Digital banking

Digital banking

-

The coronavirus outbreak has taught community bankers to think on their feet and experiment. Speakers at an industry conference this week advised their peers to stay innovative to ensure they endure in a changing world.

October 2 -

Many sectors are concerned about making money in an economic downturn, but those fears are higher in the financial sector, according to a study from Arizent.

October 2 -

Harit Talwar, who is moving from CEO of the digital banking unit to chairman of consumer banking, says Marcus wants to add checking and investment products, embed its offerings in additional high-profile platforms, and grow far beyond its current 5 million customers.

September 30 -

Promoted to executive director of the retail bank in April, McKinney oversees an operation that accounts for roughly 40% of Comerica’s workforce and 435 branches in five states.

-

Russia's largest bank is reinventing itself as a technology company and selling its own consumer electronic devices. Its chief tech officer says the moves are all about developing broader, more enduring customer relationships that the bank controls fully.

September 25 -

The company's software can now be used to handle personal loans, credit cards and specialty-vehicle loans.

September 24 -

Partnering with the account-opening software firm Mantl, the New Jersey bank created a CD campaign that helped fund its Paycheck Protection Program lending.

September 22 -

The bank worked with TravelBank, a fintech, to offer virtual cards and an app that automatically generates expense reports.

September 22 -

The bank worked with TravelBank, a fintech, to offer virtual cards and an app that automatically generates expense reports.

September 22 -

The North Carolina bank deployed Finxact's new technology, which runs on Amazon Web Services, to make Paycheck Protection Program loans and will use it next to offer business savings accounts and CDs.

September 21 -

The competition has leading-edge technology, but consumers may be looking for more than just bells and whistles when choosing where to do their banking.

September 18 -

Several companies said this week they’re slashing expenses as the economy limps along. Others would prefer to keep investing in new technologies and hold off on moves like branch closings to better gauge which changes in consumer behavior will stick.

September 15 -

A survey conducted by Harris Poll and commissioned by Plaid found that 60% of U.S. adults are using more apps to manage money since the onset of the pandemic.

September 15 -

Banks are augmenting their use of masks, distance markers and the like with apps to notify employees of exposure to infected individuals and technology meant to make branch visits safer.

September 15 -

BofA, which has applied for or been granted thousands of patents, has been working recently on technologies that analyze spending patterns to give budgeting advice and use augmented reality to provide estate-planning services.

September 14 -

U.S. Bank and Regions revamped their apps with accessibility in mind; JPMorgan Chase built a branch for customers who are deaf. Such efforts can help banks appeal to more customers in existing markets.

September 11 -

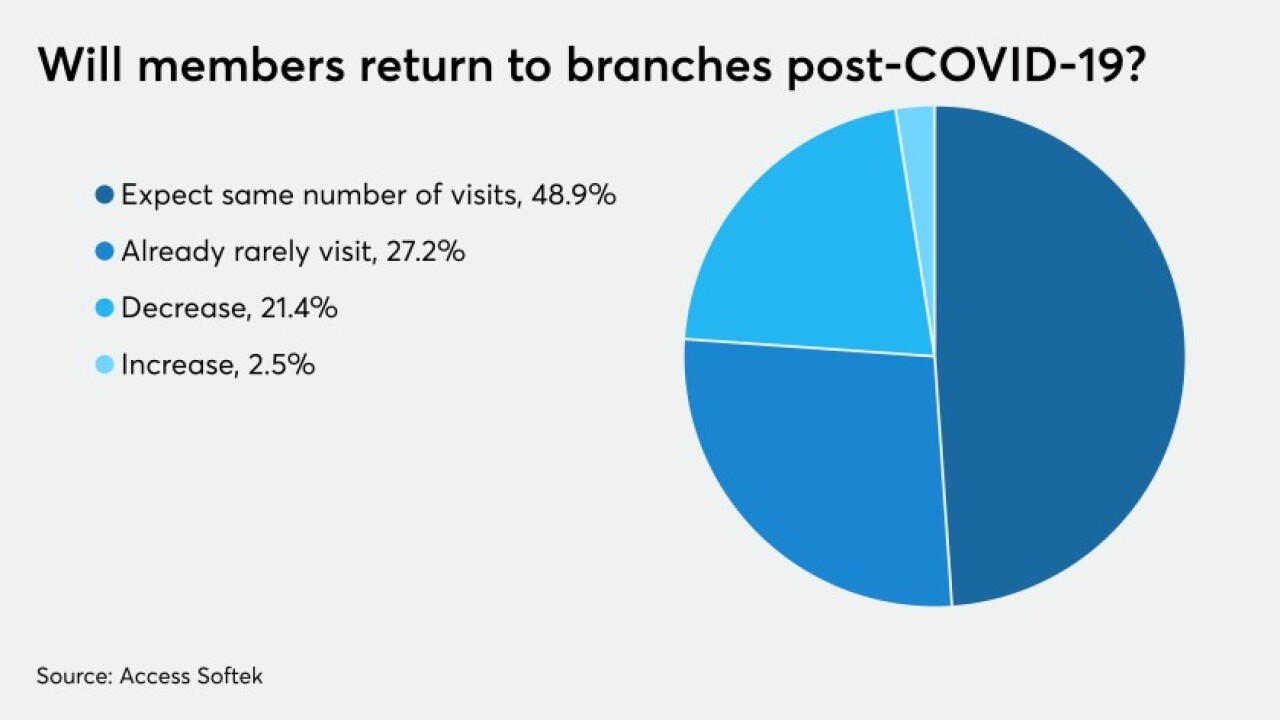

Members are completing more of their banking online than ever before, forcing many institutions to rethink their strategies for physical locations.

September 11 -

Citigroup named Hassan to the new role as part of a move to combine its marketing and branding divisions.

September 9 -

How Bank of America plans to stay ahead of the pack in digital banking; Wells Fargo gets top marks for COVID-19 safety; PPP lenders nearing $10B asset mark fear regulatory ordeal; and more from this week’s most-read stories.

September 4 -

Institutions considering new technologies must ask themselves what they're looking for not just from a product but from a partner.

September 4