-

The incident will fuel the debate on Wall Street over whether digital coins are secure enough to enter the mainstream of finance.

November 21 -

Some fintechs argue that banks are selectively working with only certain third parties in sharing information and violating the spirit of the CFPB’s data-sharing principles.

November 20 -

Successful mobile payment players such as Starbucks, Alipay and WeChat Pay all rely on optical scanning technology rather than NFC to execute payments. It's time the rest of the industry take note, writes Maikki Frisk, executive director of the Mobey Forum.

November 20 Mobey Forum

Mobey Forum -

Deciding how far to go to protect customers is a complex issue, but one that the industry should address soon as phishing attacks continue to mount.

November 20 Liberty Bank

Liberty Bank -

The startup is betting that a venture offering safe storage of digital assets will entice billions from banks and other institutional investors.

November 17 -

Company formed in partnership with core processing provider Corelation.

November 17 -

The startup Intrinio lets algorithmic traders and banks pick the types of company and market data they want to use rather than pay a large monthly fee for a broad, terminal-based service.

November 17 -

Look who's co-chairing the notoriously male-dominated World Economic Forum. A female automotive enthusiast eloquently calls out an industry where bias is ingrained in the everyday language, and women in prison cook up a better future. Plus, State Street, Goldman Sachs and Bank of Montreal.

November 16

-

Consumers are increasingly concerned about payment card fraud, but it remains to be seen how much work they’re willing to do to protect themselves when they’re not directly liable for monetary losses from stolen cards.

November 16 -

Brian Behlendorf, leader of the Linux Foundation's effort to establish standards for blockchain, likens the invention of cryptocurrencies to the moon launch and says banks, open-source developers and others are working to make the underlying technology commercially viable.

November 16 -

The advent of blockchain technology may prove to be disruptive to traditional credit reporting agencies by decentralizing data aggregation and allowing consumers to take ownership of their data through a personalized wallet they could share with prospective lenders, writes Alexander Koles, CEO, founder and managing director of Evolve Capital Partners.

November 16 Evolve Capital Partners

Evolve Capital Partners -

As consumers’ personal information is compromised almost daily, hackers are increasingly targeting banks.

November 14 -

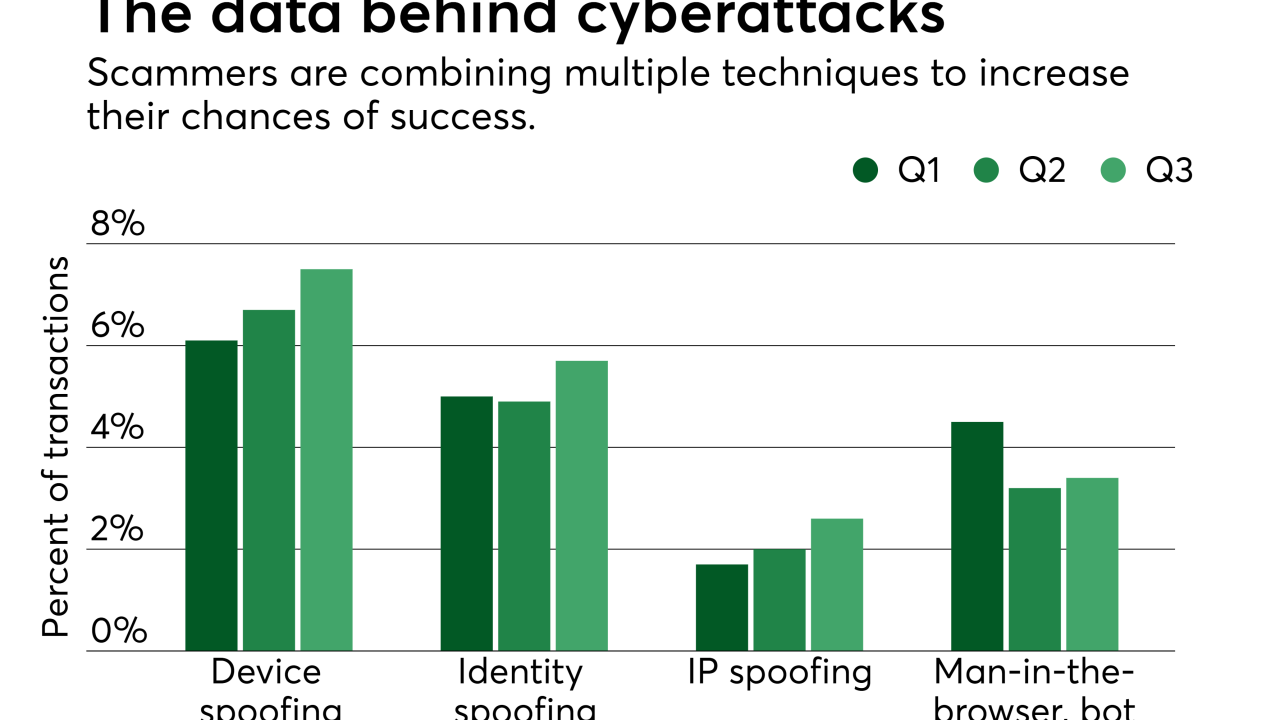

There is a visible shift in attack patterns immediately following a breach, from initial attacks focusing on high-value loan applications at online lenders to low-value identity testing on charities and social media sites to determine if a stolen credential will work.

November 14 -

While some are bullish on strong use cases for the industry, others are still skeptical about when — or even if — CUs will be willing and able to dive into blockchain.

November 14 -

Following in the footsteps of Chase, Wells Fargo and others, Fidelity is launching an application programming interface to let third-party apps access customer data — as long as the customers grant permission.

November 14 -

PayPal has suspended the operations of TIO Networks, a bill-payment company it purchased earlier this year, following the discovery of security vulnerabilities that require investigation.

November 13 -

When a coder locked $150 million of digital currency stored in Parity digital wallets last week, many bankers probably saw it as another reason to ignore cryptocurrencies. Instead they should recognize the business opportunity (key custody) that the incident presents.

November 13 -

It is important to have the right layers of security in place, ideally those that evaluate passive and behavioral biometrics, as they are proving to be the most reliable, writes Robert Capps, authentication strategist and vice president of NuData Security.

November 13 NuData Security

NuData Security -

Because wearable payments technology is still considered experimental, it is important to address security before the market for such products gets much bigger.

November 13 -

In mid-2015, several thousand banks registered for dot-bank domains. More than two years later, only a few hundred have converted.

November 10