-

SaveBetter.com from Deposit Solutions lets consumers shop for different savings products through one portal and provides national exposure for participating banks, which include Ponce Bank in New York and Central Bank of Kansas City.

October 7 -

Many community banks need brokered deposits to help fund loans, so policymakers must strike the right balance between promoting liquidity and guarding against reckless lending.

October 7 Peoples Bank

Peoples Bank -

The industry is warning regulators putting the finishing touches on the Net Stable Funding Ratio that the measure could exacerbate volatile market events like the spring selloff of Treasury securities.

October 5 -

The flood of liquidity that accompanied the pandemic recession isn’t likely to subside anytime soon. Banks will have to employ a mix of securities buying, hedging and other balance-sheet-management tricks to prop up margins longer than initially imagined.

October 5 -

Credit union groups continue to make ad buys for industry-supported candidates in advance of Nov. 3, but recent positive economic news could be short-lived.

October 5 -

To shore up the share insurance fund, the National Credit Union Administration would be wise to give the industry additional temporary investment options.

September 29 Mission Federal Credit Union

Mission Federal Credit Union -

Waiting for the SBA to sign off on PPP loan forgiveness; banks criticized for requiring balloon payments on loans in forbearance; how backlash over Scharf remarks affects Wells Fargo’s diversity push; and more from this week’s most-read stories.

September 25 -

Partnering with the account-opening software firm Mantl, the New Jersey bank created a CD campaign that helped fund its Paycheck Protection Program lending.

September 22 -

On Jun. 30, 2020. Dollars in thousands.

September 21 -

A historic influx of deposits has brought the National Credit Union Share Insurance Fund’s equity ratio close to the point where premiums would be required, but the regulator’s plan is intended to boost it.

September 17 -

Second-quarter figures from the credit union regulator paint a grim picture for many states across a variety of key earnings metrics.

September 17 -

The plan would encourage more risk-taking by big banks, which would put the industry and taxpayers in harm’s way, write former CFPB Director Richard Cordray and Camden Fine, onetime head of the Independent Community Bankers of America.

September 11 Consumer Financial Protection Bureau

Consumer Financial Protection Bureau -

The company and its global peers have seen their profitability hurt by half a decade of negative interest rates, which effectively make banks pay for holding clients’ cash.

September 9 -

A pandemic-driven surge in bank deposits helped drive the agency's insurance reserves below their statutory minimum.

September 9 -

A new report from the National Credit Union Administration shows how hard the industry was hit during the second quarter as businesses closed and consumer spending dropped.

September 8 -

A New York CDFI is halfway to its $100 million fundraising goal for a fund that would put deposits in Black-owned banks and make loans to key businesses or projects. It hopes the moves will improve availability of capital and access to mainstream financial products.

September 4 -

Why PayPal just deposited $50 million in tiny Optus Bank; ex-Bank of America employees allege 'extreme pressure' to sell credit cards; the Citi snafu may bring fresh scrutiny to custodial banks; and more from this week's most-read stories.

August 28 -

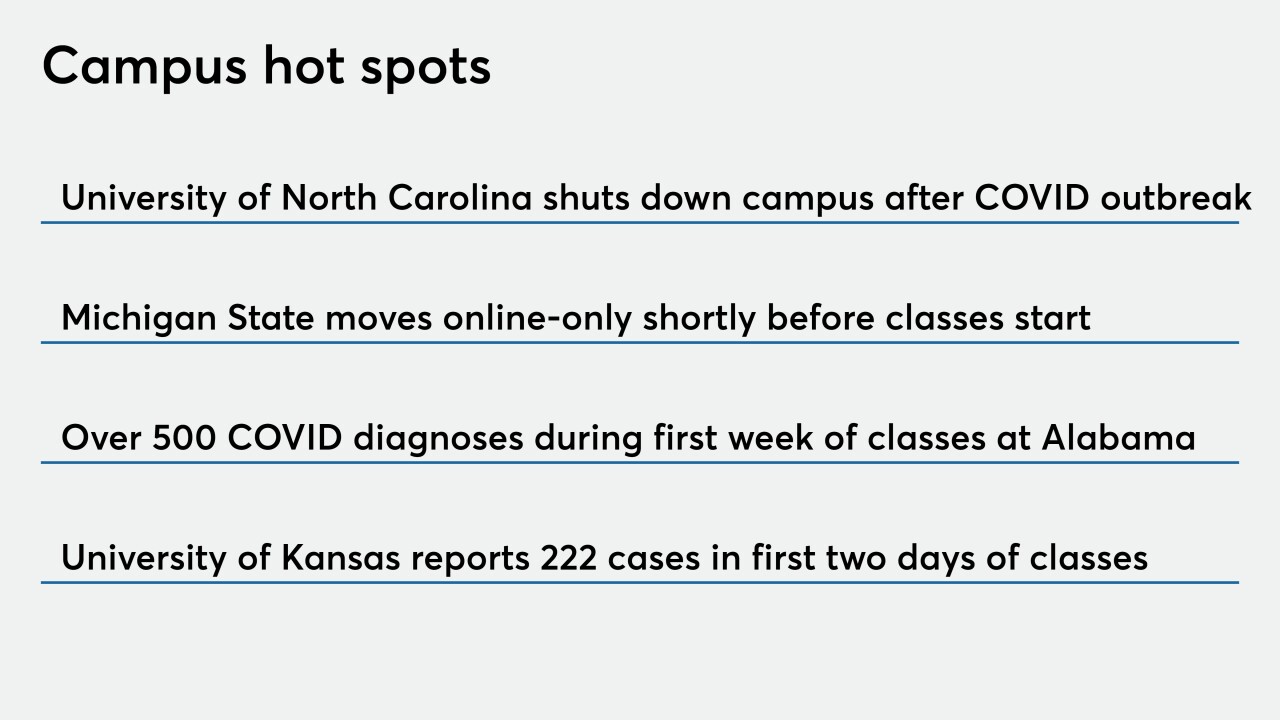

Institutions serving colleges and universities traditionally see membership surge in the fall, but are now planning for a decline as classes move online.

August 27 -

Whether the number of deals for 2020 can come close to last year's record-setting level will come down to one question: Can community banks generate strong enough profits in the second half to justify their independence?

August 25 -

Credit unions added more than $176 billion to savings balances in the first half of the year, according to new analysis from Callahan & Associates.

August 18