-

FleetCor Technologies, with broad operations in fleet cards and payroll solutions, has announced plans to purchase Cambridge Global Payments, which specializes in cross-border business-to-business payments, for $675 million.

May 2 -

U.K.-based TransferWise has enabled online customer verification at its new Asia Pacific base in Singapore, so users need not visit an office to set up an account with TransferWise's cross-border funds-transfer service.

May 1 -

In working with correspondent banks in developing countries for more than two decades, INTL FCStone Ltd. spent a fair amount of time collecting market information over the phone and through e-mail from those banks to share with others. It ultimately determined there was a better way to do this.

April 28 -

The B-to-B payments market is ripe for digital innovation. Here are some of the most recent moves to bring B-to-B payments up to speed.

April 28 -

While Germany's Wirecard AG in recent years has been steadily racking up a deep portfolio of payments technology fused with banking services through a white-label approach, it has also quietly established a global business through acquisition.

April 27 -

TransferWise Ltd., the London-based startup backed by investors including Peter Thiel’s Valar Ventures and Andreessen Horowitz, is bringing its international money transfer service to Singapore, aiming to shake up banks’ dominance of the market.

April 27 -

There has been a lot of activity lately around modernizing cross-border transfers through the use of blockchain and and cloud-hosted technology, but despite the potential savings in cost and time, none of these methods has caused a meaningful decline in the use of cash.

April 26 -

Kosta Peric, deputy director of digital payments and financial services for the poor at the Gates Foundation, discusses his efforts to expand access to low-cost financial services in developing countries.

April 25 -

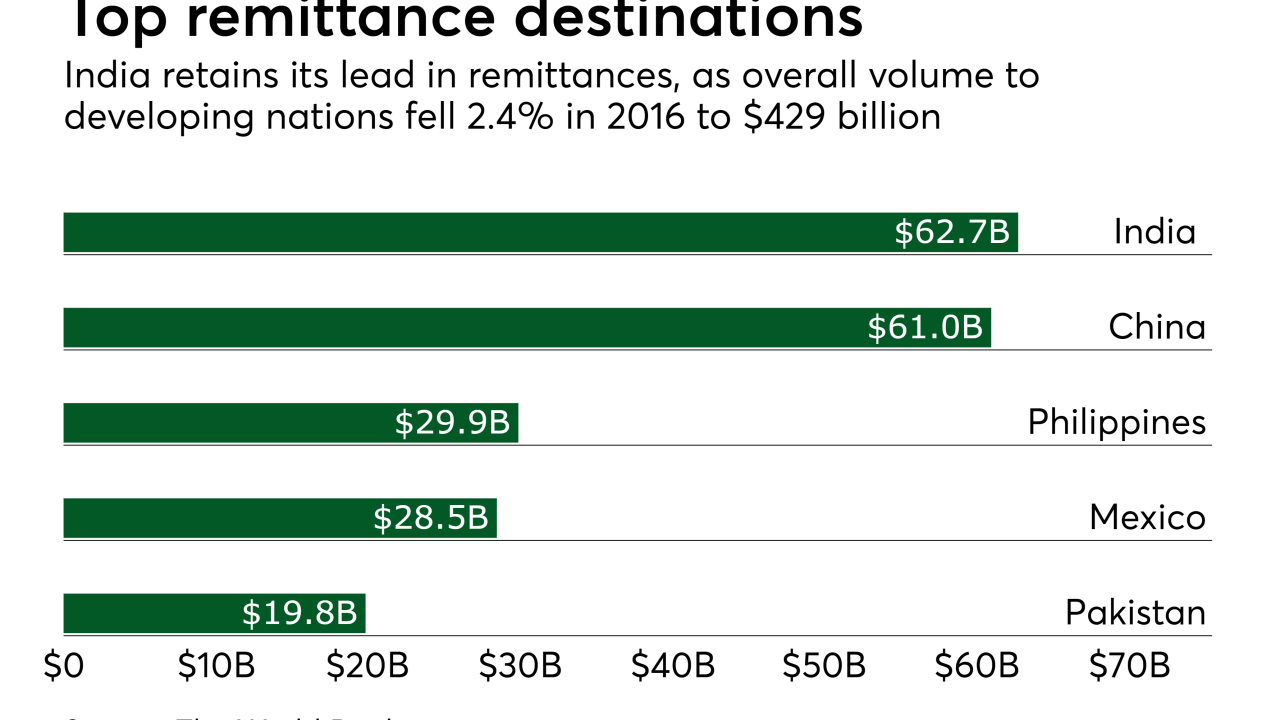

It was the second consecutive year remittances to emerging nations fell, while remittances to certain regions—including Latin America and the Caribbean—rose.

April 24 -

Banco Bilbao Vizcaya Argentaria SA, Spain’s No. 2 lender, has executed its first cross-border payments through a system based on the software that supports bitcoin.

April 21 -

Issuers and other organizations accept a nominal level of money laundering. Machine learning and artificial intelligence can improve that.

April 21 QuantaVerse

QuantaVerse -

Payments volume and cross-border business helped drive the strong performance.

April 20 -

Bottomline Technologies, which specializes in business payments, is the latest to introduce a fraud-fighting solution for members of the Swift payment network.

April 18 -

Jack Ma’s Ant Financial Services Group has deep enough pockets to win the bidding war against Euronet Worldwide for MoneyGram, but money may not be the deciding factor in this deal.

April 17 -

Leaked documents appear to show NSA analysts were able to hack into Middle Eastern banks’ servers through the Swift service bureau EastNets. The same tools could conceivably be used by cybercriminals and nation-states with more sinister motives.

April 17 -

Ant Financial raised its agreed offer for MoneyGram International Inc. by 36 percent as the financial-services company controlled by Chinese billionaire Jack Ma tries to top a competing offer and overcome security concerns.

April 17 -

The service will start with transfers to India and the Phillipines, though Remitly plans to add more recipient countries in the near future.

April 13 -

Despite some mixed signals, the Chinese government has shown a willingness to loosen restrictions on imports. That would be good news for international payments players.

April 13 Azoya International

Azoya International -

The bank said the test showed blockchain can be used to conduct secure, low-cost cross-border payments without intermediaries.

April 12 -

Ant references data breaches connected to Euronet and warns of job losses if the European company were to acquire MoneyGram.

April 12