-

With technology tightening defenses against account fraud, scammers increasingly turn to what they view as the weakest link: the human being at a call center.

September 18 -

The payments, which total more than $10 million, stem from a 2017 settlement with the Federal Trade Commission. The agency charged that NetSpend deceived consumers by advertising that they could get immediate access to their funds.

September 17 -

Marianne Lake could be JPM’s eventual choice to succeed Dimon; three agencies investigating money laundering allegations against Danske Bank.

September 17 -

Apple Federal Credit Union and Envision CU are the latest to be targeted in a growing trend as plaintiffs go after credit unions alleging deceptive overdraft practices.

September 14 -

Speaking at an investor conference in New York, John Shrewsberry addressed a recent media report saying regulators had rejected Wells Fargo’s restitution plan for overcharged auto customers.

September 14 -

The prospects are tough for Thomas Borgen of Danske Bank, whose Estonian unit has been described as a central pipeline for laundering as much as $9 billion between 2007 and 2015 in dirty money, mostly from Russia.

September 14 -

Goldman’s next CEO names a new president and replaces the CFO; insurance giant shares remain at a 25% discount to book value.

September 14 -

The consumer bureau alleges Future Income Payments lured vulnerable consumers into taking out high-cost loans in exchange for their future pension payments.

September 13 -

The time is now for Congress to enact stricter data security standards that better protect credit unions and consumers.

September 13 America's Credit Unions

America's Credit Unions -

There are several reasons, including the fact that many prospective borrowers are finding it harder to qualify for a mortgage and obscuring the truth as a result.

September 13 -

A former employee in the VyStar Credit Union mail room has been charged in a case involving mail fraud and millions of dollars in stolen stamps.

September 12 -

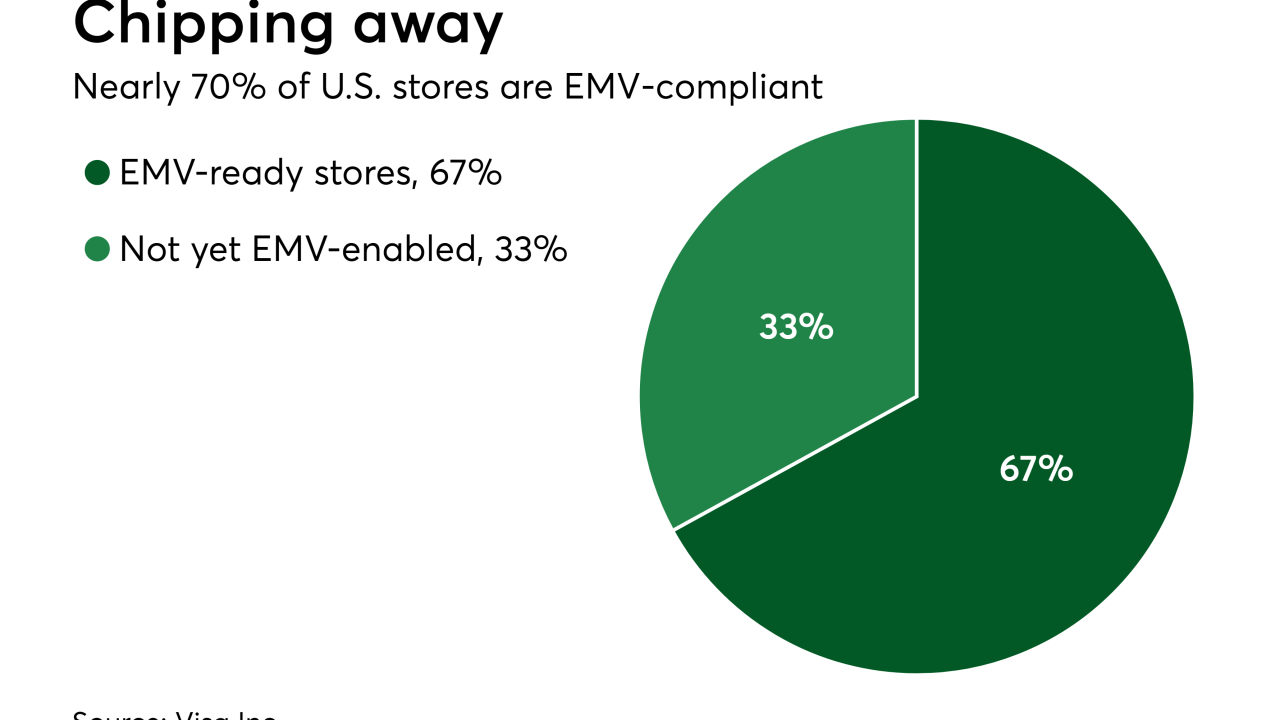

U.S. EMV coverage has gaping holes—including smaller financial institutions that haven’t fully converted to EMV and millions of merchant locations still not accepting chip cards.

September 12 -

Court gives securities regulators a victory on initial coin offerings; bank’s stock suffers its longest losing streak.

September 12 -

ING Group sacrificed one of Chief Executive Officer Ralph Hamers' top deputies as the Dutch lender seeks to restore public trust in the wake of a money-laundering scandal.

September 11 -

Happy State Bank and others use rewards, rather than punishments, to encourage employees to stay vigilant and catch fraud and cybersecurity issues.

September 11 -

The "digital asset receipt," similar to ETFs and ATRs, aims to expedite investing in cybercurrencies; CFO is taking the hit for the Dutch bank's lax anti-money laundering controls.

September 11 -

The agency said it would not apply the data collection requirement for existing accounts that automatically renew or roll over, such as certificates of deposit or commercial credit cards.

September 10 -

The financial press ponders how a replay of the 2008 crisis can be avoided; losing HNA's 7.6% stake may be a blessing in disguise, but DB's funding costs remain a worry.

September 10 -

Businesses without the substantial resources of a Danske Bank are sitting ducks for even more esoteric scams, like transaction laundering, writes Ron Teicher, CEO of EverCompliant.

September 10 EverCompliant

EverCompliant -

Andrei Tyurin, a Russian citizen who is alleged to have performed key cyber work in a hack of JPMorgan Chase and several other companies, was extradited to New York on Friday from the republic of Georgia.

September 7