-

Several fintechs are testing apps that let customers gain more say over how third parties use their data — and hope to one day be able to give them the power to revoke access to it entirely.

January 1 -

The biggest question is whether new CFPB Director Kathy Kraninger will deviate from the pro-industry policies of her predecessor, or bring continuity.

December 25 -

Since banks are under constant attack by hackers, the startup XM Cyber is offering them a simulator that seeks to do its virtual worst in order to prevent a real breach.

December 5 -

Schwark Satyavolu, original co-founder of Yodlee and current venture capitalist at Trinity Ventures, shares his opinion on how consumer data sharing is evolving.

December 4 -

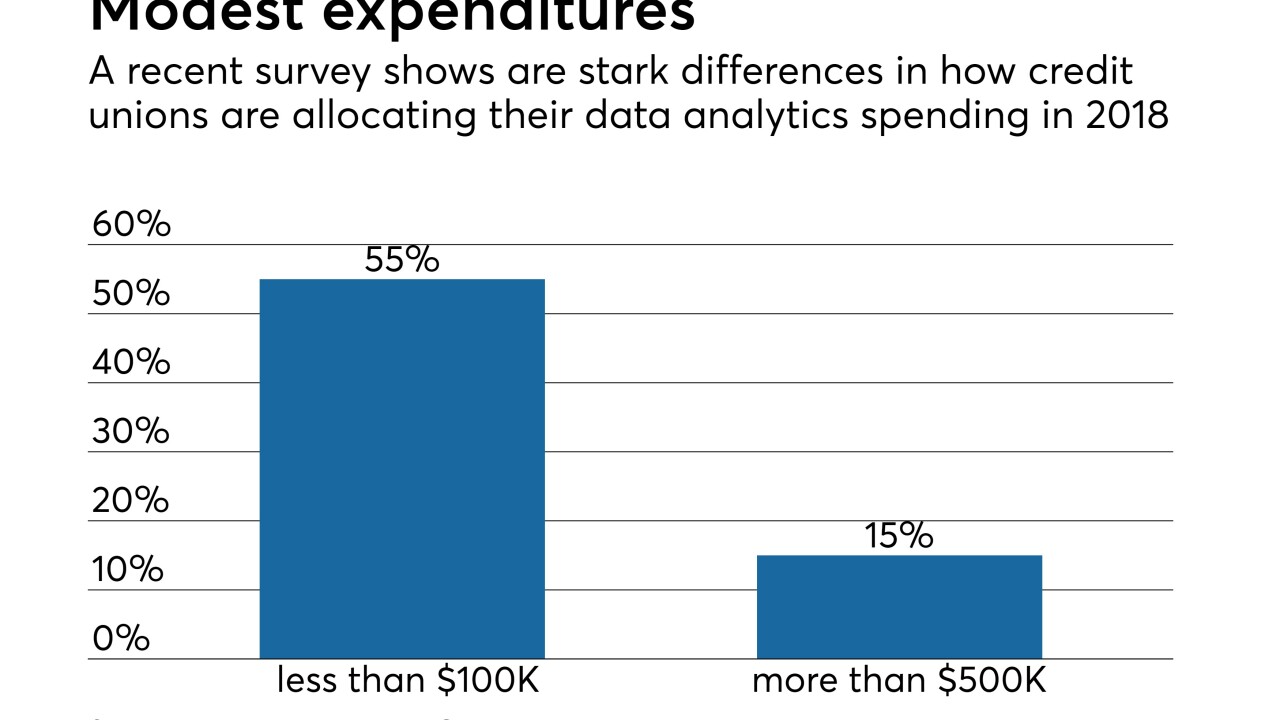

A recent report from Best Innovation Group reveals a significant number of credit unions don't have a data analytics plan, and many that do are putting off spending money on it.

November 8 -

The bank saw value in Ondot Systems’ ability to empower customer analytics in card controls.

October 26 -

Readers consider to new evidence regarding Operation Choke Point, debate the impact of Democrats taking control of the House in November, respond to concerns about weakening the Volcker Rule and more.

October 25 -

Executives can't adequately protect members if they aren't familiar with current auditing standards.

October 24 Sync1 Systems

Sync1 Systems -

Plaid will be able to access the bank’s customer information through a secure API. JPMorgan has similar agreements with three other fintechs.

October 22 -

A paper released by the agency’s Center for Financial Research says aspects of someone’s digital footprint — including whether they use Apple or Android — help predict likelihood of default.

October 4 -

To personalize products and services, banks are now tracking all sorts of alternative data sources, even the manner in which customers type in mobile banking apps.

October 3 -

The bank has long collected data about digital interactions. Now it’s adding tech to gain knowledge from phone call to better understand each customer.

October 3 -

JPMorgan Chase's Jamie Dimon downplayed "too big to fail," warned against the risk of cyberattacks and lectured high-tech giants about their privacy shortcomings during an appearance in Washington.

October 2 -

Envestnet|Yodlee wants accessing data to be as simple as selecting a song to play, while bringing institutional analytic power to the bank branch level.

October 2 -

AI-powered assistants will change the customer experience for the better, but first they must achieve a more human level of service, executives said during a discussion at Finovate.

September 28 -

The law gives residents more — and welcome — control over their data. But it will take work for credit unions to meet the new requirements, such as possibly having to amend third-party vendor agreements.

September 27 Samaha & Associates

Samaha & Associates -

The bureau's findings and request for information came after acting Director Mick Mulvaney had cited data security as a flaw at the agency.

September 26 -

The time is now for Congress to enact stricter data security standards that better protect credit unions and consumers.

September 13 America's Credit Unions

America's Credit Unions -

The transparency and responsibility you demonstrate will help you build more trusting relationships with your customers and the public, according to Carl Mazzanti, founder and CEO of eMazzanti Technologies.

August 31 eMazzanti Technologies

eMazzanti Technologies -

To compete with fintech startups, banks need to find more ways to use the mountains of data already at their disposal.

August 27 CCG Catalyst

CCG Catalyst