-

The $4 billion-asset milestone comes one year after the East Lansing, Mich.-based credit union hit the $1 billion mark for mortgage lending.

April 18 -

The Oregon-based credit union reported "strong loan demand" in all regions it serves.

April 17 -

The figure comes from the Minnesota-based credit union's annual Member Value Report.

April 11 -

The Cleveland bank's CIO, Amy Brady, said it had to start replacing legacy systems now to position itself as a leader in the future.

April 11 -

The St. Louis-based company partnered with 38 new credit unions last fiscal year.

April 6 -

The Auburn Hills, Mich.-based credit union serves 200,000 members with more than $2.3 billion in assets.

April 6 -

-

Membership, lending and assets were up at every single credit union in Maine last year, according to a recent report from the Maine Credit Union League.

March 29 -

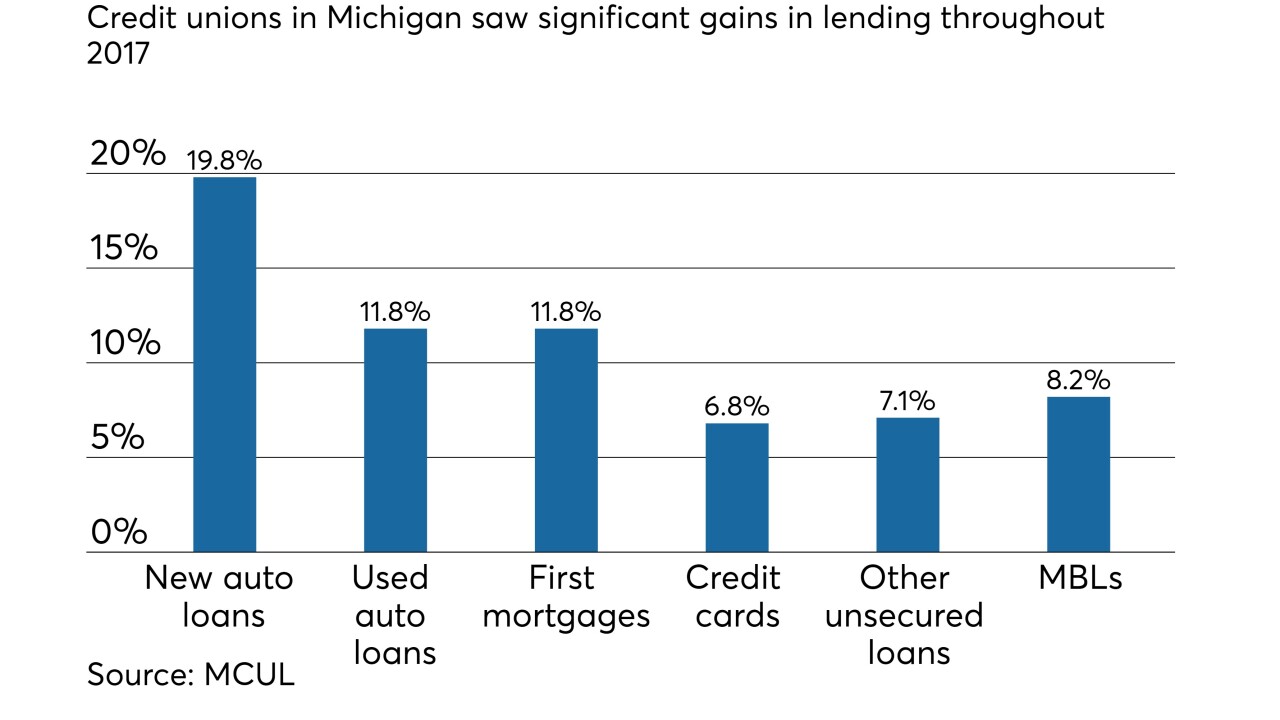

Credit unions in Michigan saw significant gains in Q4 2017, as CUs there ended the year with significant boosts to membership and lending.

March 28 -

The latest Credit Union Trends Report from CUNA Mutual Group predicts robust membership growth in the year ahead and sustained lending growth due to positive economic factors.

March 26 -

While some key indicators dropped in the year ending Dec. 31, 2017, credit unions in many states continue to thrive, with several new states jumping to the head of the pack for various growth measurements.

March 22 -

The Federal Reserve raised interest rates by a quarter-point at its Wednesday meeting and more increases are expected this year. Here's what credit unions need to know to be prepared.

March 21 -

The Jacksonville-based credit union released its 2017 annual report, highlighting record loan originations, strong member growth, community engagement and more.

March 16 -

Small-business payments are an inefficient mess of unpaid invoices and paper processes that are causing substantial funds to languish and companies to stagnate. One possible solution is to address the cash flow, not the payment mechanism itself.

March 14 -

Credit unions saw strong gains in membership, loans and more in 2017, though the industry continued to shrink, with 200 fewer credit unions in operation than at the end of 2016.

March 8 -

The Eureka, Calif.-based credit union saw assets rise by 8 percent last year, while lending was up more than 10 percent.

February 27 -

The Arizona-based online auto dealer has partnerships with 35 credit unions – and is looking to expand.

February 22 -

Provider of lending, marketing automation technology predicts more growth in 2018.

February 22 -

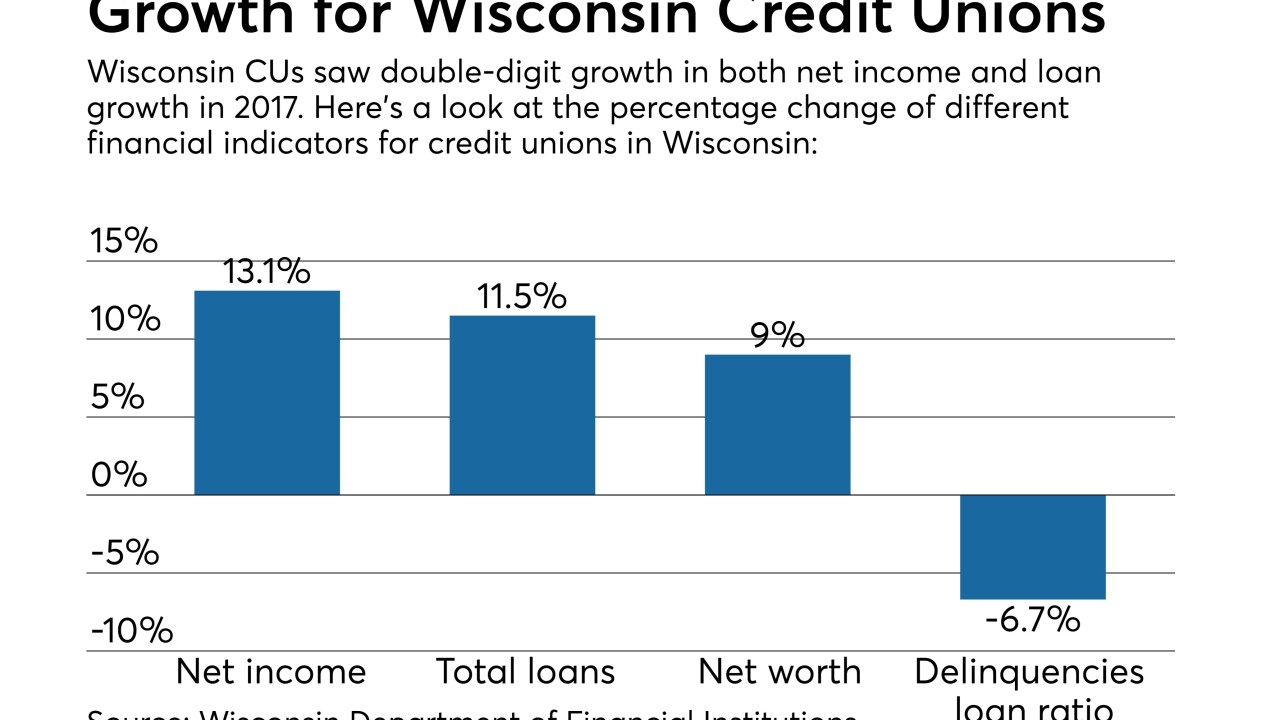

On top of a banner year for lending, delinquency rates in the state are at historic lows.

February 14 -

The Silicon Valley-based CU is funding development of an apartment building.

February 14