-

The new cloud-based solution is intended to help financial institutions make quicker credit decisions by integrating consumers’ histories with advanced software.

March 27 -

A new regulation in the Golden State could provide a de facto national standard as Congress continues to stall on data breach legislation.

March 11 -

Financial institutions must manage compliance budgets without losing sight of primary functions and quality control, writes Chad Hetherington, global vice president of professional services for NICE Actimize.

March 5 NICE Actimize

NICE Actimize -

Aspiration, Wealthfront and SoFi have all begun offering high-yield savings accounts during the past few weeks.

February 28 -

The companies have teamed up on a product to help banks, especially small ones, give customers more accurate insights into their own financial health.

February 28 -

ComplyAdvantage, Cinnamon and Zoovu recently raised millions of dollars to fuel expansion of their automated risk management, data-scanning and customer service products geared toward financial services companies.

February 22 -

Citigroup's venture capital arm is investing in technology that provides real-time analysis of millions of consumers' card transactions.

February 12 -

Spring Labs is spearheading a group of prominent fintech lenders to use a blockchain-based, peer-to-peer network to share consumer information to help with ID verification on loan applications.

January 24 -

One bank is tracking the habits of its 4.4 million customers, giving them discounts on services if they visit the gym or get a flu shot. Other companies may soon follow suit.

January 1 -

From the end of overdraft fees to the rise of banks that watch their customers' every move, there are several new banking trends on the horizon in 2019.

January 1 -

Several fintechs are testing apps that let customers gain more say over how third parties use their data — and hope to one day be able to give them the power to revoke access to it entirely.

January 1 -

The biggest question is whether new CFPB Director Kathy Kraninger will deviate from the pro-industry policies of her predecessor, or bring continuity.

December 25 -

Since banks are under constant attack by hackers, the startup XM Cyber is offering them a simulator that seeks to do its virtual worst in order to prevent a real breach.

December 5 -

Schwark Satyavolu, original co-founder of Yodlee and current venture capitalist at Trinity Ventures, shares his opinion on how consumer data sharing is evolving.

December 4 -

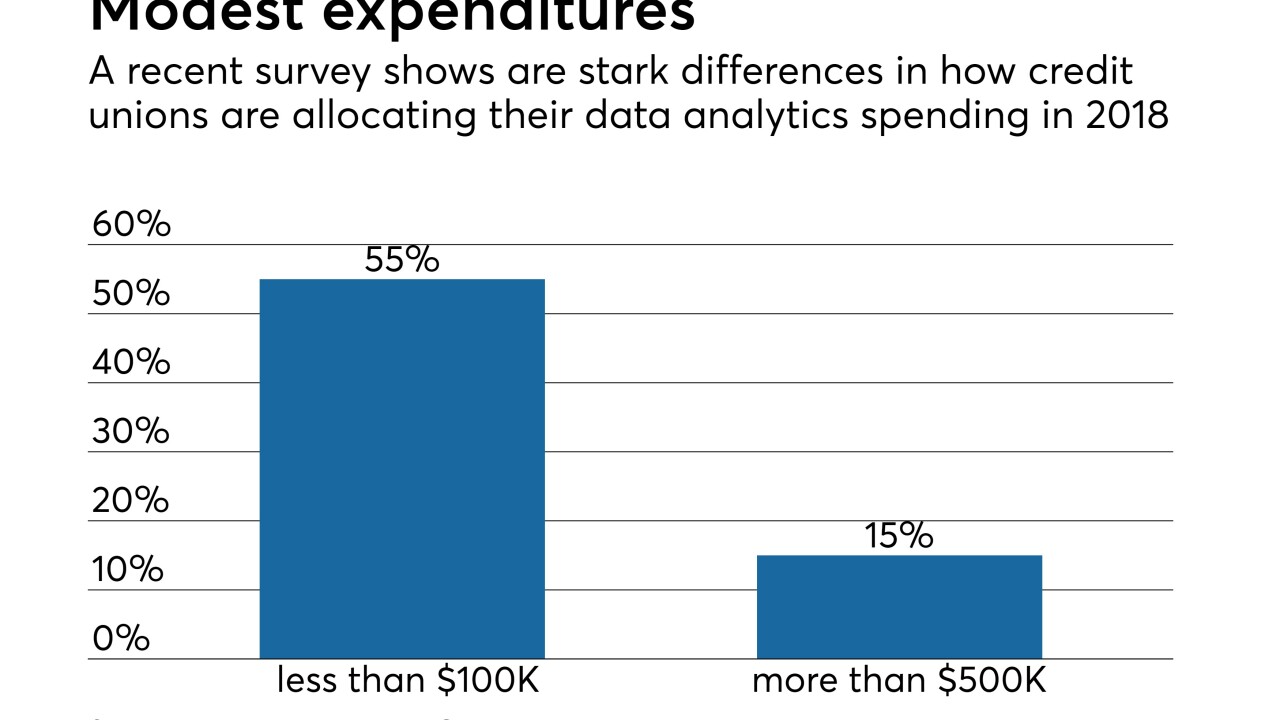

A recent report from Best Innovation Group reveals a significant number of credit unions don't have a data analytics plan, and many that do are putting off spending money on it.

November 8 -

The bank saw value in Ondot Systems’ ability to empower customer analytics in card controls.

October 26 -

Readers consider to new evidence regarding Operation Choke Point, debate the impact of Democrats taking control of the House in November, respond to concerns about weakening the Volcker Rule and more.

October 25 -

Executives can't adequately protect members if they aren't familiar with current auditing standards.

October 24 Sync1 Systems

Sync1 Systems -

Plaid will be able to access the bank’s customer information through a secure API. JPMorgan has similar agreements with three other fintechs.

October 22 -

A paper released by the agency’s Center for Financial Research says aspects of someone’s digital footprint — including whether they use Apple or Android — help predict likelihood of default.

October 4