-

Worldpay is rolling out FraudSight, a new fraud prevention tool that uses machine learning to spot suspicious transactions across all in-store and e-commerce checkout points, according to a Tuesday press release.

April 30 -

Many banks rely on the location data they get from carriers through data aggregators to spot fraudulent transactions. With telecom companies shutting that source down, banks are worried it could significantly hurt their capacity to detect fraud.

April 29 -

-

-

Many U.S. banks, especially in Florida, are struggling to comply with U.S. sanctions against the Maduro regime. Some argue artificial intelligence can make it easier to distinguish between legitimate payments and illicit transactions.

April 8 -

MoneyGram is investing more time and technology in helping law enforcement agencies spot the scammers moving money on its network.

March 28 -

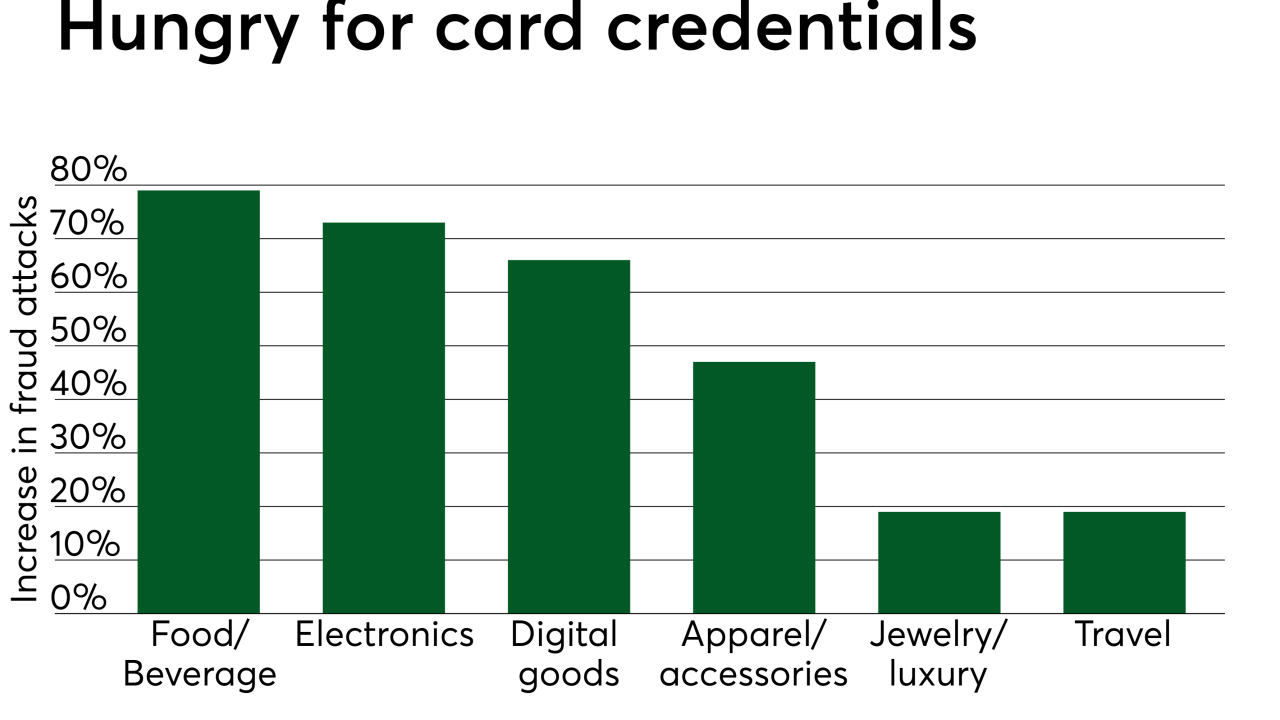

Fraud attacks against online food and beverage businesses in the U.S. increased by nearly 80 percent in the past year, as fraudsters have decided that dining establishments are the perfect places to test stolen card credentials.

March 20 -

Reports of improper charges by perpetrators who know the victim soared last year. Issuers and card networks are failing to tighten security, clearly label transactions and police chargebacks, critics say.

March 19 -

Given the size of the deal — which includes about $9 billion of Worldpay’s debt on top of a $34 billion bid — the pressure’s on to build a global powerhouse that can counter other major fintech mergers announced in the past weeks. FIS must also emerge as a nimble rival to the startups that threaten the old order.

March 18 -

Mastercard Inc. is concerned that India’s strict data localization rules could compromise its ability to detect frauds and money laundering in the domestic payments system.

March 18 -

Municipal IDs help marginalized groups, such as undocumented immigrants, open checking accounts and become credit union members but concerns over regulatory compliance linger.

March 15 -

Merchants are often the last in the payments ecosystem to know when card fraud occurs, and their losses tend to escalate in the meantime.

March 13 -

Mastercard is bringing Ethoca—a fraud solution powered by collaboration between banks and merchants—in-house.

March 12 -

The past six years have been a whirlwind for King, who had no experience in the payments industry before becoming CEO of Featurespace, the fast-growing U.K. startup enabling banks to use machine-learning technology to block payment card fraud.

March 12 -

BrightWise is a joint venture among the Iowa CU League, its holding company and LMG Security. The initiative aims to teach credit union professionals how to better protect their institutions.

March 8 -

The California company could charge off $15 million because of allegedly fraudulent acts by an employee at one of its correspondent customers.

March 8 -

Criminals are inventing new ways to hide dirty money amid transactions for digital goods bought and sold on everything from Amazon to game-app sites. Banks need to wake up to the threat, says Ben Duranske, Facebook Payments' former compliance chief.

March 7 -

Criminals are inventing new ways to hide dirty money amid transactions for digital goods bought and sold on everything from Amazon to game-app sites. Banks need to wake up to the threat, says Ben Duranske, Facebook Payments' former compliance chief.

March 5 -

Credit unions must walk a fine line between making interactions for members as easy as possible while also providing robust protection against evolving cybersecurity threats.

February 28 IDology

IDology -

As large banks put stronger fraud monitoring and authentication technology in place, fraudsters have been turning to small banks, like Kennebunk Bank on the coast of Maine. Here's how it fought back.

February 21