-

As credit union leaders converge on Washington, here's a look at some of the biggest legislative and regulatory issues facing the industry – and what it might take to move the needle.

September 9 -

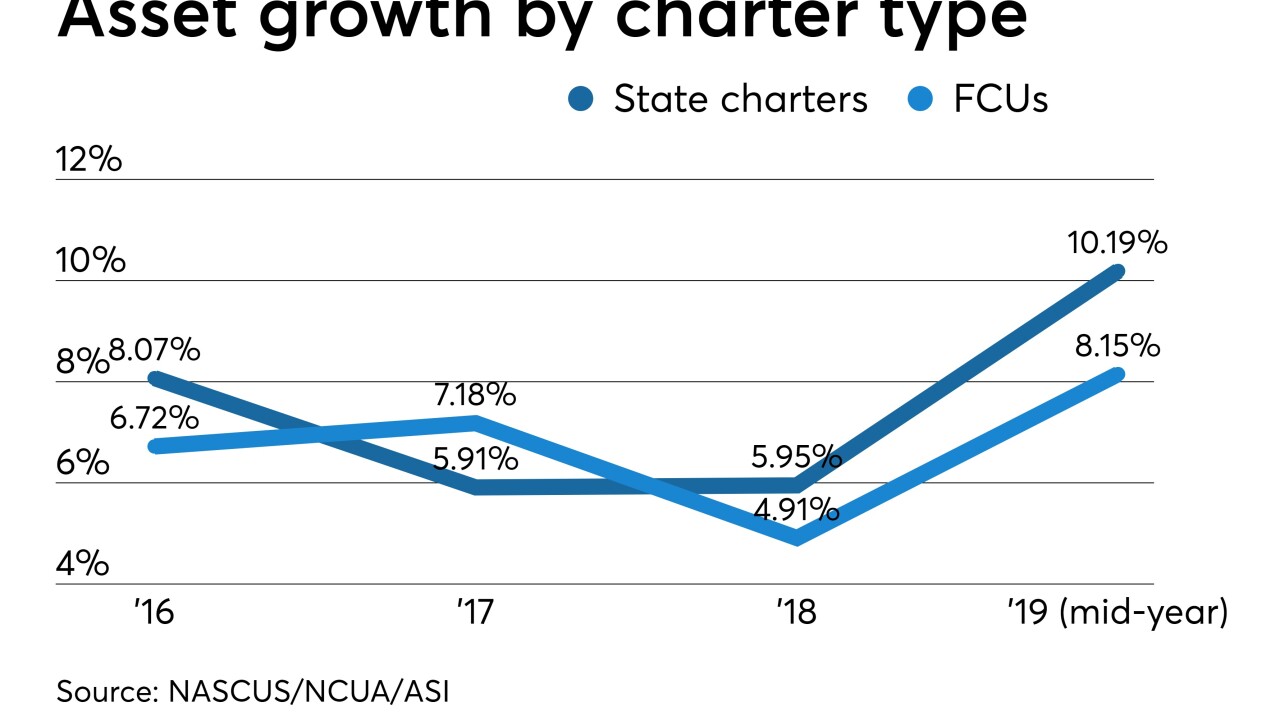

Despite state charters' best gains in four years, their ranks continue to shrink at a pace nearly equal to that of federal charters.

September 6 -

With legal questions still lingering, the regulator said it will begin accepting applications from credit unions looking to take advantage of its revised field of membership rule but did not specify when it would take action on those submissions.

September 4 -

The Poughkeepsie, N.Y.-based institution will be able to serve a dozen counties after the change takes effect on Oct. 1.

September 4 -

United Churches Credit Union, which has just one branch, can now serve anyone who worships in two counties.

August 27 -

Banks are expected to appeal last week’s field of membership ruling, but credit unions must also explain why part of their new rule doesn't discriminate.

August 26 -

Nearly three years after NCUA passed the rule, credit unions are ready to broaden their reach, but the possibility of an appeal to the Supreme Court may put those efforts on hold.

August 26 -

The Unity, Maine-based institution, which should open in the fall, will provide member business loans and other products to local farmers.

August 23 -

A panel of federal appeals court judges reversed a district court’s decision on the NCUA’s controversial field-of-membership rule, but saw merit in bankers’ claims of potential redlining.

August 20 -

A panel of federal appeals court judges reversed a district court’s decision on NCUA’s controversial field-of-membership rule, but saw merit in bankers’ claims of potential redlining.

August 20 -

The Boulder, Colo.-based institution will now serve a dozen counties in its home state.

July 31 -

The institution was formerly known as SF Police CU but can now serve law enforcement officers statewide.

July 17 -

The banking trade group sent a letter to the National Credit Union Administration board and Inspector General, arguing that a report released earlier this week was a a "wake-up call."

June 28 -

The American Bankers Association also argued that the definition of a low-income credit union was too broad.

June 26 -

The Montana-based institution will open its doors as Clearwater later this year, a move leadership hopes will better connect it with consumers in other parts of the state.

June 25 -

The Orange County-based CU had served a few cities around Los Angeles but state officials have now approved its application to serve all of Los Angeles County.

June 20 -

Speaking during an event on Wednesday, Hood touched upon charter expansions, regulatory relief and the industry's tax-exempt status.

June 12 -

The Tampa-based institution says it is poised for growth, but the new asset class also opens it up to additional scrutiny from the CFPB.

June 10 -

The Michigan-based institution is one of a handful of credit unions that have bought or announced deals to acquire banks over the last two years.

June 3 -

The McLean, Va.-based institution said that its capital hit a record $2.5 billion last year.

May 23