Fintech

Fintech

-

Since stepping down as CEO of Webster Bank last month, James Smith has spent much of his time co-chairing a panel tasked with solving his home state’s fiscal and economic woes. Banks, and perhaps even fintechs, could be a part of its comeback story, he says.

February 26 -

The Boston mutual, which lost its innovation team when it spun off Numerated last year, has hired a State Street executive to oversee a plan to encourage all employees to be more creative.

February 23 -

Scarlett Sieber will be based in the bank’s Labs division, working on forging partnerships with fintech firms.

February 22 -

The bureau’s policy of “no-action letters,” which offer some regulatory cover to participants, has failed to attract much interest from financial startups, suggesting change is needed.

February 21 -

U.S. Bank's $600 million fine for AML lapses quickly drew readers attention, while acting CFPB Director Mick Mulvaney got the Cordray treatment on Capitol Hill and big banks made moves to speed real-time payments.

February 16 -

Four of the startups are focused on business and consumer bill payments, and a fifth offers student loan repayment assistance as an employee perk.

February 16 -

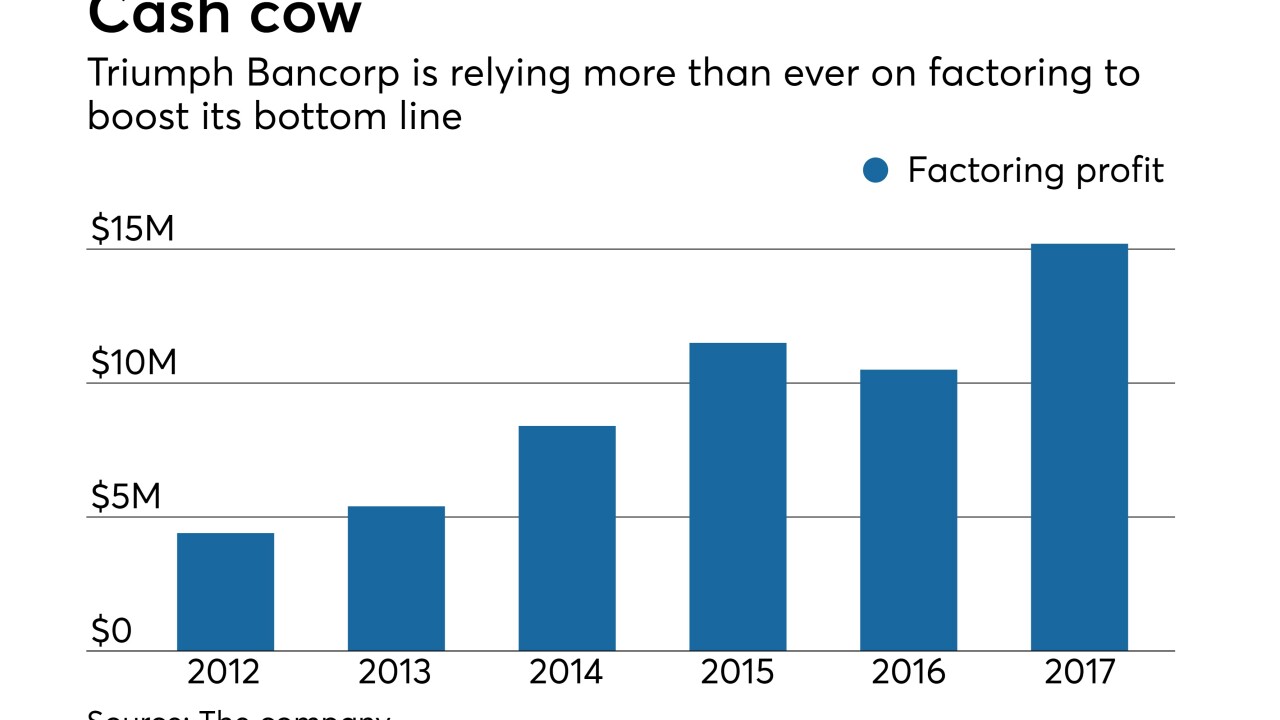

Triumph Bancorp has developed technology to help freight brokers make faster payments to truckers, charging a fee for the service.

February 16 -

The Financial Conduct Authority is seeking input on whether it should expand its fintech testing ground to include startups and regulators from around the world.

February 16 -

While small and regional banks are pushing for a rollback of the Dodd-Frank Act, big banks are largely supportive of the 2010 financial reform law, Bank of America CEO Brian Moynihan said Thursday.

February 15 -

U.S. fintechs attracted $5.8 billion in the fourth quarter as institutions sought an AI edge.

February 15 -

R&D capabilities at Interac got a boost last month when Interac Corp. was created by merging Interac Association and Acxys Corp. It brought together a payments network handling nearly 5.7 billion debit transactions annually with a company specializing in payments development, management and consultation.

February 15 -

The investment continues a trend of banks focusing on commercial payments technology.

February 14 -

The online small-business lender is enjoying a payoff from its year-old push to cut costs and tighten underwriting standards. It is also set to announce another lending agreement with a major bank this year, its CEO said Tuesday.

February 13 -

Neptune Financial plans to use technology to improve the efficiency in making loans to companies with $10 million to $100 million in annual revenue.

February 13 -

In what could be seen as a mea culpa for CEO Jamie Dimon's disparagement of bitcoin five months ago, the Wall Street megabank has released a big and relatively bullish report on cryptocurrencies.

February 12 -

Fintech firms and industry watchers hope the pilot program will help fix a balkanized chartering system, but getting enough states on board to expand the plan's reach could be a challenge.

February 9 -

Quicken Loans, Citizens Bank and Better Mortgage are refinancing loans using Airbnb income as part of a pilot project with Fannie Mae.

February 9 -

Cambridge Bancorp in Massachusetts is looking to prove to entrepreneurs that it is in the business for the long haul.

February 9 -

For many newcomers to the U.S., establishing credit is a big challenge. A handful of entrepreneurs are developing tools to help verify their financial histories.

February 9 -

It’s not just hourly workers who struggle to make ends meet — many managers also often find themselves short on cash each month. To help employees cope, the retail chain is using a tool developed by the fintech Even to give them access to their wages before the next pay period.

February 8