-

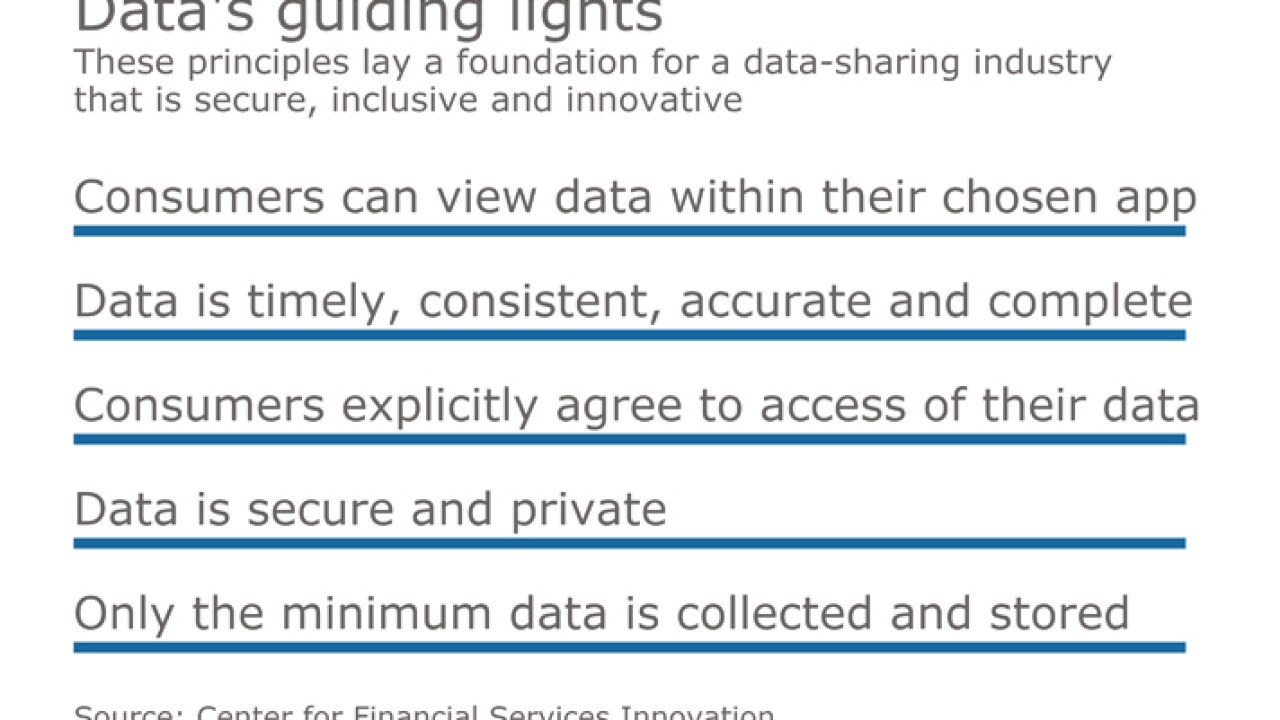

Both banks and fintech are satisfied for now with the CFPB's nonbinding principles on data-sharing. But the statement may lay the groundwork for future regulation.

October 20 -

The nonbinding guidance, which followed a nearly yearlong inquiry about industry practices, said consumers should have greater ability to obtain information about their financial data, among other principles.

October 18 -

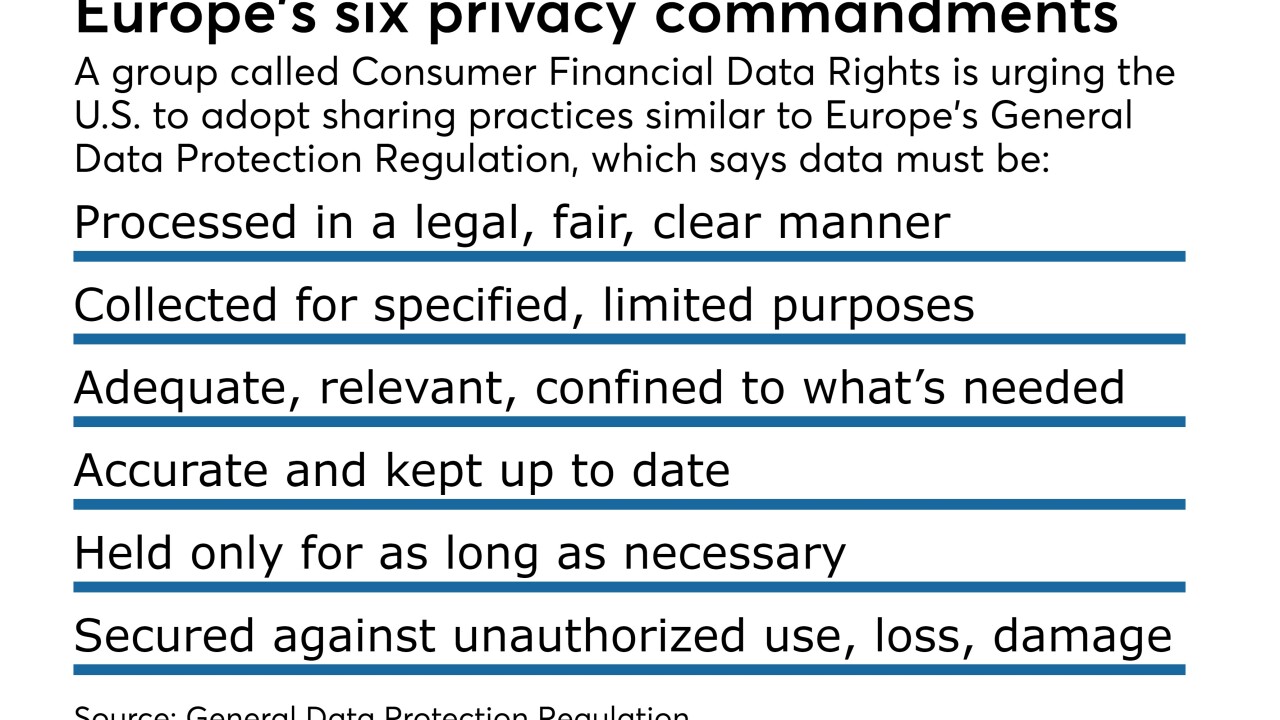

The Consumer Financial Data Rights group, representing aggregators and fintechs, says banks still aren’t forking over enough customer data. The group is meeting with bank regulators and trying to get consumers to petition regulators on its behalf.

August 15 -

Quantitative investors, starved for trading signals that can be spun into gold, are pressuring the finance firms they work with to grant them access to proprietary information.

August 8 -

The selling of anonymized customer data may be legal, but it raises ethical questions about the use and protection of that information.

June 8 -

The Spanish bank is opening its APIs to outside developers as Bank of America tests a new data-sharing model with aggregators.

May 24 -

Through the bank’s new API, small-business customers can feed their bank data into Xero’s cloud accounting technology.

May 10 -

Access to banking information ensures advisors can perform holistic planning, fintech firms say.

April 5 -

The battle over screen scraping seems to be subsiding into a series of agreements between banks and fintechs using open APIs.

April 4 -

The bank and cloud accounting platform will offer services to mutual customers via API.

February 15 -

By partnering with Intuit, Wells Fargo is continuing its journey toward API-based data sharing, and away from screen scraping.

February 3 -

Big banks increasingly are developing application programming interfaces to make their customers’ data available to third parties. But discrete deals between banks and third parties would be a bad outcome for consumers and the industry as a whole.

January 27

-

The deal points a way forward, not only to resolve the debate over screen scraping and ownership of customer data but to redefine banks' value proposition.

January 25 -

Customers of JPMorgan Chase will no longer have to surrender their bank credentials in order to use Intuit products like Mint, TurboTax or QuickBooks.

January 25 -

Bank consortium R3 CEV, one of the most well-funded blockchain working groups, has endured criticism for its meticulous process. But if blockchains are most valuable with a network effect, maybe forgoing some agility is worth the long while.

January 20 -

State Street Corp. has named John Plansky as the new head of its Global Exchange data and analytics unit.

January 6