-

The clash between the Department of Housing and Urban Development and its inspector general over down payment assistance programs run by state or local housing finance agencies continues to heat up.

October 6 -

In comments to the Treasury Department, traditional financial institutions are calling for more oversight of an industry that is fast becoming a big competitive threat.

September 30 -

Bank executives and outside experts finger technology as the area most in need of improvement when it comes to vetting financial institutions' ability to withstand the next bit economic shock.

September 21 -

Nearly 20 trade groups representing lenders, banks, credit unions, title companies and others are urging federal regulators to provide guidance on how they plan to enforce a new mortgage disclosure regime that goes into effect Oct. 3.

September 9 -

A data breach-related court case involving Wyndham hotels and new Defense Department rules governing contractors provide banks some dos and don'ts in bringing vendors' security practices into line.

August 31 -

As marketing services agreements disappear under pressure from regulators, loan officers will have to compete based on skill and customer service to win referral business.

August 31 -

WASHINGTON A Federal Deposit Insurance Corp. publication on Monday advised banks to include cyber risk in standard disaster-planning and business-continuity exercises as part of general strategic-planning discussions.

August 24 -

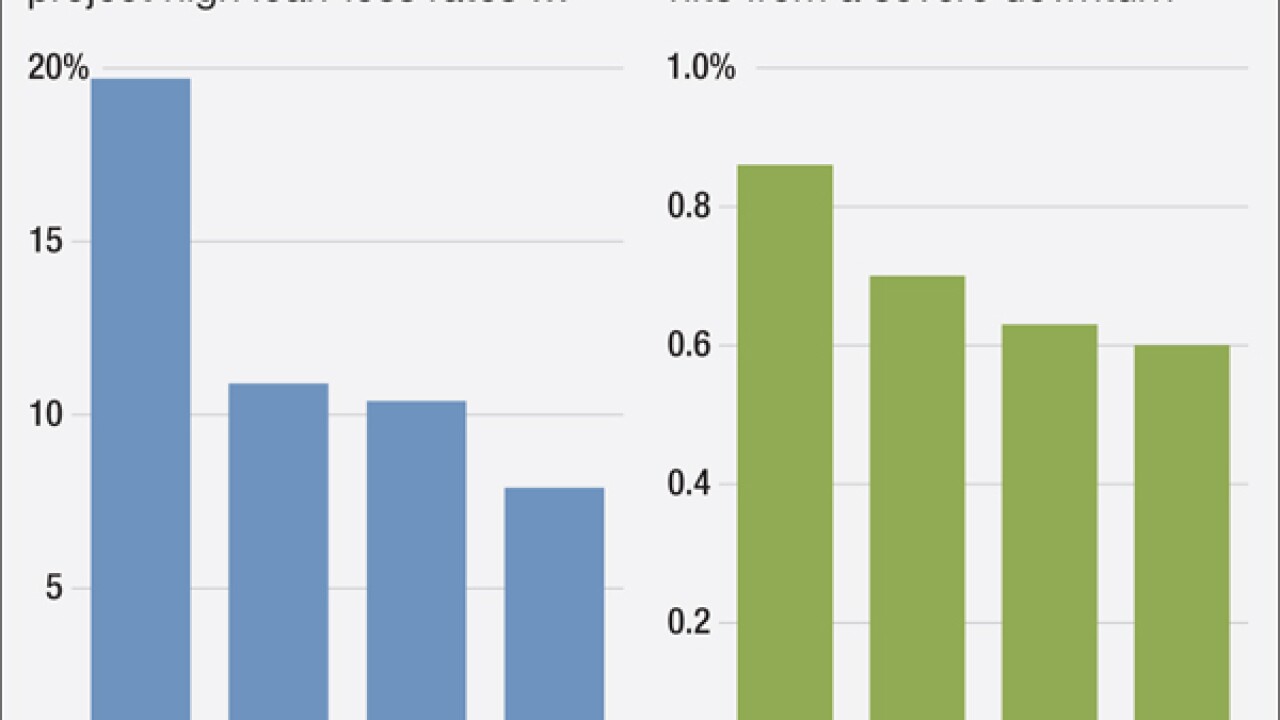

The first stress tests for regional banks show loan losses closely in line with the postcrisis period. However, an independent analysis suggests losses likely would be even higher.

August 4 -

A high percentage of loans to oil and gas firms are large and syndicated. As a result, more shared loans are becoming problematic for participating lenders.

August 3 -

The Federal Housing Finance Agency is still not producing enough adequately-trained examiners necessary to monitor Fannie Mae and Freddie Mac, according to an inspector general report.

July 29 -

The Special Inspector General for the Troubled Asset Relief Program is renewing calls for further investigation of servicers it claims may be denying too many Home Affordable Modification Program applications.

July 29 -

Federal regulators are working to streamline call reports for community banks in response to industry complaints that some of the requirements are unnecessary and increasingly burdensome.

May 29 -

Regulators' latest guide for examining anti-laundering procedures lacks wholesale changes, but institutions still must decipher minute changes with potentially big impacts.

May 1 -

Bank regulators plan to release their self-assessment tool later this quarter to gauge institutions' cyber readiness, but many see it as sign of more prescriptive measures down the road.

April 9 -

The shift in market composition is fueling concerns that if defaults rise, the Federal Housing Administration would have a harder time making lenders eat the losses on poorly underwritten loans.

April 6 -

Banks have spent a lot of money in order to comply with stress-test requirements. But they will only realize the value on their investments if they integrate stress-test tools and results into their daily decision-making process.

March 9

-

Two activist groups are urging the Fed and OCC to investigate whether OneWest used donations and other sweeteners to buy community support for its sale to CIT.

March 6 -

WASHINGTON Federal bank regulators made a tool available on Wednesday to help banks calculate capital requirements for securitization exposures.

February 11 -

The Senate Banking Committee's first look at regulatory relief for small institutions provided key insights into how the panel is likely to tackle the topic legislatively this year, suggesting it could be a long and contentious debate.

February 10 -

The Office of the Comptroller of the Currency is trying to send a clearer message to banks about potential red flags by removing low-level recommendations from its exam reports.

February 9