-

New technologies can increase lending and reduce risk but many management teams don't know where to begin with implementing them.

May 31 ZestFinance

ZestFinance -

Wider net interest margins compared to a year earlier helped make up for a slight decline in loan balances, as nearly two-thirds of banks reported higher profits in the first quarter.

May 29 -

ChargeAfter, a startup that matches retail customers with financing options at the point of sale from various lenders, has raised $8 million in its first major funding round.

May 29 -

Purpose Financial has agreed to purchase CreditGenie Inc. as payment companies face pressure to offer point of sale financing.

May 29 -

Steve Hagerman, who was responsible for the first mortgage platform at JPMorgan Chase, will be head of consumer lending technology at Wells. It also named Gary Owen, a veteran of WarneMedia, Promontory Financial and Citi, its chief information security officer.

May 28 -

The California-based institution posted growth in loans but saw net income fall from a year earlier.

May 23 -

Mastercard is making a niche play in the hot point of sale financing market, teaming with Dividio and lastminute.com to offer installment loans at checkout.

May 21 -

From data analytics to focusing on a service culture and more, here's a look at how technology is radically remaking lending.

May 20 -

Year to date Dec. 31, 2018. Dollars in thousands.

May 20 -

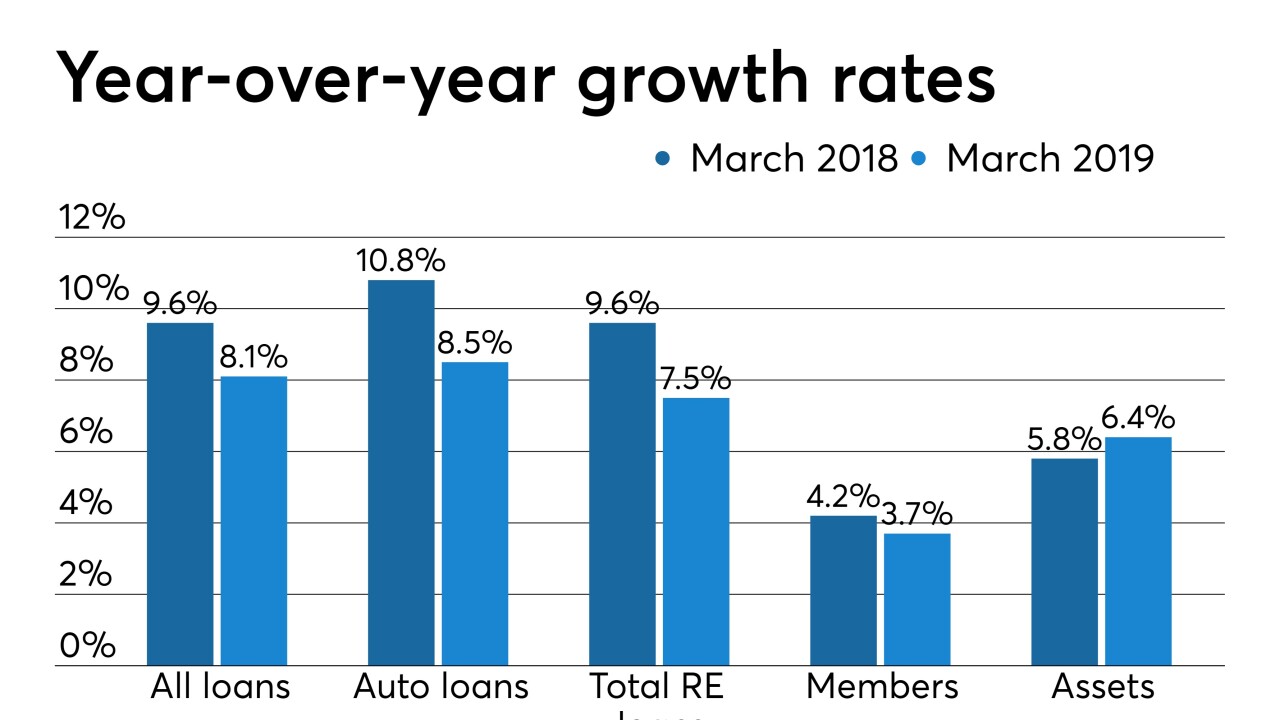

A new study from CUNA Mutual Group shows CUs ended March with tepid growth in membership and auto and real estate loans compared with a year earlier.

May 17 -

The first day of CU Direct's annual Drive conference included insights from dealers, executives at online car-buying platforms and more.

May 16 -

As evidenced by a Senate hearing, Republican and Democratic lawmakers still live in alternative universes when it comes to financial regulatory policy.

May 15 -

At a Senate Banking hearing focusing primarily on predatory lending practices, NCUA Chairman Rodney Hood offered insight into the agency's priorities under his leadership.

May 15 -

Everything from phone bills to utility payment histories could help credit unions expand lending opportunities to consumers without a credit score.

May 15 Urjanet

Urjanet -

Ask 453 bankers their forecasts on loan demand and the economy, or their feelings about the BB&T-SunTrust merger, pot banking as well as other hot issues, and a clear picture emerges. Promontory Interfinancial Network recently did just that, and here our five takeaways from the results.

May 15 -

It's not likely most lenders or credit card issuers would jump at the chance to give more money to a customer having trouble making payments. But for some borrowers, that may be the best solution to this problem.

May 8 -

The Odon, Ind.-based credit union also grew its membership to over 50,000, up more than 9% from a year earlier.

May 6 -

On Dec. 31, 2018. Dollars in thousands.

May 6 -

Community banks in the state have struggled to attract the funds to meet surging loan demand, but that could change now that a new law has made it easier for them to accept government deposits.

May 3 -

Las Vegas-based institution said its first-quarter net income was down about 21% from a year earlier.

May 3