Earnings

Earnings

-

The Canadian economy’s comeback in recent months, even as COVID-19 lingers, fueled strong domestic lending results at the country’s banks during the third quarter.

August 26 -

The banks reported fiscal third-quarter results that topped analysts’ estimates on gains in domestic personal and business loans as well as continued strength in the Canadian housing market.

August 24 -

Many banks reported sharp declines in income from home loans during the second quarter. The large gains they enjoyed last year thanks to a surge in refinancing activity are unlikely to return, according to bankers and analysts.

August 4 -

First Hawaiian and Bank of Hawaii are warning that a global spike in coronavirus cases could stunt the state's momentum and threaten credit quality.

August 2 -

With virus cases in its home state hitting their highest level since February, the San Antonio company declined to release reserves — a route that many banks took to boost their second-quarter profits.

July 30 -

The card brand has been pitching itself as a testing ground for central bank digital currencies, a payment portal for stablecoins and — most recently — an accelerator for startups.

July 29 -

The digital lender, which bought Radius Bancorp in February, still expects to record a full-year loss partly because of merger-related costs. But its stock price soared Thursday after it reported second-quarter net income of $9.37 million.

July 29 -

The payments company has completed development of its all-in-one portal. It's an ambitious project, but the first few services — such as bill pay and savings — are relatively straightforward.

July 29 -

Flagstar’s main business is lending to nonbank mortgage lenders, and New York Community Bancorp CEO Thomas Cangemi has a plan for tapping those borrowers to drive loan and deposit growth.

July 28 -

Banco Santander SA said it’s on track to beat a key profitability metric for the year with earnings from the U.S. and U.K. fueling the Spanish lender’s resurgence after historic losses linked to the pandemic.

July 28 -

The card brand's recent deals to buy Tink and Currencycloud for a combined $3 billion are meant to give it a stronger presence in fast-growing fintech markets.

July 27 -

States in its footprint have some of the lowest vaccination rates in the country. Another round of shutdowns could further damage industries like hospitality that have already been hit hard by the pandemic, executives said.

July 23 -

CEO Stephen Squeri told analysts a fresh crop of rivals, possibly including Wells Fargo, will be quick to fill the void created by Citi's departure from the high-end market.

July 23 -

The Wisconsin company’s growth initiative, expected to be unveiled by mid-September, will fund both a bigger commitment to online banking products and a push to expand in new and existing markets.

July 23 -

Small Business Administration lenders have reported strong quarterly results, but those gains could evaporate later this year. Here’s why.

July 23 -

The goal is to add customers and prop up borrowing until business travel rebounds and consumers burn through their excess cash, CEO Roger Hochschild says.

July 22 -

The retail consolidation in Midwestern markets will also support the bank’s branch expansion in Atlanta, Charlotte and other fast-growing cities across the Southeast.

July 22 -

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

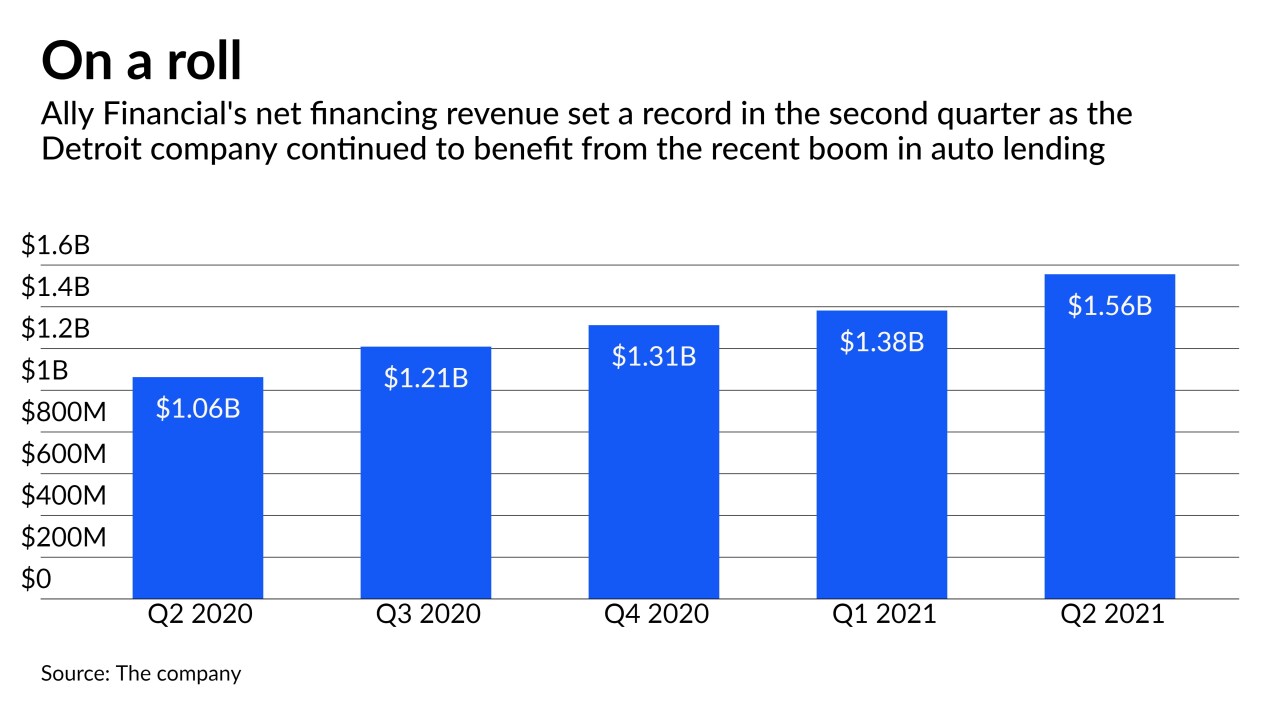

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

The Pittsburgh company offset relatively flat revenue and lending in the second quarter with strong service charges, wealth management fees and a $1.1 million reserve release.

July 20