Digital banking

Digital banking

-

How Bank of America plans to stay ahead of the pack in digital banking; Wells Fargo gets top marks for COVID-19 safety; PPP lenders nearing $10B asset mark fear regulatory ordeal; and more from this week’s most-read stories.

September 4 -

Institutions considering new technologies must ask themselves what they're looking for not just from a product but from a partner.

September 4 -

Texas Trust Credit Union boosted loan volumes with a marketing tool inspired by “Game of Thrones,” but gamification strategies can be risky in light of data privacy concerns.

September 4 -

Many community banks, like Peoples Community in Wisconsin, say they proceeded despite the technological challenges presented by social distancing because the crisis has exposed the shortcomings of their digital systems.

September 3 -

The fintech Wealthfront's latest wrinkle gives clients a high level of control over their money, including the ability to set automatic transfers to savings accounts or exchange-traded funds.

September 2 -

BBVA and U.S. Bank are fine-tuning the search functions on their sites and apps to improve navigation, sales and customer retention.

September 1 -

Banks that work with the data aggregator will tell it when account updates are ready, so it can refresh fintech (or bank) apps immediately.

September 1 -

CO-OP, a credit union payments firm, has teamed with the fintech to expand usage of digital payments offerings. But it's unclear to what extent members want those services.

September 1 -

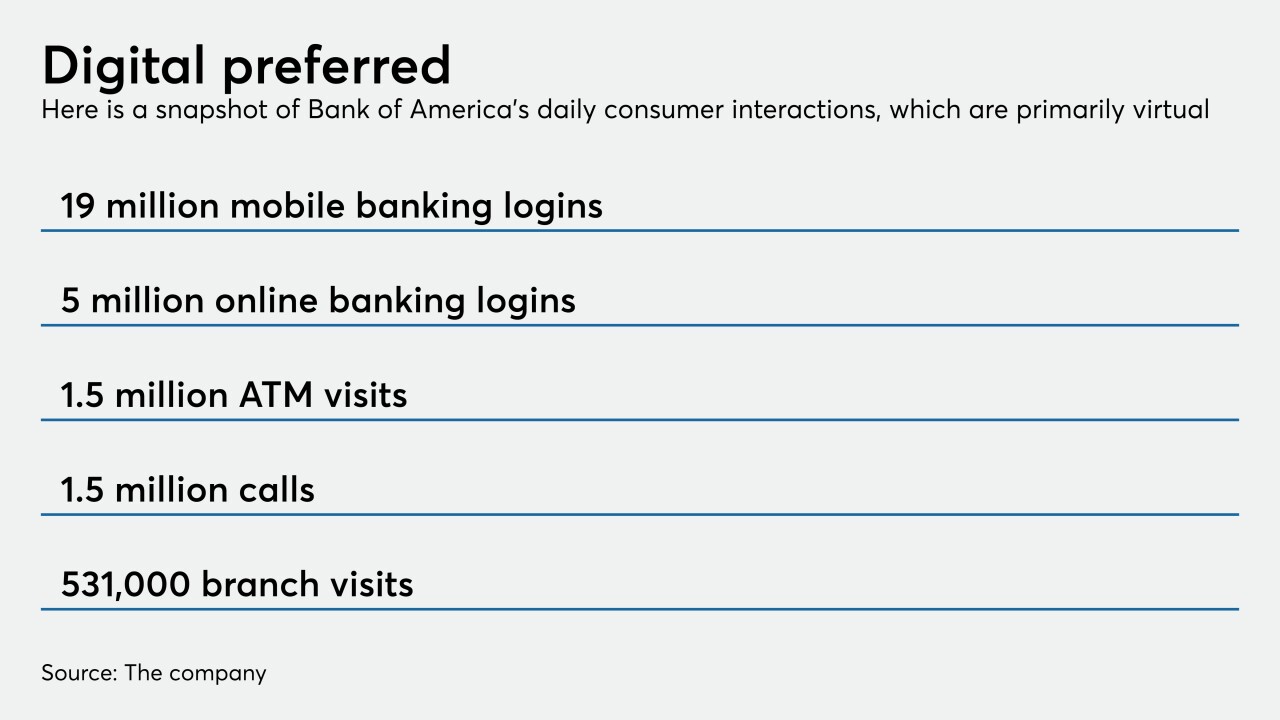

The bank is making continuous improvements, including integrating Merrill Lynch accounts into its banking app and adding a security feature to Zelle.

August 31 -

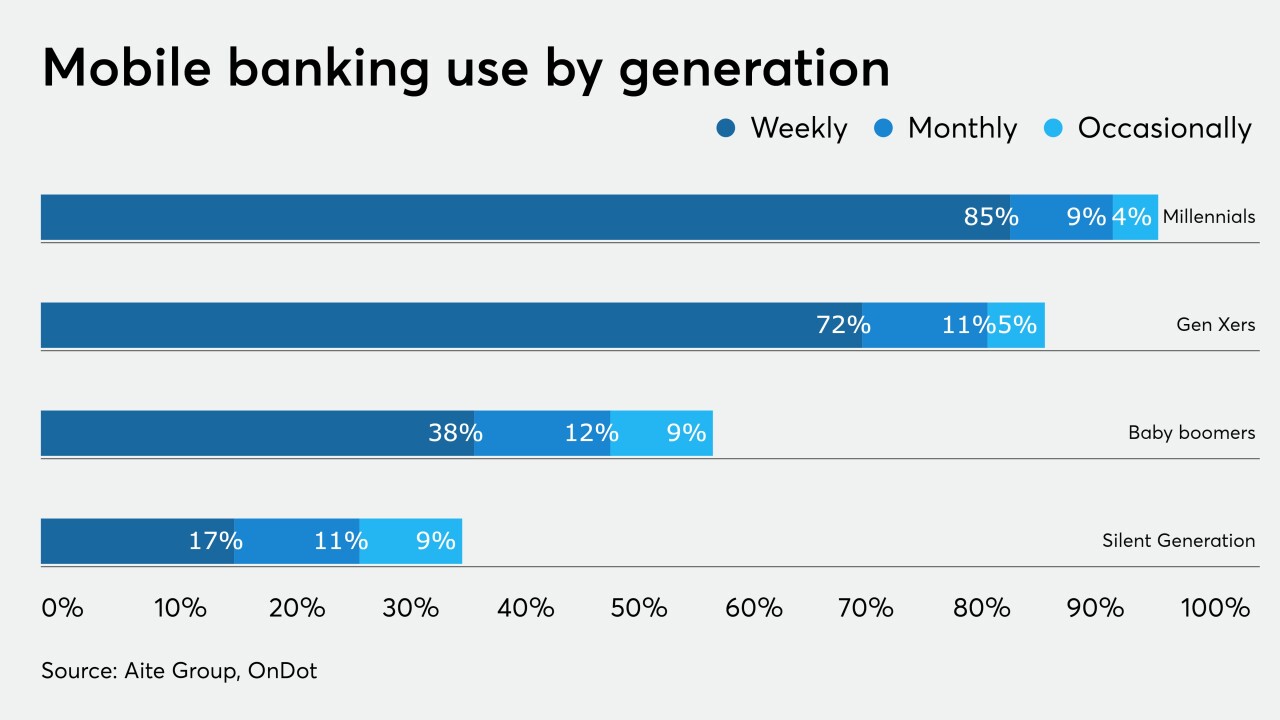

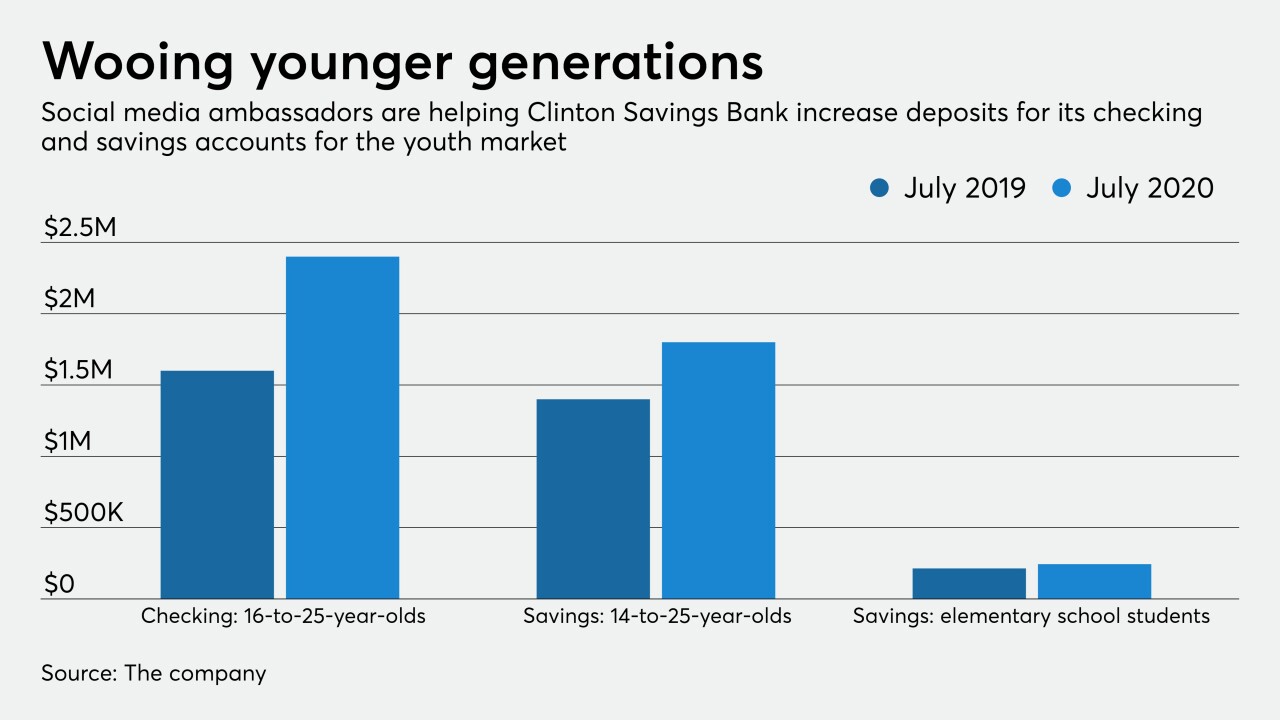

Bank of America and Clinton Savings Bank in Massachusetts are targeting consumers at a young age and hoping to keep them for life.

August 28 -

A historic charter award defines a new beginning for digital banking, Varo Money becomes the first consumer fintech in US history to gain full regulatory approval to become a national bank

-

Banks can capitalize on Amazon’s ambitions by teaming up to launch financial products and services aimed at coveted customer segments. But they should beware the legal and regulatory pitfalls.

August 24 -

T-Mobile Money is now being offered to the 150 million customers of the combined wireless carriers, which merged this spring.

August 24 -

T-Mobile Money is now being offered to the 150 million customers of the combined wireless carriers, which merged this spring.

August 24 -

The slowdown in branch traffic brought on by the coronavirus outbreak has accelerated consumers’ adoption of online banking and other tech, meaning banks have no time to waste in digitizing their customer-facing applications, says Bruce Van Saun.

August 20 -

More than half of adult consumers who don't use their parents' credit union say it is because they have moved out of that market, according to a new study from Access Softek.

August 19 -

An internally built system called Advanced Listening analyzes phone calls, emails, text messages and more, identifying possible compliance violations, systemic issues and opportunities to improve processes, products and customer service.

August 19 -

American Express isn't acquiring any loans in its deal for the online small-business lender. Here's what it is getting.

August 19 -

Dennis Devine will have to navigate a number of issues, including economic strife and a pandemic, as he takes the helm at the $13 billion-asset institution.

August 19 -

American Express isn't acquiring any loans in its deal for the online small-business lender. Here's what it is getting.

August 18