Digital banking

Digital banking

-

Fintechs like LendingClub and Varo Money illustrate how the traditional financial system is changing. Banks that don’t rapidly evolve with technology will be obsolete.

March 5 -

The online lender's latest product shows business owners their cash flow over the past 90 days and how it is likely to change. The idea is to help borrowers save time.

March 4 -

Mastercard's U.K. Pay by Bank service has been slow to get off the ground since its 2016 launch. But Mastercard predicts Pay by Bank will see significant adoption in 2020 due to the partnerships it has established with banks and processors, and the popularity of mobile banking among Britons.

March 4 -

How New York became Wells Fargo's new center of power; banks walk fine line in preparing for a coronavirus outbreak in U.S.; bankers on Bernie's electoral chances and whether a Sanders presidency would pose a threat; and more from this week's most-read stories.

February 28 -

Gill Haus oversaw efforts to transform Capital One from a bank to a software company by upgrading legacy technologies, moving systems to the cloud and experimenting with different ways of using data.

February 28 -

Credit unions that don't embrace digital retailing as part of their auto lending strategy will end up spinning their wheels.

February 27 -

Fintechs like LendingClub and Varo Money illustrate how the traditional financial system is changing. Banks that don’t rapidly evolve with technology will be obsolete.

February 26 -

WSFS, in an effort to catch up with bigger rivals, plans to upgrade digital channels in three years instead of five.

February 24 -

Observers speculate that Intuit simply wants to enhance revenue and protect its tax software business, but the CEOs of each company say the deal would also give consumers more control of their overall finances.

February 24 -

The Canadian banking giant has the resources and the tech know-how to build a digital-only bank in the U.S., but can it set itself apart from the likes of Capital One, Ally, Citizens Bank and Goldman Sachs?

February 24 -

The agency said it wants feedback on changing its ubiquitous logo greeting customers at branches and ATMs to address technological changes, shifting consumer behaviors and bank-nonbank partnerships.

February 20 -

The game has changed and bank executives will have to do more homework before striking a deal.

February 19 -

"To wake up one day and assume everyone in America is going to be above average at math and above average rational is crazy," says Ethan Bloch, whose app is designed to help people achieve financial health.

-

The German challenger bank said that its "several hundred thousand" customers in the U.K. have until April 15 to withdraw money or transfer it to another account.

February 11 -

It was Varo's second try with the Federal Deposit Insurance Corp., but it has now moved within a few steps of obtaining what has eluded fintech firms of late: a green light from banking regulators.

February 10 -

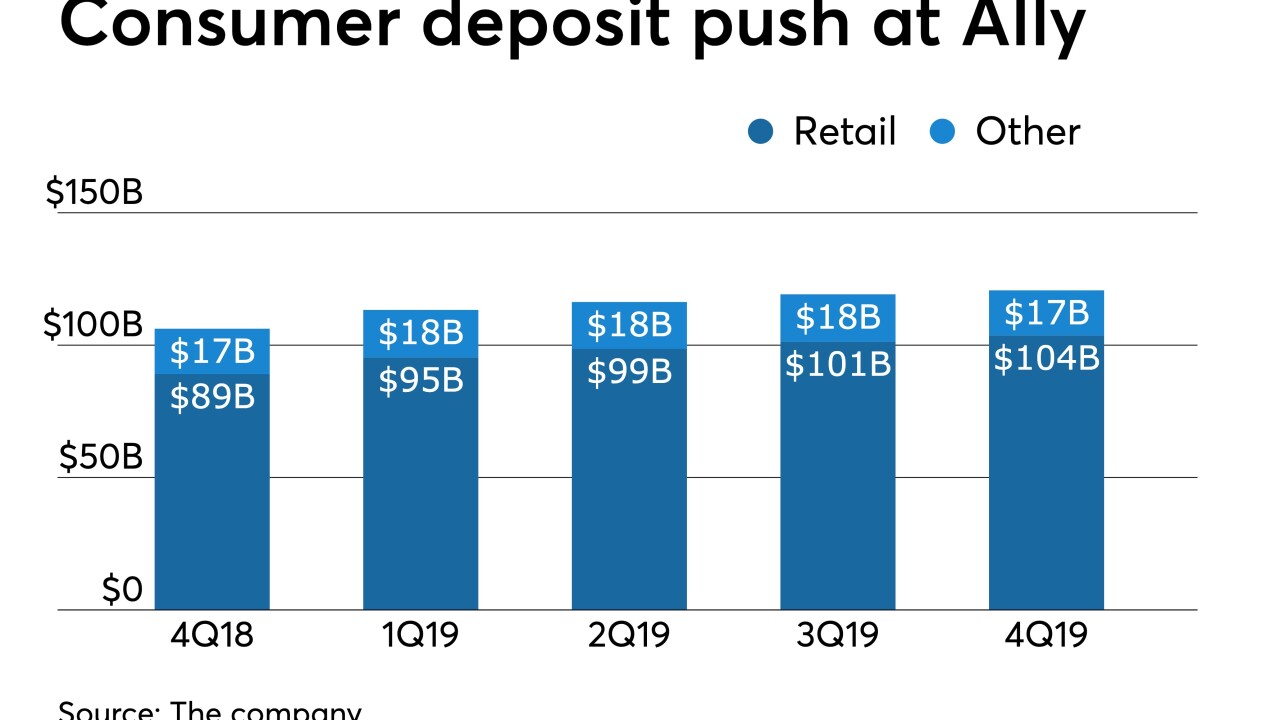

The digital-only bank found customers are anxious about their inability to set aside money, so it decided to offer automated savings tools, consumer chief Diane Morais says. It is one of the larger companies to do so.

February 7 -

Shifting to a seamless, customer-centric automation strategy can help credit unions better compete with the big banks while also meeting consumer expectations set by the likes of Amazon, Uber and more.

February 7 -

A new report from J.D. Power found that younger consumers increasingly believe the largest banks are better than regionals in providing financial guidance through digital channels.

February 6 -

Greg Seibly guided Sterling through the financial crisis before engineering its sale to Umpqua Holdings in 2014. He had most recently served as CEO of the Federal Home Loan Bank of San Francisco.

February 6 -

JPMorgan Chase is staking its consumer-banking strategy on digital technology. In 2020, that push will be spearheaded by a new team of executives.

February 6