-

Synthetic fraud brings the pain from many angles — a fluid mix of fake credentials and phony accounts that can overwhelm traditional identity theft tools.

November 5 -

In September, the National Credit Union Administration barred five people from the industry, including one individual who was accused of working to embezzle more than $1 million.

September 28 -

The regulatory relief law passed this spring contained a measure to stop synthetic fraud, but the provision is incomplete.

July 20 ID Analytics and Sagestream

ID Analytics and Sagestream -

The regulatory relief law passed this spring contained a measure to stop synthetic fraud, but the provision is incomplete.

July 17 ID Analytics and Sagestream

ID Analytics and Sagestream -

As banks beef up defenses, hackers are targeting the weaker link: customers.

July 12 -

All service providers, even those with a strong security posture, are only as secure as the Home Depots, LinkedIns and Equifaxes of the world, argues George Avetisov, chief executive of HYPR.

July 9 HYPR Corp.

HYPR Corp. -

-

The provision would make it harder for criminals who use real Social Security numbers to create fake personas and then apply for credit.

May 3 -

The provision would make it harder for criminals who use real Social Security numbers to create fake personas and then apply for credit.

May 2 -

More fraudsters are seeking out children for identity theft, highlighting another danger of the digital economy.

April 26 -

A startup called Spring Labs has launched a blockchain network with the goal of getting lenders and data providers to share data to help verify customers' identity.

March 27 -

The MyCUID product is intended to help membes protect against fraud and identity theft by creating a lifetime "portable digital identity" not dependent on any central authority.

February 26 -

Foreign operatives' alleged use of fraudulent financial accounts to try to influence the U.S. political system shows again how difficult it is for banks to truly know their customers.

February 20 -

This dangerous "wild west" scenario of fraud and breaches is pushing improving or revamping online authentication to the top of this year’s to-do list for both online companies and governments, writes Robert Capps, vice president of business development for NuData Security.

January 17 NuData Security

NuData Security -

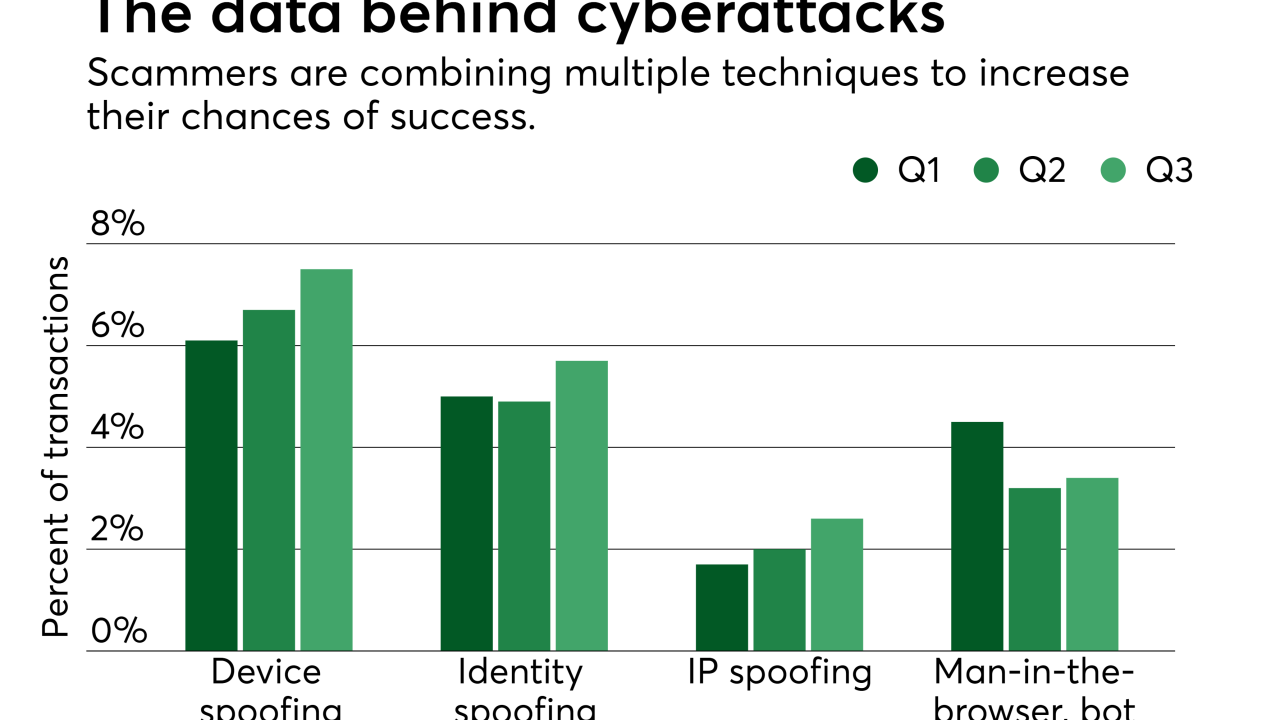

There is a visible shift in attack patterns immediately following a breach, from initial attacks focusing on high-value loan applications at online lenders to low-value identity testing on charities and social media sites to determine if a stolen credential will work.

November 14 -

KRACK, combined with other attacks, allows for the reading of pain text username, passwords, credit card numbers as well as the injection of code including ransomware, writes Timothy Crosby, senior security consultant for Spohn.

October 23 Spohn Security Solutions

Spohn Security Solutions -

The identity theft threat created by the Equifax hack and the growth of online lending have given software makers a platform to pitch products that rely on selfies, scans of driver’s licenses and other nontraditional ID methods.

September 27 -

The Equifax breach has millions of Americans now thinking about freezing their credit to guard against identity theft. But those who act could be cutting themselves off from the nation's vast credit economy.

September 19 -

The breach may result in a huge new dump of names, addresses, Social Security numbers and other personal information that fraudsters can leverage to gain access to a legitimate user’s account, writes Jason Tan, CEO of Sift Science.

September 14 Sift Science

Sift Science -

Lenders aren’t happy with the way the credit bureau has responded to the data breach; JPM chief calls digital currency “a fraud.”

September 13