-

The company, formed by the merger of BB&T and SunTrust, shared the information in response to a credit union's legal challenge to its new name.

May 19 -

In response to Truliant Federal Credit Union's request for an injunction, the bank said it has already spent $125 million on the Truist branding, and changing that name would add further costs and damage the bank's reputation.

May 19 -

The Summerville, S.C.-based institution will also close two branches as part of a broader strategic effort to better service members.

May 11 -

Mortgage lenders impose steep pricing adjustments for cash-out refinancing; bankers fear massive borrower fraud in the Paycheck Protection Program; some worry the coronavirus is giving banks an excuse to spy on employees; and more from this week's most-read stories.

May 8 -

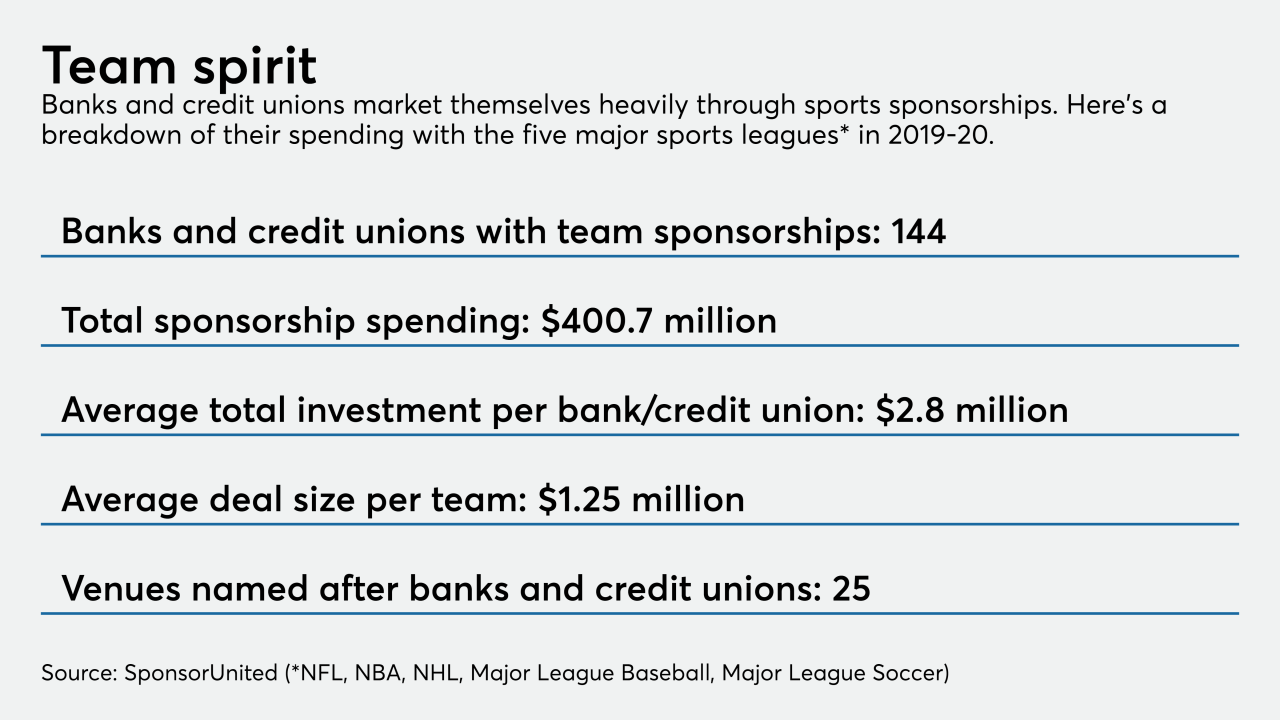

Many banks are slashing their spending. Others are changing their messaging strategies. And those banks that partner with pro sports teams are stuck in limbo, since it remains unclear when games will resume.

May 3 -

-

With its "people helping people" mindset, the industry is uniquely positioned to serve consumers who are suffering during the pandemic. Credit unions need to capitalize on this.

April 28 PenFed

PenFed -

Plans to update agency branding and other materials are on hold as the credit union regulator focuses on its response to the coronavirus.

April 24 -

The Ohio company, which bought United Community Financial in February, will start operating as Premier Bank this summer.

April 22 -

The newly minted Transact Bank will provide payment processing and card issuing services to a wide range of clients.

March 31