Congress won’t return from its August recess until next week but plenty of credit union matters are still moving forward in Washington.

One of the week’s biggest pieces of Washingon CU news won’t even take effect until next year. The Credit Union National Association on Monday morning announced plans to shift its annual Governmental Affairs Conference to an online format for 2021. The majority of credit union events for 2020 have been held online and it's possible industry events

“It might feel a little different, but the goal of coming together to strengthen the credit union system is more important now than it’s ever been,” Todd Spiczenski, chief products and services officer for CUNA, said in a press release.

As usual, the event will feature speakers from the world of law and regulation, along with keynote addresses, a virtual exhibit hall and more. The event is scheduled for March 2 to 4.

In the meantime, the National Association of Federally-Insured Credit Unions has announced additional speakers for when it holds its own event with members of Congress and policymakers starting in two weeks. Sens. Mike Crapo, R-Idaho, and Sherrod Brown, D-Ohio, will both speak during the trade group’s virtual Congressional Caucus. The event will also include National Credit Union Administration Board Member Todd Harper and Consumer Financial Protection Bureau Director Kathy Kraninger.

NAFCU and other industry groups are also sharing their concerns with NCUA regarding how digital technologies can be better incorporated into examinations and supervision moving forward. In a

"Duration of an exam has a direct correlation to the time and resources credit union staff can devote to serving members," she wrote. "Shorter, more efficient exams would allow credit unions to better serve their members, particularly during an unanticipated disruption, like the COVID-19 pandemic."

CUNA expects to send its own letter on the matter later this week.

Finally, voters in Massachusetts will head to the polls this week for one of the year’s last primaries before the general election season heats up. Chief among the contests is the race for the state’s first congressional district, where Holyoke Mayor Alex Morse is challenging incumbent Richard Neal for the Democratic nomination. The Credit Union Legislative Action Council has thrown its support behind Neal, who is chairman of the House Ways and Means Committee.

Data from the National Credit Union Administration shows that despite a dip during the second quarter, the rate of industry consolidation has not changed dramatically from last year, despite the pandemic.

The legislation, which would apply to both banks and nonbanks, would give borrowers the right to sue for damages when servicing violations occur.

Refinancing has been one of the bright spots in a difficult year for lending, and the industry has concerns that a fee to be imposed by Fannie Mae and Freddie Mac could slow down the business.

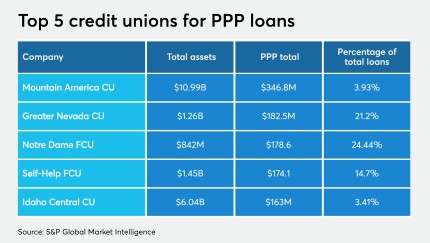

New analysis from S&P found that only two of the of the top 20 credit unions that participated in the Paycheck Protection Program loans had assets of less than $1 billion.