-

Ant Financial, the parent of China’s largest online payment service, is seeking to raise less than $3 billion by issuing debt to fund its acquisitions, people familiar with the matter said.

February 9 -

The National Bank of Abu Dhabi (NBAD) has introduced real-time payments leveraging blockchain technology from Ripple, providing a new approach for the bank’s UAE-based customers to send and receive payments across borders.

February 3 -

To date, Ant's Alipay has been comparable to PayPal, seldom venturing beyond payments. The financial products Alipay plans to pursue as it enters new markets put it more firmly in direct competition with mainstream banks.

January 31 -

Alipay's deal to buy MoneyGram for $880 million may be the centerpiece of its strategy to expand beyond China's borders, but it's not its first move in recent months. The Alibaba payments affiliate has already extended its reach in several other ways.

January 27 -

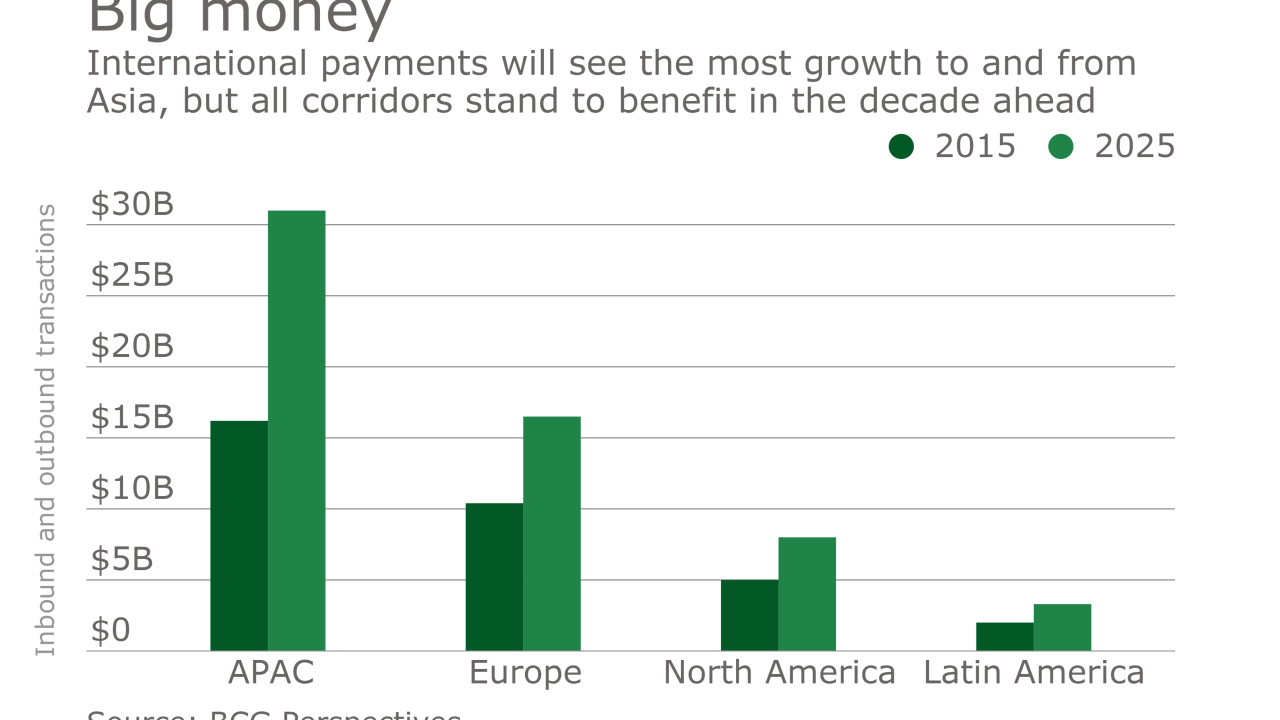

The U.S.-to-China payments corridor is one of the biggest in the world, according to the most recent World Bank data. It is dwarfed only by the U.S.-to-Mexico corridor, which the Trump campaign targeted as part of its border wall plan.

January 27 -

Ant Financial, the company that operates Alipay, is buying MoneyGram for $880 million, its boldest move yet in a series of partnerships and investments that signal an international ambition.

January 26 -

President Donald Trump's signing of an executive order Wednesday to push forward with plans for a "security wall" between the U.S. and Mexico has strong implications for how the plan will affect cross-border payments.

January 25 -

UnionPay's collaboration with United Airlines and Planet Payment is the latest salvo in a race among Chinese companies to cater to overseas travelers.

January 24 -

The parent of Alipay is also investigating uses for biometrics and artificial intelligence.

January 20 -

The Western Union Company agreed to pay $586 million and admitted to a lapse in anti-money laundering controls in an agreement with the U.S. Justice Department and other U.S. authorities.

January 19 -

UnionPay customers can now transfer funds from Canada to China without fees through a partnership with Canadian bank CIBC.

January 18 -

The Financial Conduct Authority has given the green light to Geoswift, the Hong Kong-based cross-border payments company, to operate collection and settlement services between the U.K. and China.

January 18 -

A growing number of U.S. merchants, both large and small, are using online marketplaces to sell their wares worldwide. Payment companies that specialize in currency exchange have taken note.

January 18 -

Hong Kong-based OKLink, a blockchain-based digital payments network specializing in international remittances, is now available in Vietnam, the twenty-first country it's reached since launching six months ago.

January 13 -

Axis Bank, one of India’s largest private-sector financial institutions, has reportedly become the first bank in the country to partner with Ripple for a blockchain-powered approach to cross-border payment.

January 12 -

The Society for Worldwide Financial Telecommunication is exploring the potential of distributed ledger technology for banks to provide real-time reconciliation of their databases for accounts they hold in other banks in a foreign currency.

January 12 -

Alibaba Group Holding Ltd. pioneered shopping on the internet in China. Now it thinks it can teach old-school retailers a thing or two about real-world commerce.

January 10 -

Around the same time PayPal spun off from eBay Inc. to become its own company last year, it also took on the global money transfer provider Xoom. This acquisition may have been overshadowed by PayPal's bigger news, but it remains key to the company's post-eBay strategy.

January 9 -

PayPal's digital money transfer service Xoom will allow Japanese immigrants and others in the U.S. to send money for deposit into bank accounts in Japan.

January 3 -

The University of Illinois is getting an education in how complex tuition payment processing can be, especially when the students enrolled from outside of the U.S. It also serves as an example of the clients that are in big demand for cross-border payment companies seeking larger volumes.

December 29