Earnings

Earnings

-

Slower-than-expected lending and "lackluster" trading could be concerns; new CEO David Solomon sets his sights on fixed income.

October 10 -

Big banks are expected to report that commercial lending weakened in the third quarter thanks to tax cuts, nonbank competition and seasonal factors. It raises questions about whether the second-quarter rally was an anomaly and if an overall economic slowdown is edging closer.

October 9 -

Several other recent hires may have been an attempt to refute charges it can’t attract top talent; rising rates have helped banks, but a reckoning awaits.

October 9 -

Profits at big banks should be solid if not spectacular; the Vermont senator proposes a hard cap on assets held by the biggest banks.

October 4 -

The company will record a quarterly charge after reporting potential fraud tied to commercial deposit accounts.

October 1 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

Laplanche agrees to a three-year securities industry ban and a small fine to settle SEC fraud charges on loan sales; analysts are expecting a "tepid" quarter as some trading activity suffers.

October 1 -

Large retailers want the right to reject rewards cards at the point of sale to avoid higher swipe fees; Germany's financial regulator appoints an auditor to monitor the Deutsche Bank's progress.

September 25 -

The Dallas company said a commercial client submitted falsified documents that inflated how much colloteral it had available.

September 21 -

The Delaware company said it recouped nearly two-thirds of the costs it incurred as part of a legal settlement reached earlier this year.

September 13 -

The broadening of JPMorgan's Sapphire Reserve brand is emblematic of the niche expansion megabanks must rely on since bank M&A is not an option.

September 13 -

The Tennessee regional said the sale should boost quarterly profit by $160 million.

September 12 -

The popularity of technology-driven international transactions are making their way to TransferWise's balance sheet.

September 10 -

Diebold Nixdorf will use the funds to buy the remaining shares of its Germany subsidiaries, repay debt and undertake operational improvements.

August 31 -

Women managers in the Well Fargo’s wealth management division say they are being passed up for promotions; TD Bank's U.S. retail division saw profit jump 27% in fiscal Q3.

August 31 -

Bank of Montreal set a profit record for its U.S. business, thanks in part to Donald Trump's tax cuts and lower provisions for bad loans.

August 28 -

The CFPB nominee wins approval from the Senate Banking Committee by a 13-12 vote; the country is looking to borrow $11 billion after Aramco IPO is delayed.

August 24 -

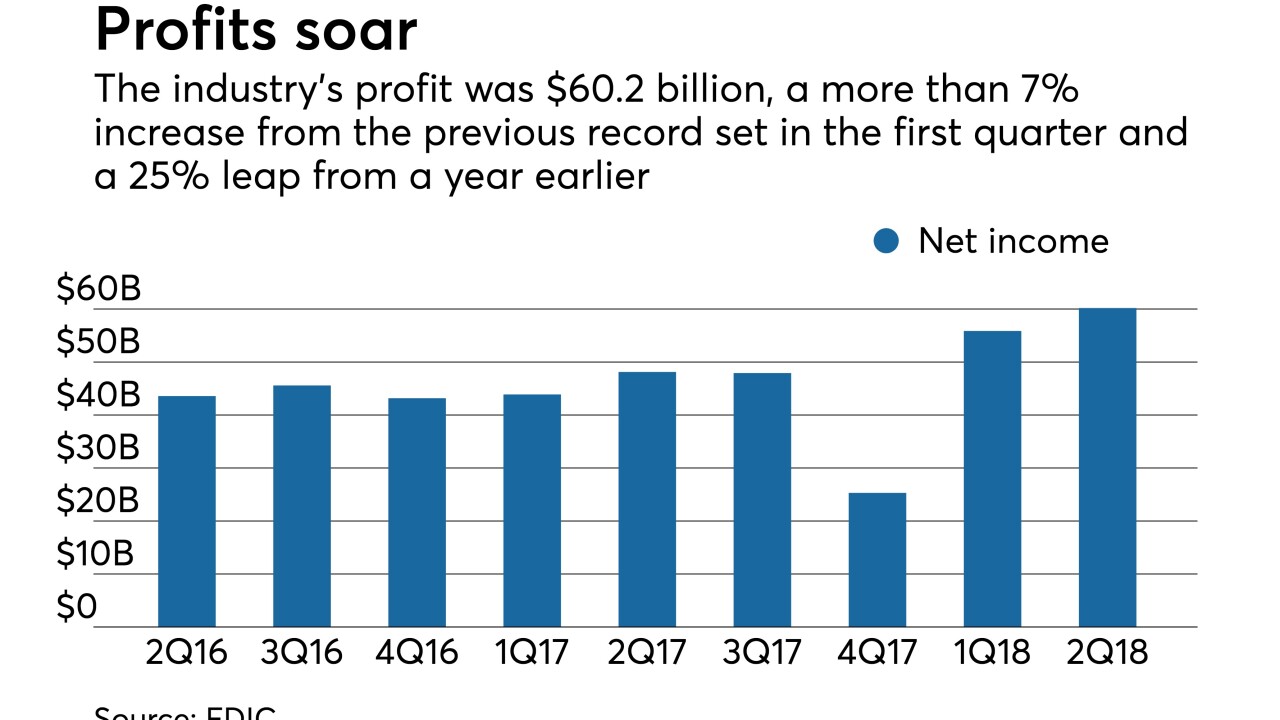

A huge chunk of the profit increase in the second quarter was due to a lower tax rate, but rising net interest margins and loan growth signal that institutions continue to derive revenue from their loan book.

August 23 -

A deceleration in mortgage balances ends CIBC's three-year streak of outpacing Canada's other large lenders on mortgage growth. Royal Bank of Canada said this week that mortgage balances were 5.9% higher than a year earlier.

August 23 -

The industry’s profit was $60.2 billion, a more than 7% increase from the previous record set in the first quarter and a 25% leap from a year earlier, the agency said in its quarterly report on the industry's health.

August 23