-

One recent study finds consumers have flipped their point-of-sale preference from credit to debit. That could be a sign of fears about a possible economic downturn.

November 27 -

Rodney Hood, chairman of the National Credit Union Administration board, visited a Connecticut institution while others announced personnel changes.

November 26 -

The Bank is poised to pick two people to handle Simon Potter’s former job; Securities backed by subprime U.S. car loans are “going gangbusters.”

November 26 -

More than half of U.S. counties lost access to bank branches between 2012 and 2017, with rural counties that have less educated and minority residents especially hurt, the central bank said.

November 25 -

Paul Simons has worked in the industry for 48 years, including more than three decades at the helm of the Illinois-based institution.

November 21 -

Several credit union leaders were recognized for their contributions while other personnel changes were announced.

November 21 -

The Boise-based credit union is the fourth institution in the Northwest to receive the recognition.

November 20 -

Several credit unions announced management changes at their branches while others in the industry made their own personnel moves.

November 19 -

Over the last decade, American voters have proved remarkably receptive to bans on high-cost consumer loans. Next year, a proposed ballot measure in a traditionally red state trending purple will offer a test case for the durability of that consensus.

November 15 -

Service Credit Union announced several promotions across the organization while other institutions made their own personnel moves.

November 14 -

Truliant FCU and Topline FCU made changes to their member experience teams while other institutions also announced personnel moves.

November 12 -

John Rhea has served as president and CEO of the Georgia-based institution for 11 years.

November 11 -

Earlier this decade, a boom in low-cost prepaid cards undercut the firm's business model. Now the fiercest competition is coming from venture capital-backed startups that offer accounts with no overdraft fees.

November 8 -

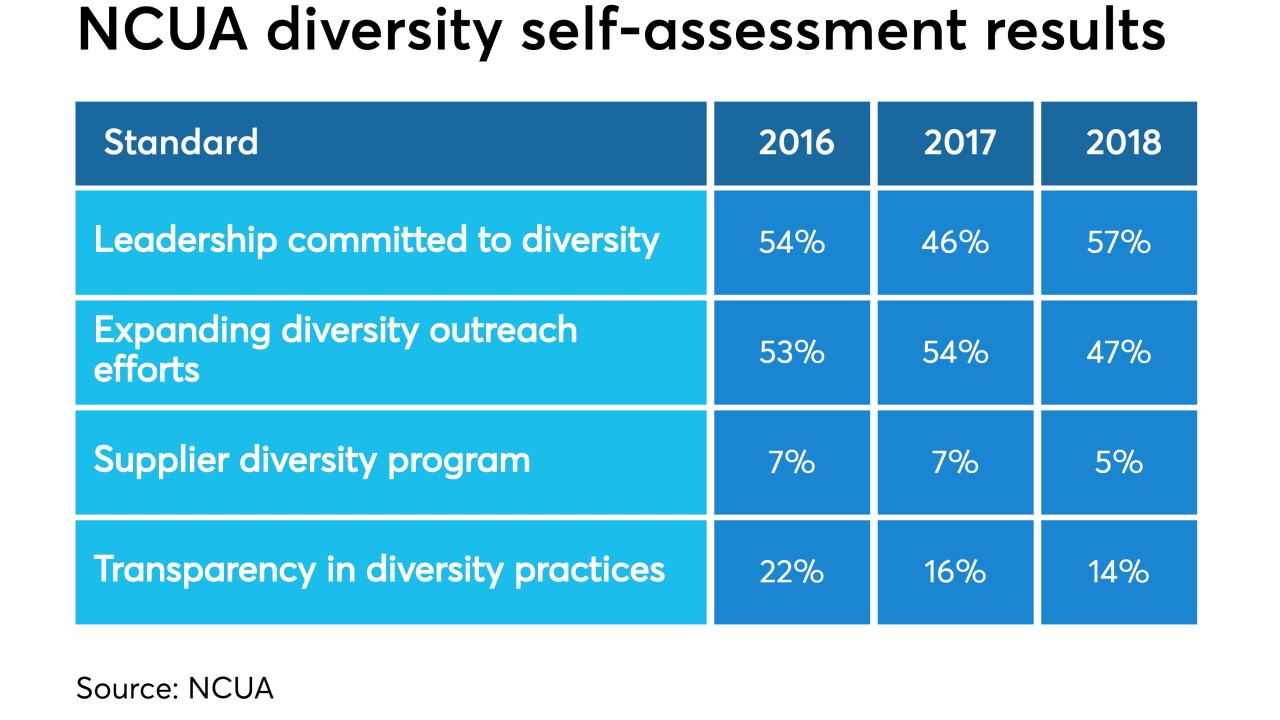

The regulator’s inaugural event on equity and inclusion highlighted the personal and professional but also veered into addressing hurdles credit unions face regarding this issue.

November 7 -

Margaret Hunnicutt, the institution's current former CFO and currenet CEO, will retire in January and be succeeded by the credit union's current chief financial officer.

November 7 -

Credit unions recently made new hires and promoted employees in areas such as human resources, finance and membership development.

November 7 -

Clear communication is critical when banks undergo a leadership or operational change.

November 7

-

Ralph Babb had stepped down as CEO in April. Curtis Farmer, who succeeded him as chief executive, will assume the chairman's title starting next year.

November 5 -

Trade groups from several different states honored industry leaders while many individual institutions have announced recent personnel moves.

November 5 - LIBOR

New tech lets American Express instantly issue cards to immigrants; the end of Libor raises concerns about financial stability; regulators shutter banks in Kentucky and Ohio; and more from this week's most-read stories.

November 1