-

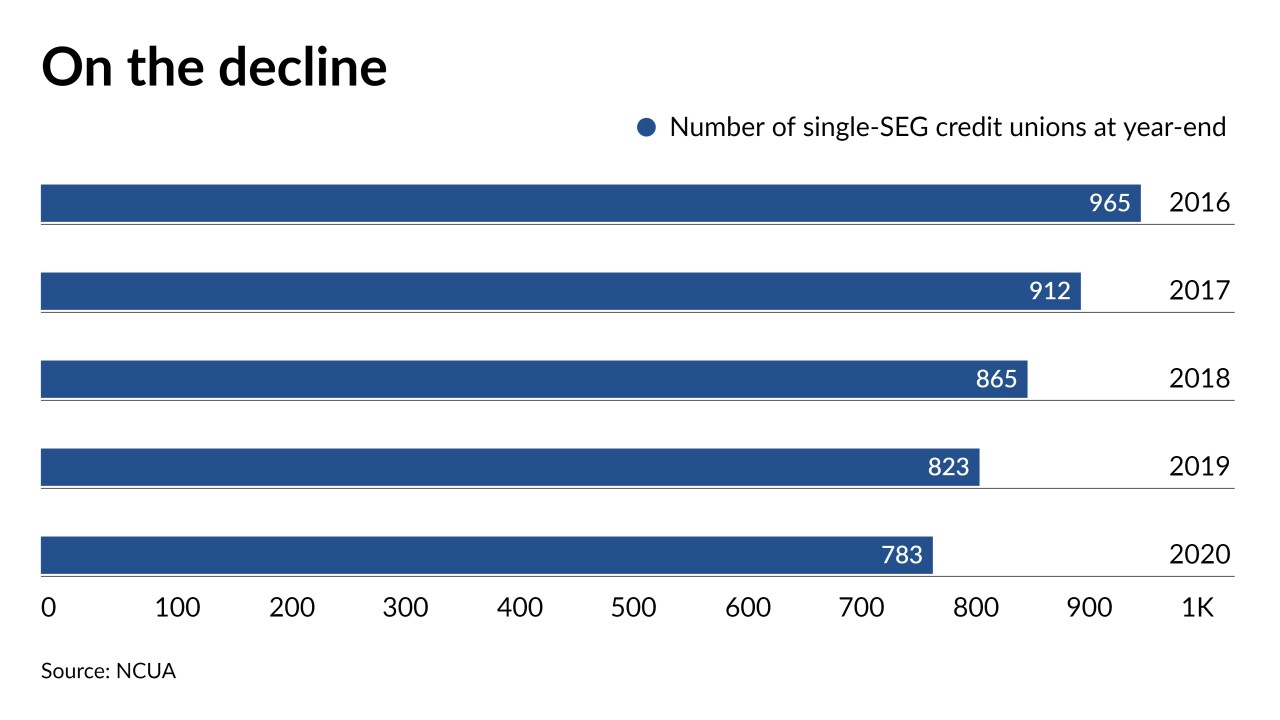

Regulators recently eased field-of-membership rules to promote growth of federal credit unions. A handful of institutions are taking advantage of the changes to recruit more members, but some may find the process too cumbersome.

April 22 -

Cal Poly Federal Credit Union's recent merger into SchoolsFirst highlights the difficult choice many small institutions face: diversify your field of membership or risk going out of business.

April 21 -

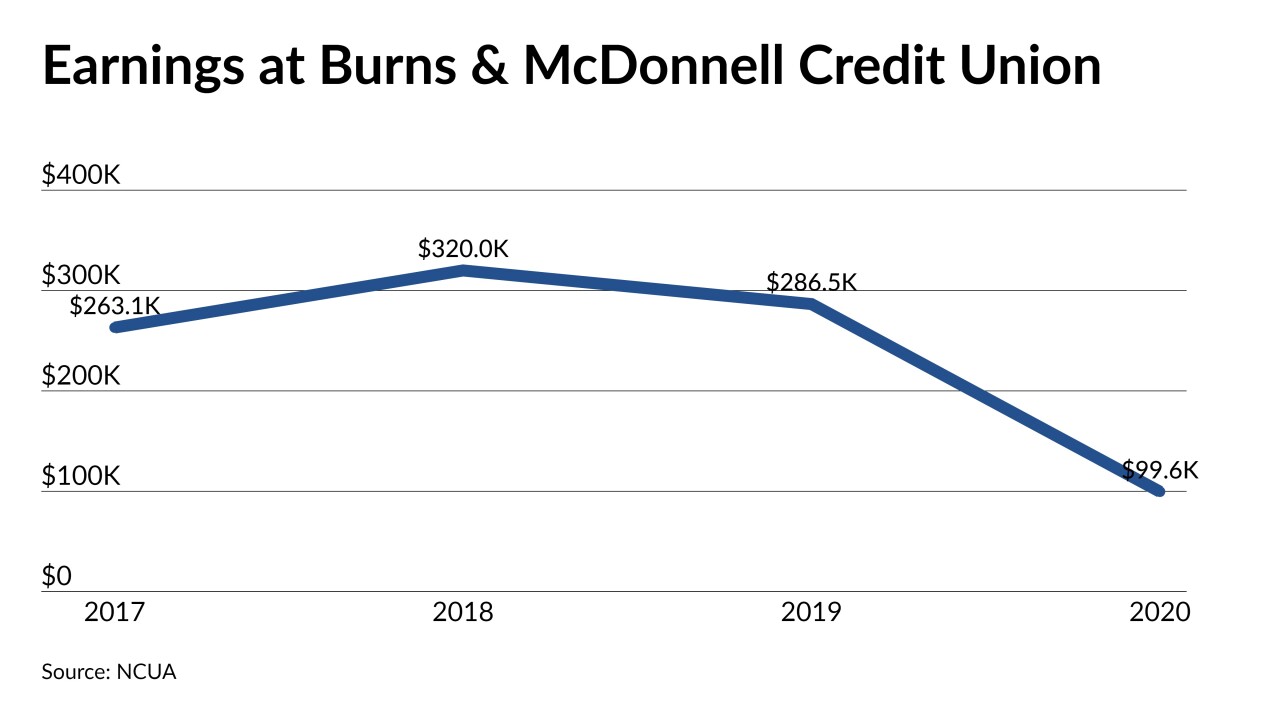

Burns & McDonnell Credit Union holds just $27 million of assets and is seeking approval to merge into CommunityAmerica, which serves the KC metro region and is the largest credit union in Kansas and Missouri.

April 21 -

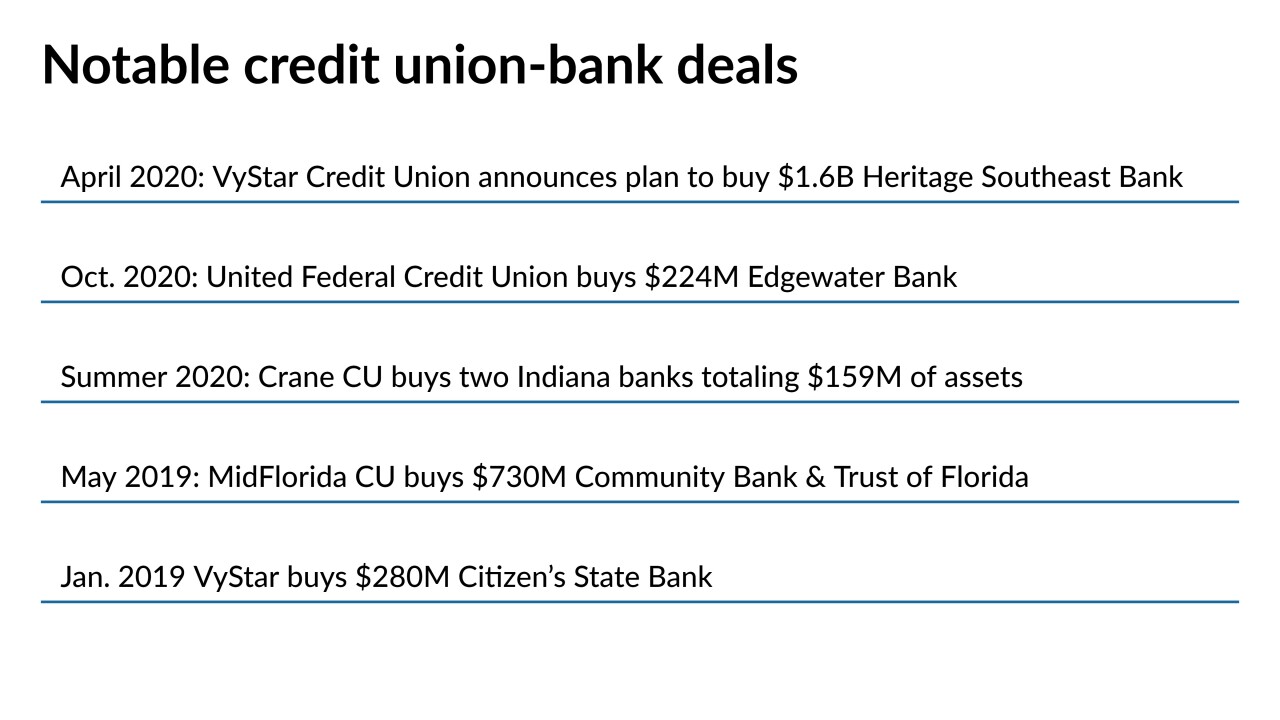

Banking trade groups have called for congressional hearings following the Jacksonville, Fla.-based credit union's agreement to purchase the $1.6 billion-asset Heritage Southeast Bank, the largest deal of its kind to date.

April 12 -

Regulators have approved the credit union's request to add 477 underserved census tracts to its field of membership, allowing it to reach roughly 2.5 million consumers.

April 8 -

United Neighbors Federal Credit Union holds just $4.4 million of assets, but the addition will help broaden SeaComm's branch network and expand its member base.

March 31 -

As the refi boom continues, many lenders will need to find the right balance of staffing and technology to meet members’ needs.

March 18 Promontory MortgagePath, LLC

Promontory MortgagePath, LLC -

After digging deep into member data, Randolph-Brooks FCU in Texas developed a marketing campaign aimed at persuading JPMorgan Chase clients to switch to the credit union's own card. It's an effort its peers could imitate.

March 15 -

The social media platform skews toward a more youthful demographic, while credit unions' average member age has been stuck in the late 40s for decades. But even institutions that use it have concerns about security.

March 11 -

Indiana Members CU will expand its reach later this year following completion of a proposed combination with Members Choice FCU.

March 10 -

Chris Hendry has served on the credit union's board but has spent his career in health care and philanthropy. He said many of his skills are easily transferable, including a focus on marketing and community engagement.

March 9 -

Members of two smaller institutions will soon vote on whether to join South Carolina-based REV, boosting its assets by 15% and giving it a foothold in North Carolina.

February 26 -

A plan to make expansion easier for credit unions is getting pushback not just from bankers, but also from the regulator's current chairman and a former board member.

February 12 -

Home loans accounted for the bulk of the industry’s lending gains in 2020, but inventory shortages in some markets and an uneven economic recovery may dim prospects this year.

February 9 -

The onset of COVID-19 forced the industry’s largest trade group to put its Open Your Eyes campaign on hold, but nearly a full year later it’s still struggling for industry buy-in.

February 5 -

The Flint-based credit union is the state's third in just over one year to get the OK for an expansion allowing anyone who lives or works in the state to join.

February 3 -

Any business loan growth the industry sees this year will be closely tied to mass vaccination efforts and a broader economic recovery, meaning it may take until at least the third quarter for pent-up demand to translate into new opportunities.

February 3 -

California Polytechnic State University is said to be seeking a new banking partner, a move that could leave the university-based credit union without a home.

February 2 -

After rising losses in 2020, First Credit Union of Scranton is seeking members' approval to merge into Penn East FCU.

February 1 -

A deal to bring Coulee Dam FCU into the fold will expand the Spokane, Wash.-based credit union's branch network while providing a wider array of technologies to the former CDFCU members.

January 28