payments company released a platform made up of nine B2B networks and powered by Microsoft’s Azure.

September 13 -

The payments technology that powers international trade is crucially important because it helps streamline the processes and trim the costs of conducting business overseas, according to Darren Hutchinson, head of commercial in the Americas for WorldFirst.

September 13 WorldFirst

WorldFirst -

The highly lucrative remittance business, once the sole purview of established players with large agent-based locations such as Western Union and MoneyGram, is under an all-out attack by digital fintechs.

September 12 -

The popularity of technology-driven international transactions are making their way to TransferWise's balance sheet.

September 10 -

The Bank of Lithuania has been courting fintechs which need an EU payments or banking license to operate in Europe. In July 2018, it introduced an e-licensing tool that makes it cheaper and quicker to submit the information necessary to obtain an operating licence.

September 10 -

International e-commerce is booming these days and so too are the opportunities—and challenges—for payments players.

September 7 -

It’s possible for all types of companies to live in tandem and ultimately, benefit from this new business ecosystem, writes Khalid Fellahi, senior vice president and general manager of Western Union Digital.

September 5 Western Union Digital

Western Union Digital -

About half of Swift Global Payments Innovation transactions are credited within 30 minutes and many within seconds.

August 30 -

Very few organizations have adopted blockchain technology for any meaningful day-to-day use. But a change could be afoot.

August 29 -

The DirectRemit service will enable the large British population in the UAE to send funds to family members' Lloyds Bank accounts in less than 60 seconds and to other U.K.-based banks within an hour.

August 29 -

The Society for Worldwide Interbank Financial Telecommunication, or Swift, has named David Scola, a former Barclays exec, its new head of North America operations.

August 28 -

Canada’s credit unions have been losing out to the country’s banks in terms of business banking market share, and have struggled to keep up with the banks’ capacity for technological innovation. Central 1 wants to redress this imbalance in the credit unions’ ability to compete with the banks.

August 28 -

After the 2008 banking crisis, centralized payment systems and financial services don’t have as much appeal to the younger set as a more transparent decentralized system, argues Csaba Csabai, founder and CEO of Inlock.

August 24 Inlock

Inlock -

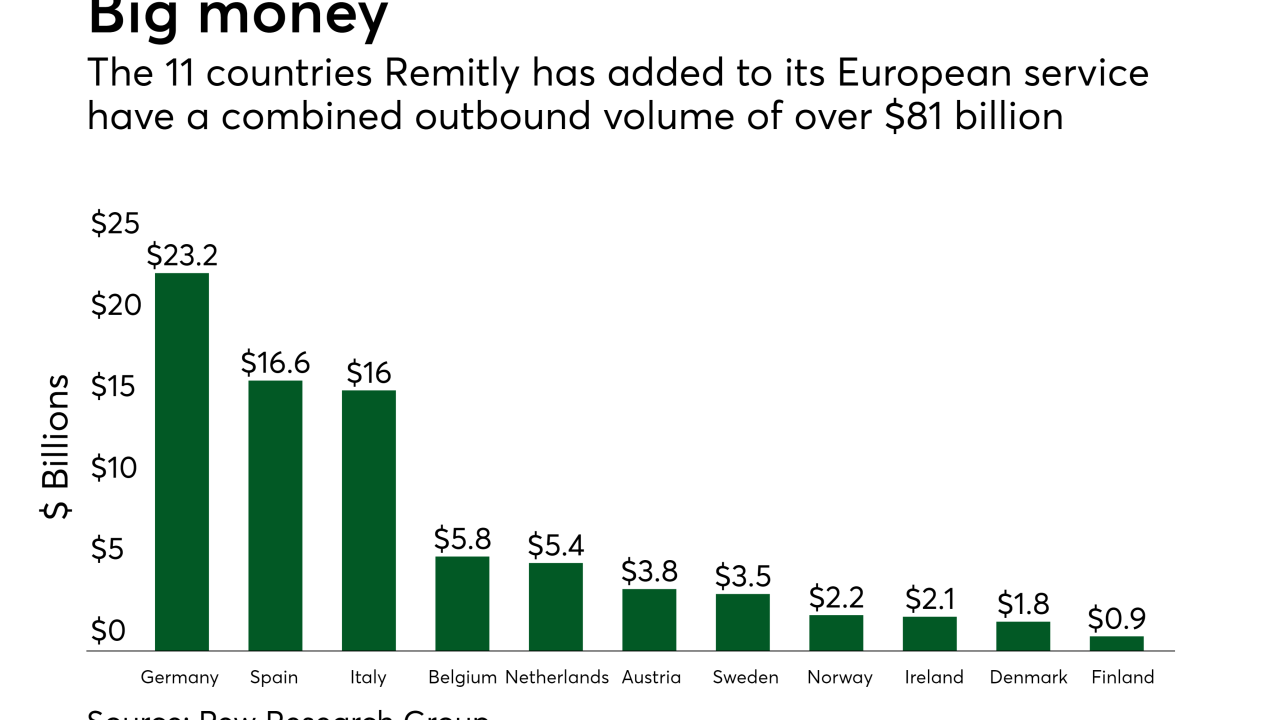

Remitly’s moves are clearly in response to the growing competitive pressure being placed in a key U.S. outbound corridor.

August 23 -

Since his 2016 campaign, Donald Trump has loomed over the international payments system with a series of threats that are proving increasingly empty.

August 22 -

These money transfers offer many transformative benefits, such as lifting recipient families out of poverty, improving health and nutrition conditions, increasing education opportunities and promoting entrepreneurship, says Raj Agrawal, CFO of Western Union.

August 22 Western Union

Western Union -

Equity Group Holdings Ltd.’s financial technology unit is in discussions with six Ethiopian banks to collaborate on cross-border mobile payments and e-commerce.

August 20