Fintech

Fintech

-

Control breakdowns and poor governance can affect fintech partnerships of all types, whether lending, payments, deposit-taking, wealth management, or insurance activities,according to Cliff Stanford, a partner in Alston & Bird's Financial Services and Products Group.

March 7 -

Pacific Mercantile and P2Bi are collaborating on a program to help businesses that are not ready for traditional bank financing.

March 7 -

The league will work with Quatrro Processing Service to provide member credit unions with access to emerging technologies to combat fraud.

March 7 -

Banks moving past traditional card lending to compete on POS; ; five board members plan to leave before the bank’s May meeting.

March 7 -

Karen Mills, who led the Small Business Administration from 2009 to 2013, is joining the Eastern Bank spinoff Numerated as an adviser and investor as it tries to bring online-lending technology to community banks.

March 6 -

Is it realistic to think Wells Fargo might get a new female CEO? How one fintech makes women feel welcome, and how another fosters innovation. Plus some of our Most Powerful Women make big moves – two retire, one jumps from BNY Mellon to Amex, one exits a board and another joins one.

March 6 -

Concerns about an economic slowdown, rising deposit prices and cybersecurity abound, a survey found.

March 5 -

JPMorgan's Dimon: Square innovated where we should have; this company simplifies bank switching (and banks pay for it); BB&T-SunTrust deal has Atlanta banks licking their chops; and more from this week's most-read stories.

March 1 -

Revolut has caught the attention of U.K. regulators over money laundering compliance, a predicament that sheds light on issues faced by the entire digital financial services industry.

March 1 -

Revolut Ltd., the fast-growing financial technology startup, is facing regulatory scrutiny following an alleged compliance lapse that could have allowed illegal transactions on its app.

March 1 -

Readers weigh in on Democrats' call for more scrutiny of the BB&T-SunTrust merger, changes to the CFPB's payday lending rule, criticism of Square's ILC application and more.

February 28 -

Aspiration, Wealthfront and SoFi have all begun offering high-yield savings accounts during the past few weeks.

February 28 -

Bank of America, MX and Carolina Fintech Hub are training refugees and nontechies to become developers while at the same time showing corporate citizenship.

February 27 -

Figure, the startup headed by Mike Cagney, uses blockchain technology to provide home equity loans in as little as five days. It intends to use the newly raised funds to offer other services, including wealth management.

February 27 -

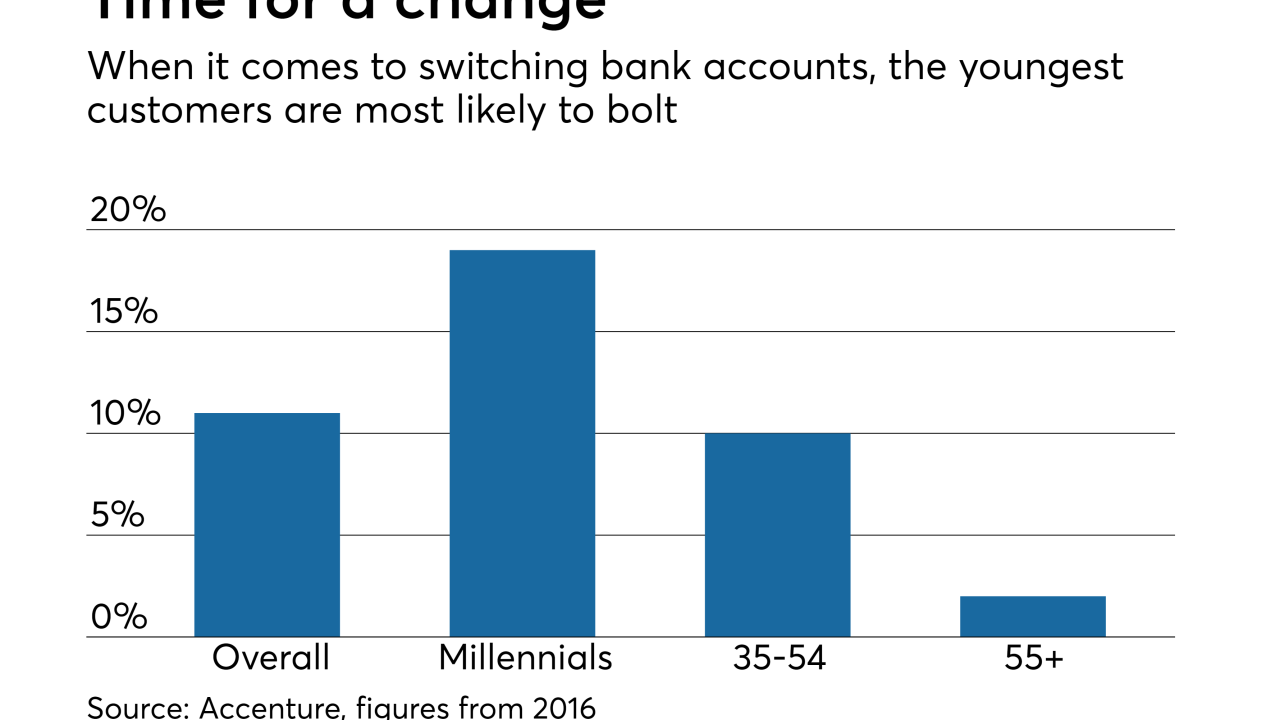

The drudgery of filling out forms and changing bills prevents many customers from swapping banks. One fintech has simplified that exchange, and banks are willing to pay it to deliver them new customers.

February 26 -

The Small Business Administration should consider partnering with fintechs, which have the capacity to approve loans quickly, to help avoid the kind of application backlog the agency faced after the last government shutdown.

February 26 -

The former deputy director of the Consumer Financial Protection Bureau shares his thoughts on the bureau's evolution, payday lending, and fintech regulation.

February 26 -

The health care industry yearns for a digital antidote to paper payments, a challenge that awaits an executive who has spent years bringing businesses into the digital light.

February 26 -

Nap pods and beanbag chairs are nice, but what employees really care about are personal respect and generous compensation. Oh, and it helps to be dog-friendly.

February 24 -

A look at the difference in responses between employees working for companies that made the list and those that did not.

February 24