-

A new court filing suggests that Stephen Calk was named to a 13-member economic advisory team in 2016 in exchange for approving a $9.5 million loan to former campaign manager Paul Manafort.

July 6 -

Leandra English, who sued President Trump and Mick Mulvaney last year claiming to be the rightful director of the CFPB, said Friday that she plans to resign and drop the litigation.

July 6 -

One firm's inability to access bank data shows how fragile fintechs can be; payments processor Square quietly withdraws bank application; turnover of chief risk officers is on the rise; and more from this week's most-read stories.

July 6 -

Beach Community Bank, which recently added $100 million in capital, hired veteran banker Carl Chaney as its executive chairman.

July 6 -

The fundraising is a sign of the rise in the anti-money-laundering market, which is expected to reach $4.26 trillion worldwide in less than a decade.

July 6 -

The Swiss bank allegedly hired Chinese officials’ friends and relatives to win business; JPM asked “several dozen” employees to consider moving from London.

July 6 -

Guy Gentile ran a stock brokerage. He spent years running sting operations as an FBI informant. Then, after he was arrested anyway, he beat the charges. Now his plan for his next act — opening a bank in Puerto Rico — is hitting a snag.

July 5 -

The decision not to go after the real estate firm could have “serious implications” for lenders; British banks have three months to address technology issues.

July 5 -

Both South Korea and Japan, for example, are crypto-friendly countries, but they’re also cracking down on anonymous cryptos, citing money laundering risk, according to Bob Rutherford, CEO and founder of Hedge.

July 5 Hedge

Hedge -

Nonlisted encryption solutions are designed for easier deployment, but often lack many of the key attributes of PCI-listed point-to-point encryption products, writes Ruston Miles, founder and chief strategy officer of Bluefin.

July 3 Bluefin

Bluefin -

Theft and money laundering are both thriving in the crypto world, according to a report released Tuesday by CipherTrace.

July 3 -

A judge rules the accounting firm should have detected the fraud that brought down Colonial Bank; Fed deal with Goldman and Morgan Stanley shows softer side.

July 3 -

Joel Tucker is the brother of Scott Tucker, who in January was sentenced to 16 years in prison for perpetrating an unrelated payday-loan scheme.

July 2 -

Chris Furlow, who was a founding staff member at the Department of Homeland Security, is now the president and CEO of the Texas Bankers Association.

July 2 -

The company continues to be restricted from pursuing acquisitions until the Federal Reserve lifts its enforcement order requiring it to strengthen anti-money-laundering controls.

July 2 -

Phone-based customer service opens opportunity for voice phishing, or "vishing," and other types of attacks linked to card not present transactions, according to Rafael Lourenco, an executive vice president at ClearSale.

July 2 ClearSale

ClearSale -

Deutsche Bank failed and Goldman Sachs and Morgan Stanley restrained; antitrust lawsuit brought by retailers may be near a resolution.

June 29 -

As data breaches mount in the "Equifax era," CFOs have a broad vision of enterprise data that can prove helpful in mitigation, according to Lauren Ruef, a research analyst for Nvoicepay.

June 29 Nvoicepay

Nvoicepay -

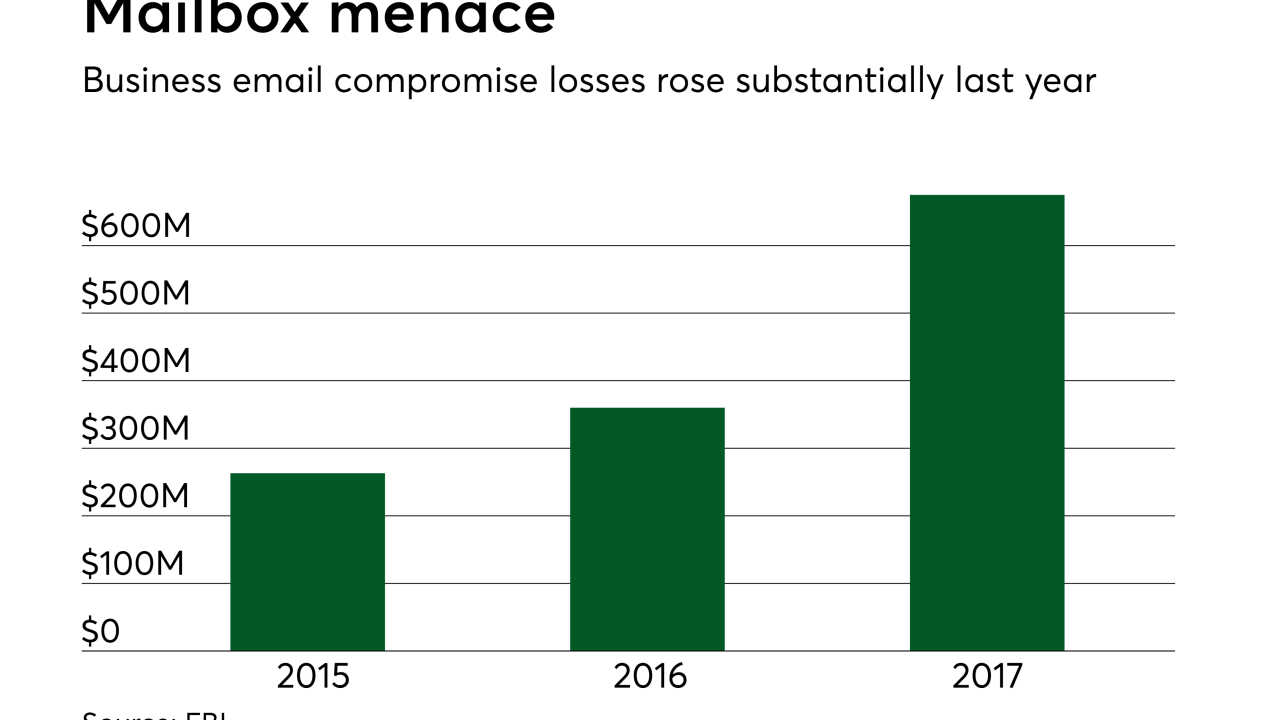

Payments fraud from business email compromise, or BEC, occurs when scammers use phishing tricks and email to fool businesses into making fraudulent payments to perceived suppliers. Experts suggest newer factors are accelerating the trend.

June 27 -

Two Native American tribes agreed to forfeit $3 million in money they took in for acting as fronts for a scam run by Scott Tucker, the former race-car driver convicted of operating an illegal payday loan business.

June 27