-

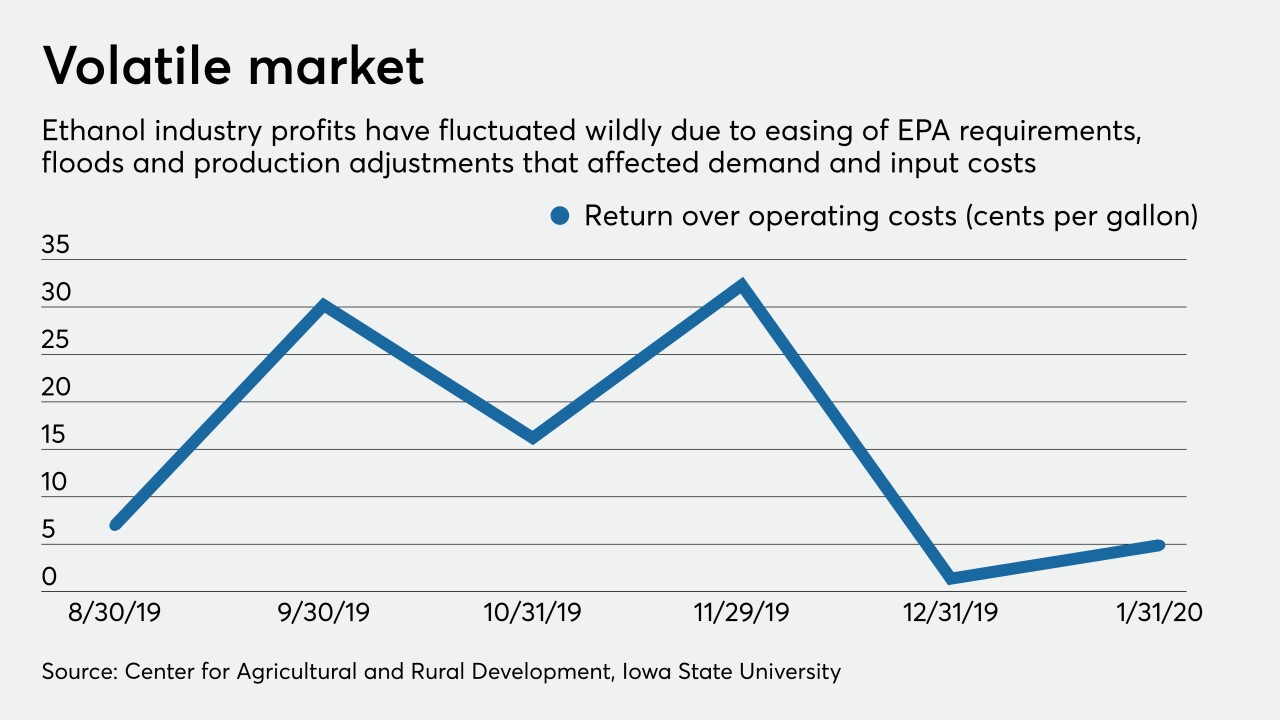

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12 -

Wells is thought to be the first big U.S. bank to allow harassment victims to go to court instead of arbitration. An investment firm that advocates for progressive causes claimed credit for the policy change.

February 12 -

Activist investors say the lender's words on combating climate change have not matched its actions. But the company argues that requests to put climate resolutions to a shareholder vote amounts to micromanagement.

February 12 -

Point of sale credit is a popular option, and Visa has followed its investment in Klarna by financially backing ChargeAfter.

February 12 -

Regulators are alarmed about banks' rising exposure to high-risk corporate credits and want more data on how they would perform in a recession.

February 11 -

The administration proposed to end the housing trust funds now financed by Fannie Mae and Freddie Mac, and to subject numerous agencies to the congressional appropriations process, among other things.

February 10 -

The bank’s former Asia investment banking co-chief is its third executive to be so punished; the agency says Telegram’s digital coin is a security.

February 5 -

Metrics and strategy are key at YCharts. So is the Oreo flavor of the week.

February 4 -

Stock markets have endured dramatic swings since the coronavirus erupted in China and talks of pandemics surfaced. But the notoriously volatile bitcoin market has been steadily climbing as investors see value in crypto's ability to thrive as traditional financial rails are under pressure.

February 4 -

Activist investor Starboard Value has built a position in Green Dot Corp. and may push for changes including a potential merger at the prepaid debit card company.

February 4 -

Andy Rachleff, the fintech's CEO, discusses the digital bank it's developing and the concept of "self-driving money."

February 3 -

Digital receipts and rewards startup Flux has been gaining ground with retailers and challenger banks, and had continued the momentum by attracting investment from Barclays.

January 29 -

The country’s banks plan to raise overdraft rates to 40%, which has regulator watching; starting this year pay increases won’t be retroactive to Jan. 1.

January 29 -

Regulators already finalized a rollback of the proprietary trading ban section of the rule but signaled then that their overhaul was not finished.

January 23 -

In the year since it voluntarily disclosed its own data, Citigroup has shown an improvement in its median pay for female and minority employees, the firm said Wednesday.

January 15 -

A MagnifyMoney report shows an overwhelming majority of consumers regret not investing sooner, a sign that credit unions could deepen relationships by upping their wealth management options for members.

January 13 -

On Sep. 30, 2019. Dollars in thousands.

January 13 -

Population shifts and the explosion of e-commerce will upend commercial real estate lending while heightened demand for clean energy, not to mention pressure from investors, will diminish banks’ enthusiasm for fossil-fuel financing.

-

Marcus and the Apple credit card accounted for 3% of the bank’s profit in the first three quarters of 2019, despite a multibillion-dollar investment in consumer operations; the senator’s plan would make it easier to expunge debt.

January 8 -

The company, which has agreed to buy Marquis Bancorp, could use some of the proceeds to fund growth and pay off a line of credit.

January 7