-

The industry has made great strides in faster payments over the past year. Even more cooperation among stakeholders will be needed in the year ahead.

March 13 Nacha

Nacha -

Third party technology development from APIs and real-time digital payments are expanding, creating a new area of security risk.

March 1 ACI Worldwide

ACI Worldwide -

When Zelle launches, it will not allow users to share information about their payments with other folks in their network. That decision puts the P-to-P service on a different course than Venmo, its fast-growing rival.

February 22 -

When Zelle launches, it will not allow users to share information about their payments with other folks in their network. That decision puts the P-to-P service on a different course than Venmo, its fast-growing rival.

February 21 -

The technology can help to speed processing, and the number of banks investing in the technology is expanding rapidly.

February 16 Cognizant Technology Solutions

Cognizant Technology Solutions -

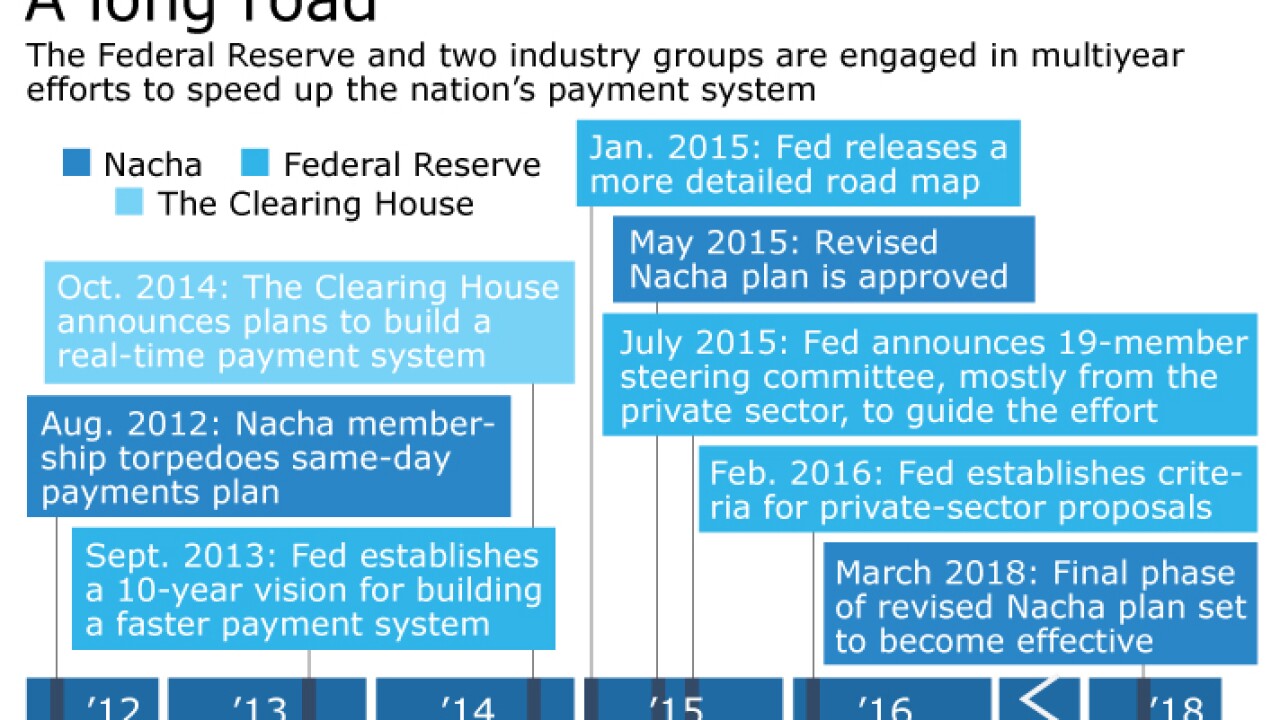

Several groups are developing real-time payments systems for the U.S., and most everyone agrees success is inevitable, but how quickly they can make enough progress to satisfy consumers is a point of contention.

February 1 -

The upcoming launch of Zelle gives Chase, B of A, Wells Fargo and other large banks an opportunity to correct their past mistakes.

January 27 -

Recommendations for a framework to develop a "universal security baseline" to protect sensitive payment data at rest and in transit remains a key goal of the Federal Reserve faster payments initiative.

January 27 -

Direct deposit transactions accounted for 52% of all transactions processed through the speedier system

January 25 -

After more than two years of work on its real-time payments rail, The Clearing House senses it has the proper plumbing in place to make any new system hum. And the one thing it wants to make clear: This isn't your father's ACH.

January 18 -

Corporate clients are increasingly asking their banks to help digitize back-office processes. Such a move can help both parties save time and money.

January 13 -

Payment companies' efforts to modernize by connecting systems through partnerships and acquisition has invariably caused a chain reaction of competitive issues in the eyes of regulators.

January 12 -

Bank technology provider D+H Corp. is expanding its role in the expected launch of The Clearing House Real-Time Payments System by offering banks cloud-based testing to simulate a connection to that system.

January 10 -

The time banks have to investigate red-flagged credit payments has shrunk from several days to a few hours and fraudsters have already taken notice.

December 29 -

Australia’s central bank is set to deploy a new, faster payments system enabling near real-time payments for consumers and businesses that will roll out in 2017.

December 27 -

The Federal Reserve is asking the payments industry for input on securing faster payments processing.

October 25 -

In a world filled with a growing number of options for instant and same-day payments, the paper check still holds strong as a barrier to innovation. But it could also be a sign of opportunity.

October 21